Nevada Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

It is feasible to dedicate numerous hours online trying to locate the legal document format that meets the federal and state requirements you need.

US Legal Forms offers a wide variety of legal templates that are reviewed by experts.

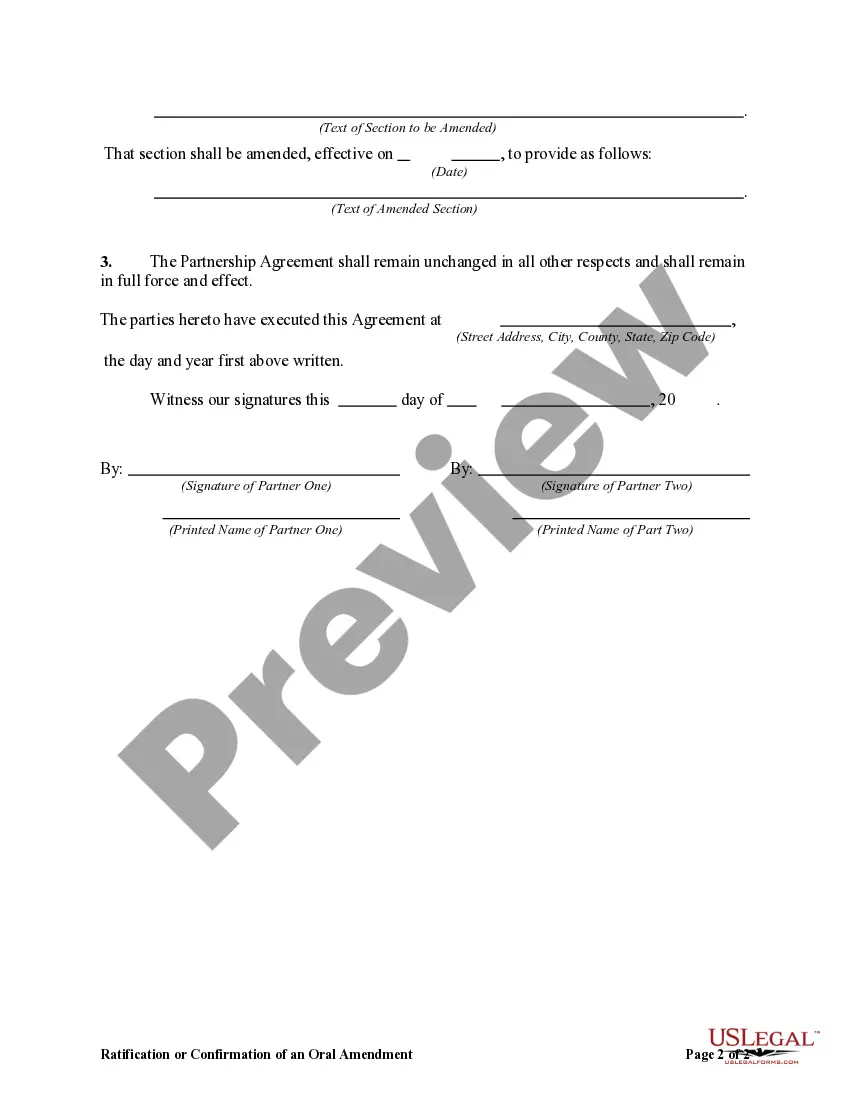

You can download or print the Nevada Ratification or Confirmation of an Oral Amendment to a Partnership Agreement from our platform.

If available, utilize the Review button to browse through the document format as well. If you need to find another version of the document, use the Search field to locate the format that fulfills your needs.

- If you possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Nevada Ratification or Confirmation of an Oral Amendment to a Partnership Agreement.

- Every legal document format you purchase is your personal property indefinitely.

- To obtain another copy of the obtained form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document format for the region/city of your choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

An LLC, or Limited Liability Company, offers liability protection to all its owners, while an LP, or Limited Partnership, includes both general and limited partners, where only general partners face personal liability. In real estate, LLCs are often favored for their flexible management structure and protection from personal liability. Understanding the nuances of these entities is crucial, especially when considering amendments to partnership agreements in Nevada.

YES, It Is Legal to Backdate a Business Buyout or Other Restructure. Many people are trying to work out new arrangements with their business partner but find themselves in bad place on the calendar. Despite both parties agreeing to a change, it could take months to worth out the terms.

Nevada's incorporation of the UCC is found in the Nevada Revised Statutes, chapter 104, which is divided into eight articles. The first of these covers the general provisions of the law, including definitions, interpretations and territorial applicability.

A Partnership Amendment, also called a Partnership Addendum, is used to modify, add, or remove terms in a Partnership Agreement. A Partnership Amendment is usually attached to an existing Partnership Agreement to reflect any changes.

Courts are empowered to dissolve partnerships when on application by or for a partner a partner is shown to be a lunatic, of unsound mind, incapable of performing his part of the agreement, guilty of such conduct as tends to affect prejudicially the carrying on of the business, or otherwise behaves in such a way

The dissolution of a partnership is the change in the relation of the partners caused by any partner ceasing to be associated in the carrying on as distinguished from the winding up of the business. On dissolution the partnership is not terminated, but continues until the winding up of partnership affairs is completed.

A partnership by estoppel is a doctrine or a legal concept that allows a court to provide a remedy to a plaintiff, such as awarding him monetary damages.

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner.

1. Changing partners. When a new partner comes into the partner or when an existing partner leaves, you may want to amend the partnership agreement. This may be desirable to reflect new roles in the business, as well as new allocations of partnership items for tax purposes.

Drafting and FilingAn amendment to a partnership agreement is a legal document that includes specific information about the action, such as a statement that the amendment is made by unanimous consent, a statement that the undersigned agree to the amendment and an explanation of the amendment.