Nevada Personal Monthly Budget Worksheet

Description

How to fill out Personal Monthly Budget Worksheet?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Nevada Personal Monthly Budget Worksheet within moments.

Review the form details to confirm you've selected the correct one.

If the form doesn't meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you already have a subscription, Log In to download the Nevada Personal Monthly Budget Worksheet from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You have access to all previously downloaded forms from the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have chosen the correct form for your city/state.

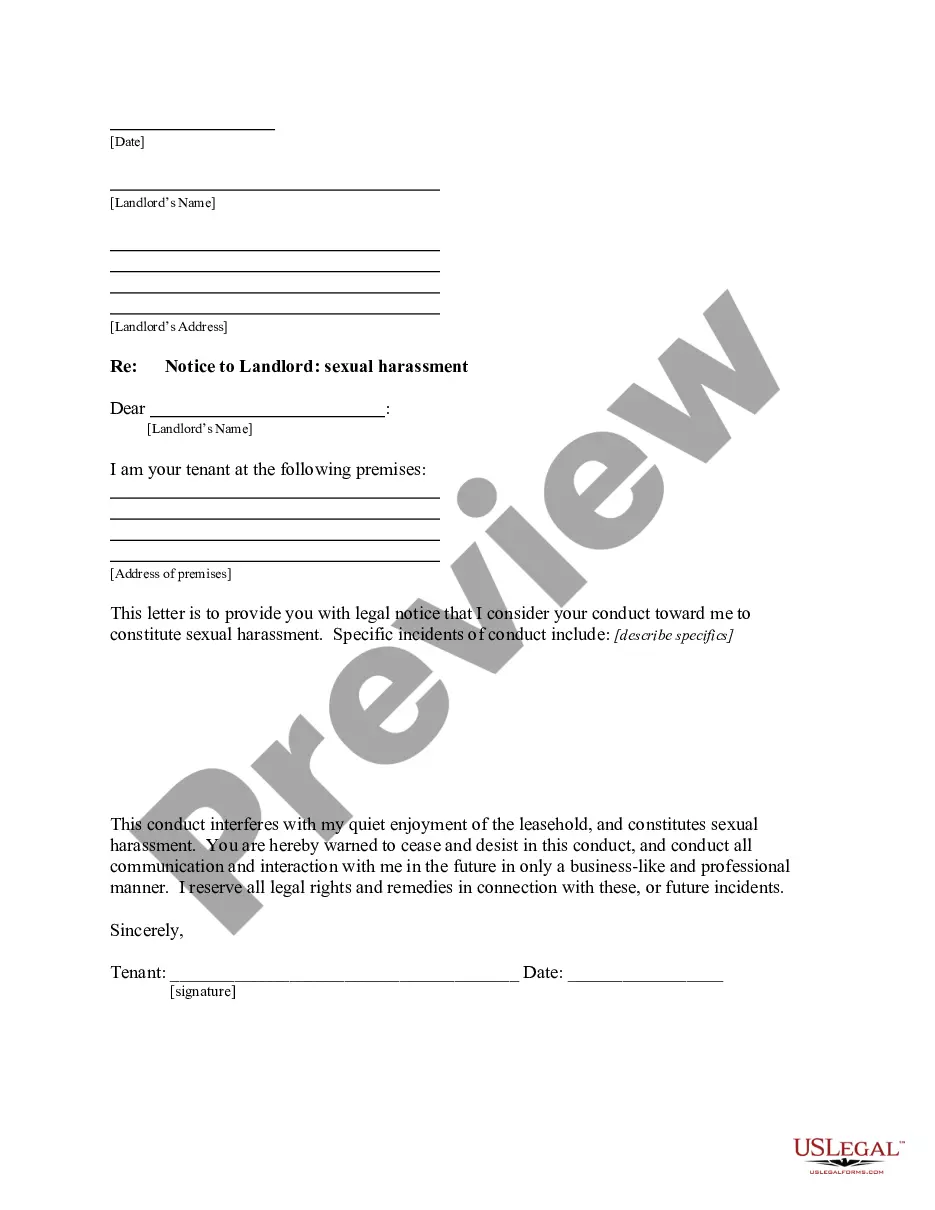

- Select the Preview button to review the content of the form.

Form popularity

FAQ

A budget sheet should include sections for income, fixed expenses, variable expenses, and savings. In the case of a Nevada Personal Monthly Budget Worksheet, it usually features clear categories for easy tracking and calculations. You might find sections for necessary expenses like rent and utilities, alongside areas for discretionary spending. A well-organized budget sheet enables you to visualize your financial situation at a glance, supporting smarter financial choices.

The 50/30/20 rule budget is a guideline for allocating your income in a balanced way. This budget encourages you to spend 50% on necessities, 30% on discretionary items, and 20% on savings or debt repayment. Implementing this system using a Nevada Personal Monthly Budget Worksheet allows for clear tracking of your financial situation. This approach helps you make informed financial decisions while fostering healthy savings habits.

The 50/30/20 rule is a simple budgeting method that helps you manage your finances effectively. This strategy divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Using a Nevada Personal Monthly Budget Worksheet can help you apply this rule by visually organizing your expenses and income. By following this approach, you ensure that you cover essentials while also setting aside funds for savings.

The 50 20 30 budget rule is a simple guideline for personal budgeting. It suggests allocating 50% of your income to needs, 20% to savings and debt repayment, and 30% to discretionary spending. Using a Nevada Personal Monthly Budget Worksheet can help you implement this rule effectively by visually organizing your budget allocations. This strategy provides a balanced approach to managing your personal finances.

Creating a monthly budget as a beginner involves understanding your income and tracking your expenses. Start by documenting all income sources, then list your fixed and variable expenses. A Nevada Personal Monthly Budget Worksheet can provide a guided framework for organizing this information. This method makes it easier for beginners to manage their finances and develop healthy spending habits.

Yes, Excel offers various household budget templates that are easy to use. You can find templates designed for personal budgeting, including options that align with the Nevada Personal Monthly Budget Worksheet. Using these templates can assist you in organizing your finances efficiently and tracking your spending habits with clarity. This convenience can lead to better budgeting practices over time.

A good monthly personal budget should align with your financial goals while covering your essential expenses. Typically, you should allocate a portion for savings, fixed costs, variable expenses, and discretionary spending. Incorporating a Nevada Personal Monthly Budget Worksheet can help you balance these categories effectively. This way, you can optimize your spending while ensuring financial responsibility.

To create a monthly budget, start by listing all your income sources. Next, categorize your expenses, such as housing, food, transportation, and entertainment. Use a Nevada Personal Monthly Budget Worksheet to help track your numbers effectively. This structured approach allows you to visualize your finances and control your spending.

Filling out a monthly budget sheet starts with providing your projected income at the top of the Nevada Personal Monthly Budget Worksheet. Next, categorize your expenses into fixed and variable, inputting estimated amounts for each. By updating this sheet regularly with actual figures, you can better track your spending and enhance your budgeting strategy over time.

Create a personal budget example by utilizing the Nevada Personal Monthly Budget Worksheet to outline a monthly snapshot of your finances. Start with your income, list essential bills, and include discretionary spending. Detailing these categories illustrates how much you can save or where you need to cut back, providing a clear vision of your financial health.