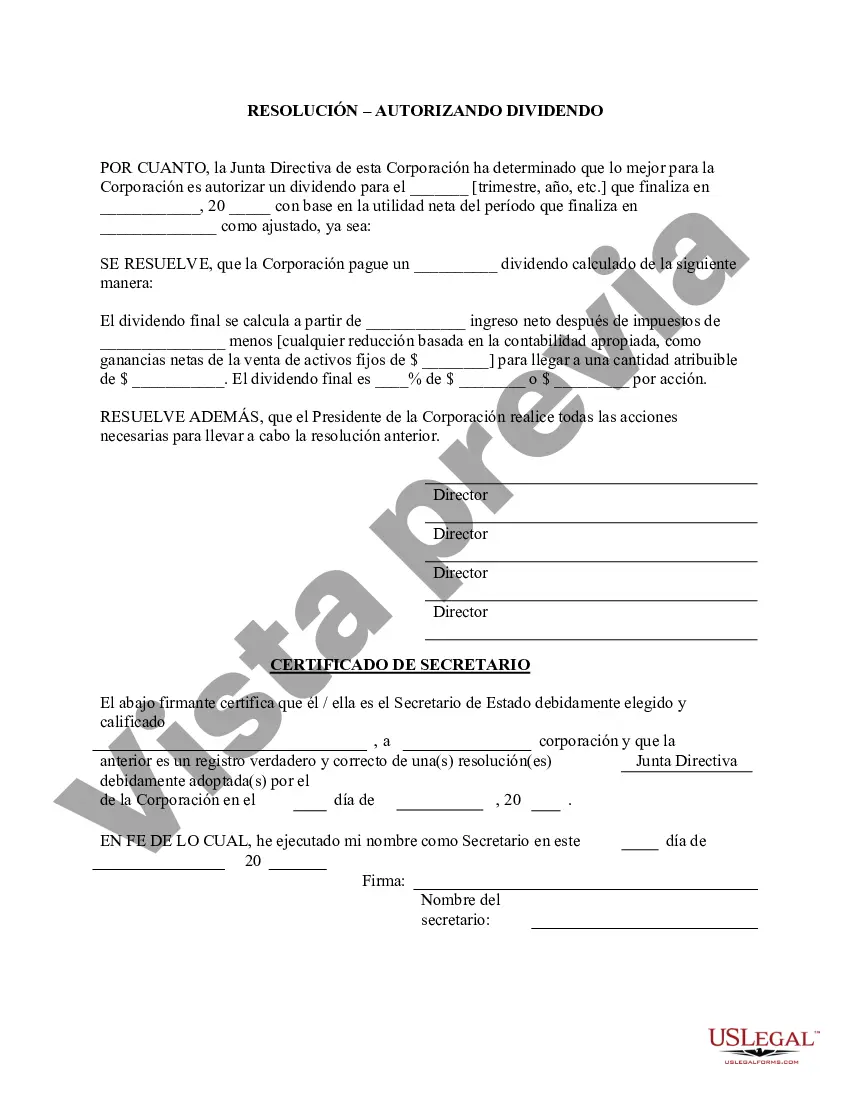

The Nevada Stock Dividend Resolution Form is an essential corporate resolution document used in Nevada for the purpose of declaring a stock dividend. This form ensures that the proper steps are followed in accordance with Nevada corporate laws and regulations when issuing stock dividends. A stock dividend is a distribution of additional shares of a company's stock to existing shareholders as a form of dividend payment. Unlike cash dividends, stock dividends are issued in the form of additional shares, which increases the ownership stake of shareholders without affecting the overall value of the company. The Nevada Stock Dividend Resolution Form serves as a written record of the board of directors' decision to declare a stock dividend. It outlines important details such as the date of the resolution, the number of additional shares to be distributed, the record date (the date on which shareholders must be recorded in the company's books to be eligible for the dividend), and any other terms and conditions associated with the dividend. This resolution form is designed specifically for companies incorporated in Nevada, as the state has its own set of laws governing corporate actions and resolutions. It ensures compliance with Nevada Revised Statutes (NRS) and maintains the transparency and legality of the stock dividend declaration process. Different types of Nevada Stock Dividend Resolution Forms may exist based on the specific requirements of a company or the particular circumstances of the dividend declaration. Some possible variations may include: 1. Regular Stock Dividend Resolution Form: This is the standard form used by Nevada corporations when issuing stock dividends. It is typically used when a company wishes to distribute additional shares to existing shareholders as a way to maintain proportional ownership and reward shareholders. 2. Special Stock Dividend Resolution Form: This form may be used when there are unique circumstances of the dividend declaration, such as a specific purpose for issuing the stock dividend or certain restrictions on the shareholders' eligibility. 3. Preferred Stock Dividend Resolution Form: If a company has both common and preferred stock, a separate form may be utilized to declare a stock dividend specifically for the preferred shareholders. This form would outline the details of the dividend applicable to the preferred stockholders, such as the number of preferred shares to be issued. Regardless of the specific type, the Nevada Stock Dividend Resolution Form is crucial for ensuring proper documentation and compliance with the statutory requirements in Nevada when issuing stock dividends. It helps maintain transparency and facilitates the smooth implementation of dividend distributions for Nevada corporations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Dividendo en Acciones - Formulario de Resoluciones - Resoluciones Corporativas - Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Nevada Dividendo En Acciones - Formulario De Resoluciones - Resoluciones Corporativas?

US Legal Forms - among the most significant libraries of lawful varieties in the United States - offers a wide array of lawful document web templates you can acquire or printing. Making use of the internet site, you will get a large number of varieties for enterprise and personal reasons, sorted by groups, claims, or search phrases.You can get the most recent variations of varieties such as the Nevada Stock Dividend - Resolution Form - Corporate Resolutions in seconds.

If you already have a membership, log in and acquire Nevada Stock Dividend - Resolution Form - Corporate Resolutions in the US Legal Forms catalogue. The Download key will show up on each type you view. You have accessibility to all earlier saved varieties in the My Forms tab of the accounts.

If you would like use US Legal Forms initially, here are simple instructions to help you began:

- Be sure to have selected the right type for the town/region. Click on the Review key to review the form`s articles. Browse the type information to ensure that you have selected the appropriate type.

- In case the type doesn`t satisfy your requirements, utilize the Search industry towards the top of the screen to get the one who does.

- In case you are content with the shape, affirm your option by simply clicking the Acquire now key. Then, opt for the prices prepare you want and supply your accreditations to sign up for an accounts.

- Procedure the financial transaction. Make use of your charge card or PayPal accounts to accomplish the financial transaction.

- Select the structure and acquire the shape on your own device.

- Make modifications. Fill up, modify and printing and indicator the saved Nevada Stock Dividend - Resolution Form - Corporate Resolutions.

Each format you included with your bank account does not have an expiry particular date and is also the one you have permanently. So, if you would like acquire or printing an additional duplicate, just visit the My Forms portion and click about the type you require.

Get access to the Nevada Stock Dividend - Resolution Form - Corporate Resolutions with US Legal Forms, one of the most extensive catalogue of lawful document web templates. Use a large number of expert and state-particular web templates that satisfy your company or personal requires and requirements.