A Nevada Lease of Business Premises, also known as a commercial lease, is a legal document that outlines the terms and conditions under which a property owner, known as the landlord or lessor, agrees to lease their business premises to a tenant, known as the lessee. This type of real estate rental agreement is specifically tailored for commercial properties and allows both parties to protect their rights and obligations during the lease term. Nevada Lease of Business Premises typically covers key elements such as the duration of the lease, rental payment details, property description, permitted use of the premises, maintenance responsibilities, insurance requirements, and dispute resolution procedures. It is crucial for both landlords and tenants to carefully negotiate and draft the lease to ensure clarity and avoid potential conflicts. In Nevada, there are various types of Lease of Business Premises options available to suit different needs and situations: 1. Gross Lease: This type of lease agreement requires the tenant to pay a fixed rent while the landlord covers all or most of the property expenses, including utilities, taxes, insurance, and maintenance costs. 2. Net Lease: In a net lease, the tenant is responsible for paying a base rent along with additional costs such as property taxes, insurance, and maintenance expenses. There are different variations of net leases, including single net lease, double net lease, and triple net lease, which differ in terms of expenses shared between the landlord and tenant. 3. Percentage Lease: A percentage lease is commonly used in retail settings, where the tenant pays a base rent plus a percentage of their gross sales. This type of lease allows the landlord to benefit from the tenant's success while ensuring a stable income. 4. Modified Gross Lease: A modified gross lease is a hybrid between a gross lease and a net lease. In this arrangement, the tenant pays a lower fixed rent initially, and as the lease progresses, they become responsible for a portion of the property expenses. Regardless of the type of lease chosen, it is crucial for both parties to carefully review the terms and negotiate any necessary modifications before signing the agreement. Seeking legal advice from a qualified attorney specializing in real estate law is highly recommended ensuring all legal requirements are met and protect the rights and interests of both the landlord and tenant.

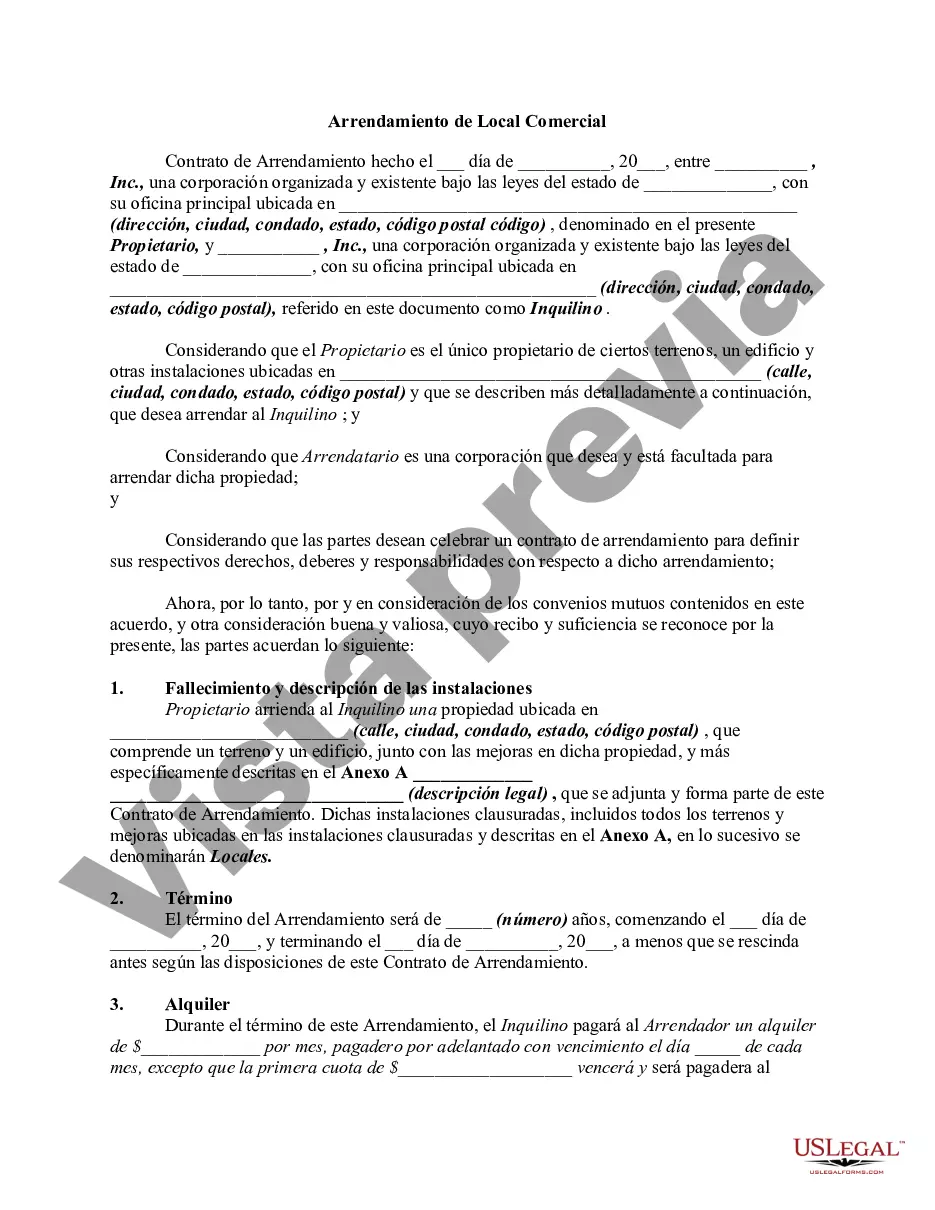

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Arrendamiento de Local Comercial - Alquiler de Bienes Raíces - Lease of Business Premises - Real Estate Rental

Description

How to fill out Nevada Arrendamiento De Local Comercial - Alquiler De Bienes Raíces?

If you need to full, down load, or produce legitimate papers templates, use US Legal Forms, the greatest collection of legitimate types, that can be found online. Take advantage of the site`s easy and handy search to discover the files you will need. Various templates for business and personal purposes are sorted by groups and suggests, or search phrases. Use US Legal Forms to discover the Nevada Lease of Business Premises - Real Estate Rental in just a couple of click throughs.

Should you be currently a US Legal Forms buyer, log in to your account and click the Acquire switch to have the Nevada Lease of Business Premises - Real Estate Rental. Also you can entry types you previously delivered electronically in the My Forms tab of your account.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape to the appropriate town/region.

- Step 2. Take advantage of the Review solution to examine the form`s information. Never forget about to learn the information.

- Step 3. Should you be not satisfied together with the form, make use of the Research field near the top of the display screen to get other models of your legitimate form format.

- Step 4. After you have located the shape you will need, select the Buy now switch. Pick the pricing program you favor and add your credentials to sign up on an account.

- Step 5. Method the financial transaction. You can utilize your credit card or PayPal account to perform the financial transaction.

- Step 6. Pick the structure of your legitimate form and down load it on your own system.

- Step 7. Full, change and produce or sign the Nevada Lease of Business Premises - Real Estate Rental.

Each and every legitimate papers format you purchase is the one you have eternally. You have acces to each and every form you delivered electronically within your acccount. Click the My Forms area and pick a form to produce or down load once more.

Remain competitive and down load, and produce the Nevada Lease of Business Premises - Real Estate Rental with US Legal Forms. There are many professional and express-specific types you may use for your business or personal requires.