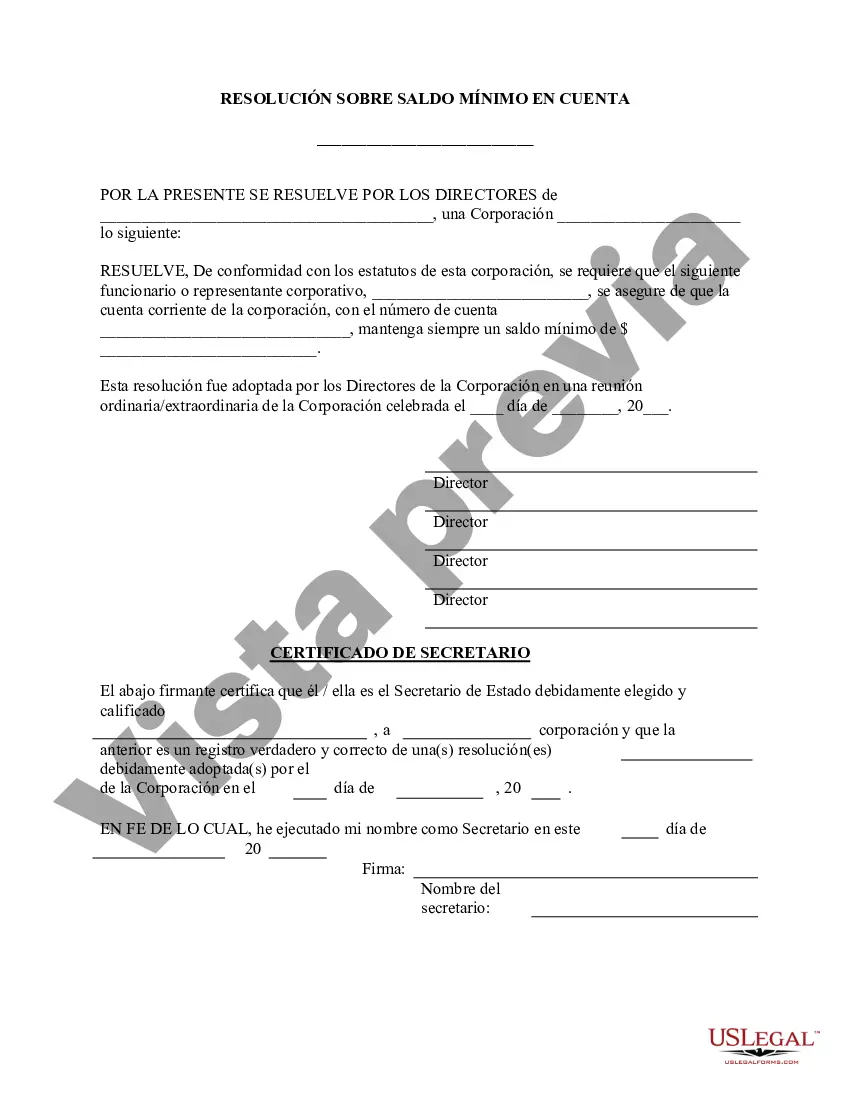

The Nevada Minimum Checking Account Balance — Corporate Resolutions Form is a document specifically designed for corporations in the state of Nevada to establish and maintain a minimum balance requirement for their checking accounts. It is a legal resolution that outlines the precise minimum balance that must be maintained in the corporation's checking account. This form serves as an internal governance tool for corporations, allowing them to set financial guidelines and ensure the availability of funds for operational expenses, such as paying bills, issuing payments, and managing daily financial activities efficiently. By implementing a minimum balance requirement, corporations can ensure that they maintain a healthy cash flow and avoid any potential issues or penalties related to insufficient funds. Some common types of Nevada Minimum Checking Account Balance — Corporate Resolutions Forms include: 1. General Corporate Resolution Form: This form is created by the corporation's board of directors to establish a minimum checking account balance applicable to the company as a whole. It covers all financial transactions and sets out guidelines for maintaining the minimum balance. 2. Department-Specific Corporate Resolution Form: This type of form enables corporations to set different minimum balance requirements for specific departments or subsidiaries within the company. It allows for greater flexibility in managing different financial needs and responsibilities within the organization. 3. Tiered Corporate Resolution Form: A tiered approach is often adopted by larger corporations that have various divisions or business units. This form categorizes different departments or segments of the corporation and assigns specific minimum balance requirements to each tier, which can vary based on the size, scope, or importance of the department. Nevada Minimum Checking Account Balance — Corporate Resolution Forms are vital for corporations to maintain financial stability and ensure the smooth execution of daily financial operations. It is important for corporations to consult with legal professionals or financial advisors to accurately determine the appropriate minimum balance requirement for their specific needs and comply with applicable state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Saldo Mínimo de Cuenta Corriente - Formulario de Resoluciones Corporativas - Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Nevada Saldo Mínimo De Cuenta Corriente - Formulario De Resoluciones Corporativas?

US Legal Forms - one of many biggest libraries of lawful kinds in the United States - gives an array of lawful file web templates it is possible to acquire or printing. Using the site, you may get a huge number of kinds for business and person purposes, categorized by types, says, or keywords and phrases.You can find the newest versions of kinds just like the Nevada Minimum Checking Account Balance - Corporate Resolutions Form in seconds.

If you already possess a subscription, log in and acquire Nevada Minimum Checking Account Balance - Corporate Resolutions Form through the US Legal Forms collection. The Obtain button will show up on every develop you view. You get access to all in the past acquired kinds inside the My Forms tab of your own accounts.

If you wish to use US Legal Forms initially, listed below are basic instructions to help you began:

- Make sure you have chosen the best develop for your personal area/region. Select the Preview button to check the form`s content. Look at the develop description to actually have chosen the right develop.

- If the develop does not match your demands, utilize the Research area at the top of the display to find the one that does.

- When you are content with the form, validate your decision by simply clicking the Buy now button. Then, choose the rates program you like and provide your references to sign up for the accounts.

- Approach the deal. Utilize your bank card or PayPal accounts to finish the deal.

- Pick the formatting and acquire the form on your system.

- Make alterations. Load, edit and printing and indicator the acquired Nevada Minimum Checking Account Balance - Corporate Resolutions Form.

Every web template you put into your account lacks an expiry date and is your own forever. So, if you would like acquire or printing an additional backup, just visit the My Forms portion and click about the develop you require.

Obtain access to the Nevada Minimum Checking Account Balance - Corporate Resolutions Form with US Legal Forms, by far the most substantial collection of lawful file web templates. Use a huge number of skilled and express-distinct web templates that meet up with your company or person requires and demands.