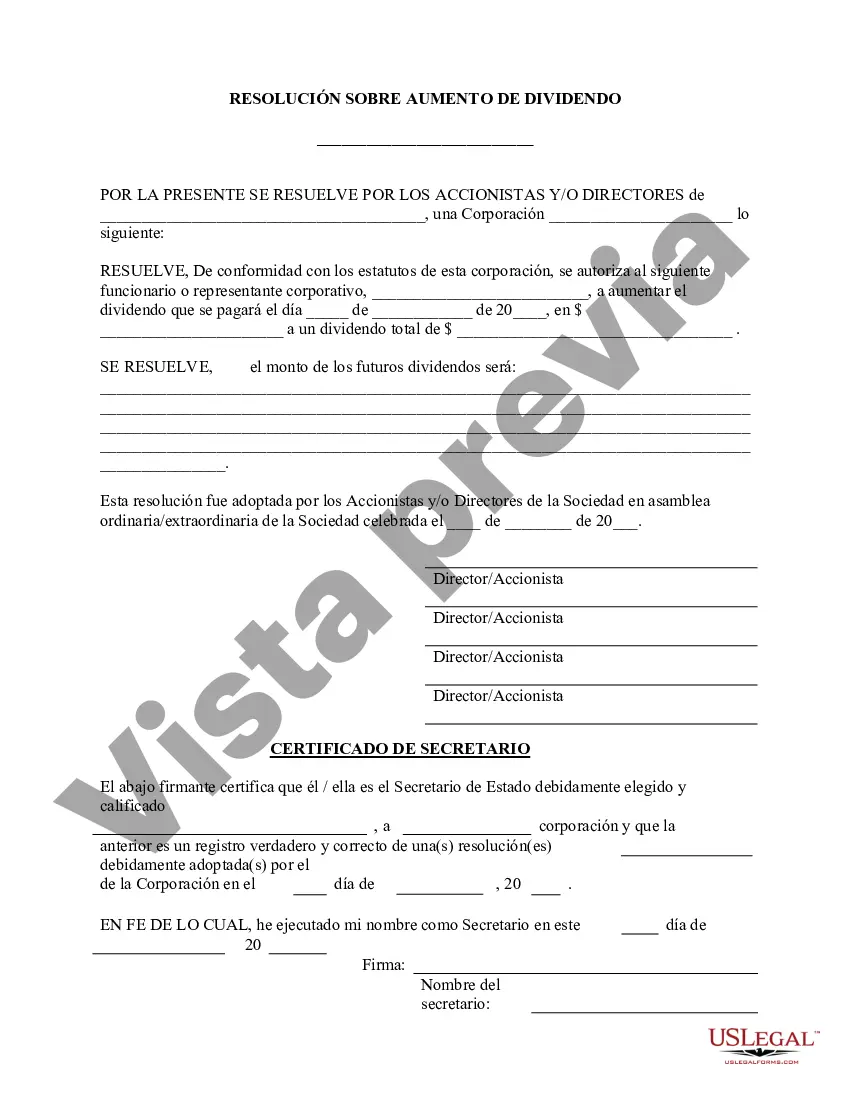

Nevada Increase Dividend — Resolution For— - Corporate Resolutions is a legally binding document used by corporations in Nevada to formalize a decision to increase dividends. This form is essential for maintaining transparency, ensuring compliance, and protecting the rights and interests of shareholders. The Nevada Increase Dividend — Resolution For— - Corporate Resolutions includes several key elements. First, it identifies the corporation's name, registered office address, and the date on which the resolution is being adopted. It also specifies the applicable Nevada Revised Statutes (NRS) provisions governing dividend distributions. The resolution form outlines the details of the dividend increase, including the proposed amount, timing, and frequency of disbursement. Furthermore, the reasons behind the dividend increase are usually explained, such as improved financial performance, increased profitability, or a desire to reward shareholders for their support. The form also includes provisions for the approval process. It typically requires director approval, with signatures and dates from each director endorsing the resolution. Additionally, the form may need to be signed by the corporate secretary or other authorized officers to validate its authenticity. It is important to note that there can be different types of Nevada Increase Dividend — Resolution For— - Corporate Resolutions. These variations mainly depend on the specific circumstances and requirements of each corporation. Some possible types include: 1. Regular Dividend Increase Resolution: This type of resolution is used when a corporation plans to increase its dividends on a regular basis, such as annually or quarterly, to reward shareholders and align with its financial performance. It is a routine process for maintaining shareholder value and satisfaction. 2. Special Dividend Increase Resolution: Occasions may arise where a corporation decides to distribute an additional dividend on a one-time or special basis. A special dividend increase resolution is used to formalize this decision by outlining the details of the additional dividend and the reasons behind it, such as extraordinary profits, asset sales, or windfall gains. 3. Interim Dividend Increase Resolution: In some cases, a corporation may choose to distribute an interim dividend increase between regular dividend payment periods. This resolution serves as a means to document and authorize the interim dividend payment, specifying the amount, timing, and purpose, which can vary from regular dividend distributions. Regardless of the specific type, Nevada Increase Dividend — Resolution For— - Corporate Resolutions play a crucial role in ensuring proper corporate governance and adherence to legal requirements. They provide a framework for decision-making, record-keeping, and communication with shareholders, strengthening the corporation's financial stability and reputation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Incrementar Dividendo - Formulario de Resoluciones - Resoluciones Corporativas - Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Nevada Incrementar Dividendo - Formulario De Resoluciones - Resoluciones Corporativas?

You are able to commit several hours online searching for the legal papers template that meets the state and federal demands you want. US Legal Forms offers a large number of legal types which can be examined by specialists. It is possible to download or print the Nevada Increase Dividend - Resolution Form - Corporate Resolutions from our support.

If you already possess a US Legal Forms bank account, you are able to log in and click on the Obtain switch. Next, you are able to complete, modify, print, or indicator the Nevada Increase Dividend - Resolution Form - Corporate Resolutions. Every legal papers template you purchase is your own property permanently. To obtain yet another version for any bought form, proceed to the My Forms tab and click on the related switch.

If you are using the US Legal Forms internet site the very first time, adhere to the straightforward recommendations listed below:

- First, be sure that you have chosen the correct papers template for your county/city of your liking. Read the form description to ensure you have picked the right form. If offered, take advantage of the Review switch to look throughout the papers template also.

- If you want to find yet another variation in the form, take advantage of the Search field to discover the template that fits your needs and demands.

- Upon having identified the template you would like, click on Get now to proceed.

- Select the prices prepare you would like, type your qualifications, and register for an account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal bank account to cover the legal form.

- Select the structure in the papers and download it for your system.

- Make changes for your papers if necessary. You are able to complete, modify and indicator and print Nevada Increase Dividend - Resolution Form - Corporate Resolutions.

Obtain and print a large number of papers templates utilizing the US Legal Forms site, which provides the most important collection of legal types. Use professional and state-distinct templates to handle your organization or person needs.