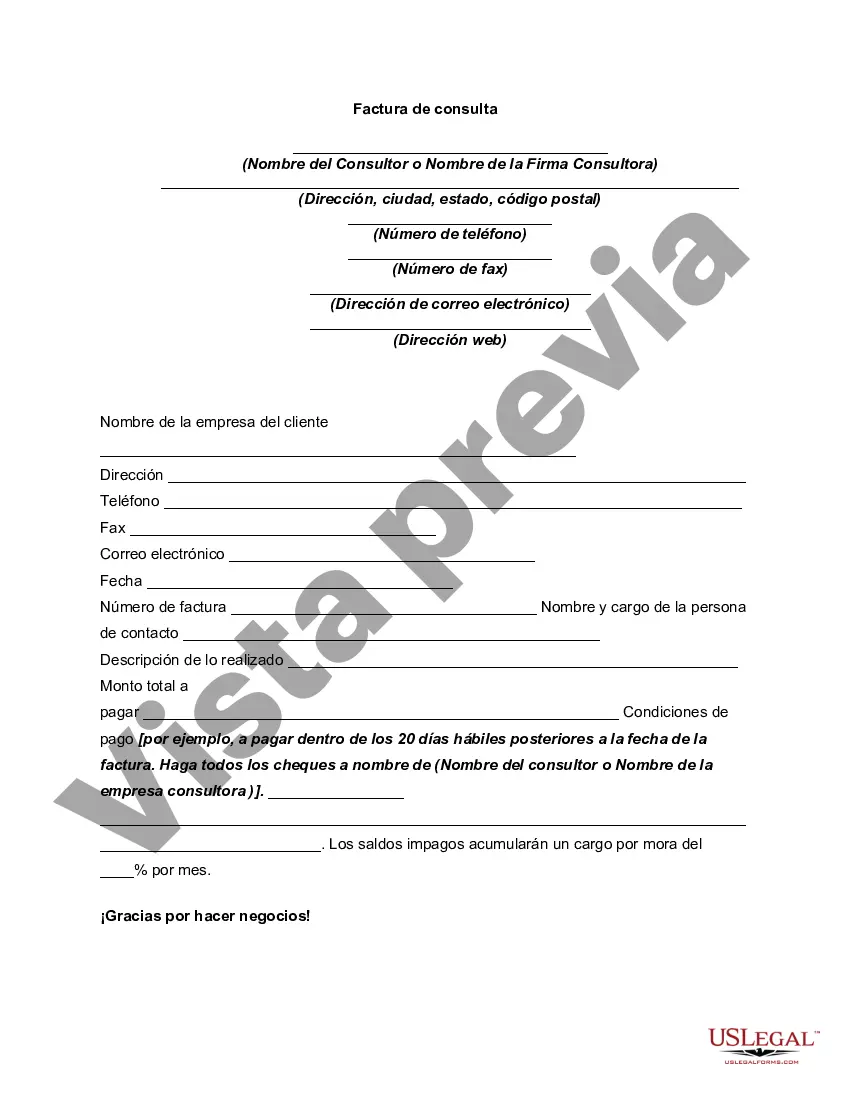

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Nevada consulting invoice is a document that outlines the details of services rendered by a consulting firm or individual consultant to their client in the state of Nevada. It serves as a formal request for payment, including a breakdown of the services provided, the agreed-upon fees, and any additional expenses incurred during the consulting engagement. Keywords: Nevada, consulting, invoice, services, payment, fees, expenses, breakdown, engagement. Different types of Nevada consulting invoices may include: 1. Nevada Consulting Service Invoice: This type of invoice is used to bill clients for consulting services provided in the state of Nevada. It includes detailed descriptions of the services rendered, hourly rates, project duration, and any additional costs such as travel or materials. 2. Nevada Financial Consulting Invoice: This invoice is specific to financial consulting services offered in Nevada. It may include services like financial analysis, investment advice, tax planning, or risk management. The invoice will outline the financial consultant's fees, consultation hours, and any relevant taxes. 3. Nevada IT Consulting Invoice: Designed for IT consultants operating in Nevada, this invoice covers services such as systems analysis, software development, network management, or cybersecurity consulting. It includes the IT consultant's hourly rates or flat fees, the duration of the engagement, and any applicable taxes. 4. Nevada Management Consulting Invoice: This invoice is used by management consultants in Nevada who offer services related to organizational strategy, business process improvement, project management, or change management. It details the consultant's fees, project scope, and any additional expenses incurred. 5. Nevada Marketing Consulting Invoice: Specifically tailored for marketing consultants in Nevada, this invoice covers services like market research, brand development, advertising campaigns, or social media management. It includes the marketing consultant's fees, campaign duration, and any related costs such as advertising expenses. By using a Nevada consulting invoice, businesses can ensure accurate record-keeping, provide transparency to their clients regarding the services performed and fees charged, and streamline the payment process. It also assists in maintaining financial accountability and serves as documentation for tax and accounting purposes.A Nevada consulting invoice is a document that outlines the details of services rendered by a consulting firm or individual consultant to their client in the state of Nevada. It serves as a formal request for payment, including a breakdown of the services provided, the agreed-upon fees, and any additional expenses incurred during the consulting engagement. Keywords: Nevada, consulting, invoice, services, payment, fees, expenses, breakdown, engagement. Different types of Nevada consulting invoices may include: 1. Nevada Consulting Service Invoice: This type of invoice is used to bill clients for consulting services provided in the state of Nevada. It includes detailed descriptions of the services rendered, hourly rates, project duration, and any additional costs such as travel or materials. 2. Nevada Financial Consulting Invoice: This invoice is specific to financial consulting services offered in Nevada. It may include services like financial analysis, investment advice, tax planning, or risk management. The invoice will outline the financial consultant's fees, consultation hours, and any relevant taxes. 3. Nevada IT Consulting Invoice: Designed for IT consultants operating in Nevada, this invoice covers services such as systems analysis, software development, network management, or cybersecurity consulting. It includes the IT consultant's hourly rates or flat fees, the duration of the engagement, and any applicable taxes. 4. Nevada Management Consulting Invoice: This invoice is used by management consultants in Nevada who offer services related to organizational strategy, business process improvement, project management, or change management. It details the consultant's fees, project scope, and any additional expenses incurred. 5. Nevada Marketing Consulting Invoice: Specifically tailored for marketing consultants in Nevada, this invoice covers services like market research, brand development, advertising campaigns, or social media management. It includes the marketing consultant's fees, campaign duration, and any related costs such as advertising expenses. By using a Nevada consulting invoice, businesses can ensure accurate record-keeping, provide transparency to their clients regarding the services performed and fees charged, and streamline the payment process. It also assists in maintaining financial accountability and serves as documentation for tax and accounting purposes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.