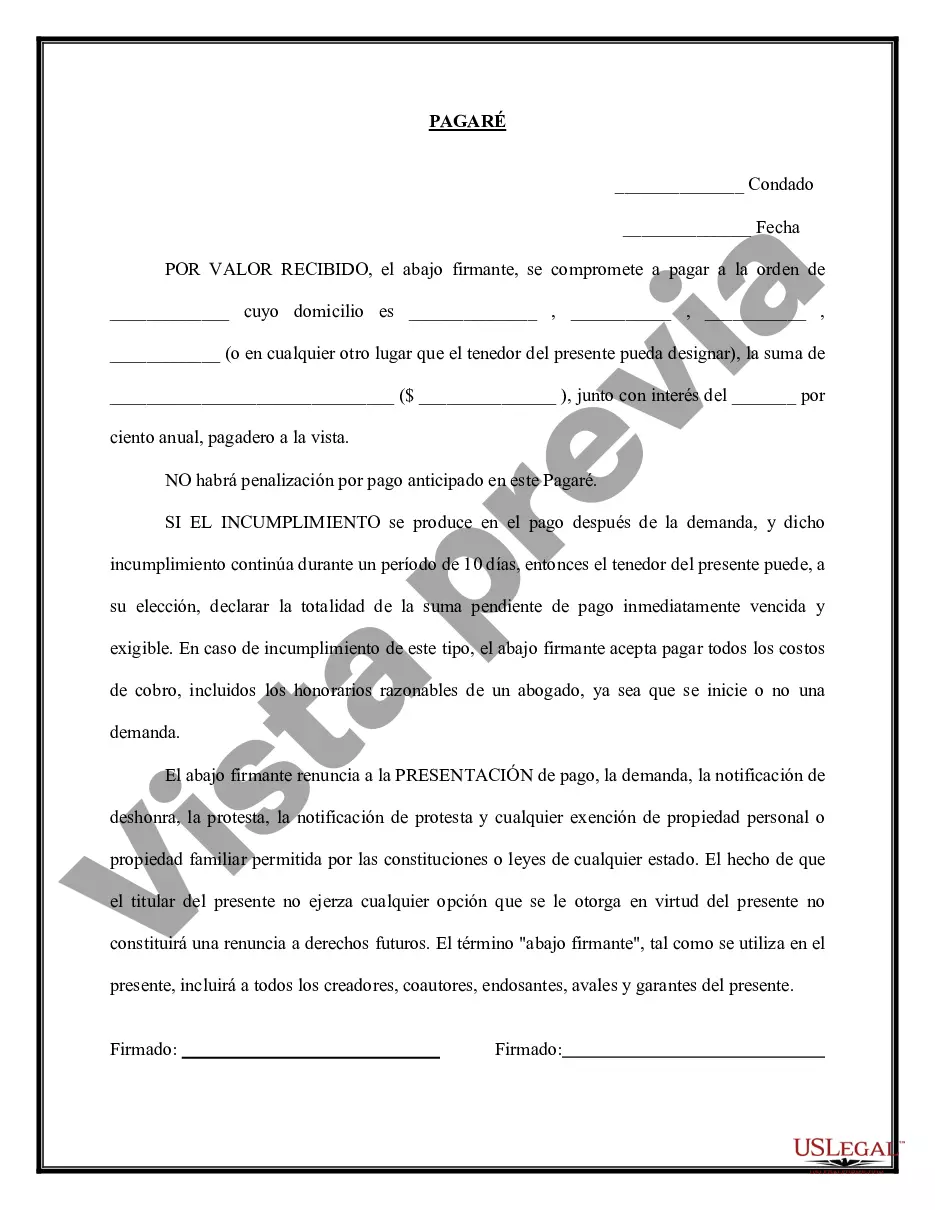

A Nevada Promissory Note — Payable on Demand is a legally binding document that outlines an agreement between a lender and a borrower in the state of Nevada. This type of promissory note is specifically designed to be payable immediately upon the lender's request or demand. Keywords: Nevada, promissory note, payable on demand, legally binding, lender, borrower, agreement. There are several types of Nevada Promissory Note — Payable on Demand, each catering to specific situations or terms: 1. Simple Promissory Note — Payable on Demand: This is the most basic type of promissory note that outlines the borrower's promise to repay the lender on demand. It includes essential details such as the principal amount, interest rate (if any), repayment terms, and consequences of default. 2. Secured Promissory Note — Payable on Demand: In this type of promissory note, the borrower pledges collateral (such as property, assets, or vehicles) to secure the loan. If the borrower fails to make repayment, the lender has the right to seize the collateral to recoup their losses. 3. Unsecured Promissory Note — Payable on Demand: Unlike a secured promissory note, an unsecured note does not involve any collateral. Therefore, the lender relies solely on the borrower's promise to repay the debt. This type of note usually carries a higher interest rate to compensate for the increased risk. 4. Demand Revolving Promissory Note: This is a unique type of promissory note that allows the borrower to access funds repeatedly within a specified limit. Once the funds are borrowed, the borrower must pay the amount back on demand, enabling them to have a revolving line of credit. 5. Business Promissory Note — Payable on Demand: Specifically designed for business purposes, this type of note is used when a company borrows funds from an individual or another business entity. It outlines the repayment terms, interest rate, and consequences of non-payment. 6. Personal Promissory Note — Payable on Demand: Similar to a business promissory note, a personal note is used for personal loans between individuals. It can include terms regarding interest, repayment schedule, and any necessary penalties for non-payment. 7. Loan Modification Promissory Note — Payable on Demand: This type of note is often created when modifying an existing loan agreement. It outlines the new terms, repayment options, and any changes to the original loan's structure. In conclusion, a Nevada Promissory Note — Payable on Demand is a comprehensive legal document used in various situations to secure lending transactions, be it personal or business-related. The specific type of note will depend on the borrower's and lender's preferences and the circumstances of the loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Nevada Pagaré - Pagadero A La Vista?

US Legal Forms - one of many greatest libraries of legal varieties in the USA - offers an array of legal papers layouts you may download or printing. While using website, you will get a huge number of varieties for business and personal reasons, sorted by categories, states, or search phrases.You can find the latest versions of varieties much like the Nevada Promissory Note - Payable on Demand in seconds.

If you currently have a membership, log in and download Nevada Promissory Note - Payable on Demand from your US Legal Forms catalogue. The Download option can look on every kind you look at. You gain access to all earlier delivered electronically varieties from the My Forms tab of the profile.

In order to use US Legal Forms for the first time, listed below are basic recommendations to help you get started:

- Be sure you have picked out the proper kind to your metropolis/state. Click on the Preview option to analyze the form`s content. Browse the kind outline to actually have chosen the right kind.

- In the event the kind doesn`t fit your requirements, utilize the Look for area towards the top of the monitor to find the one which does.

- Should you be pleased with the shape, affirm your decision by visiting the Acquire now option. Then, opt for the prices plan you favor and offer your references to sign up for an profile.

- Procedure the transaction. Make use of your Visa or Mastercard or PayPal profile to finish the transaction.

- Find the format and download the shape on your own product.

- Make adjustments. Complete, change and printing and indicator the delivered electronically Nevada Promissory Note - Payable on Demand.

Each format you included in your bank account does not have an expiration day and is also the one you have for a long time. So, in order to download or printing one more copy, just visit the My Forms segment and then click around the kind you need.

Gain access to the Nevada Promissory Note - Payable on Demand with US Legal Forms, one of the most extensive catalogue of legal papers layouts. Use a huge number of expert and state-particular layouts that satisfy your organization or personal needs and requirements.