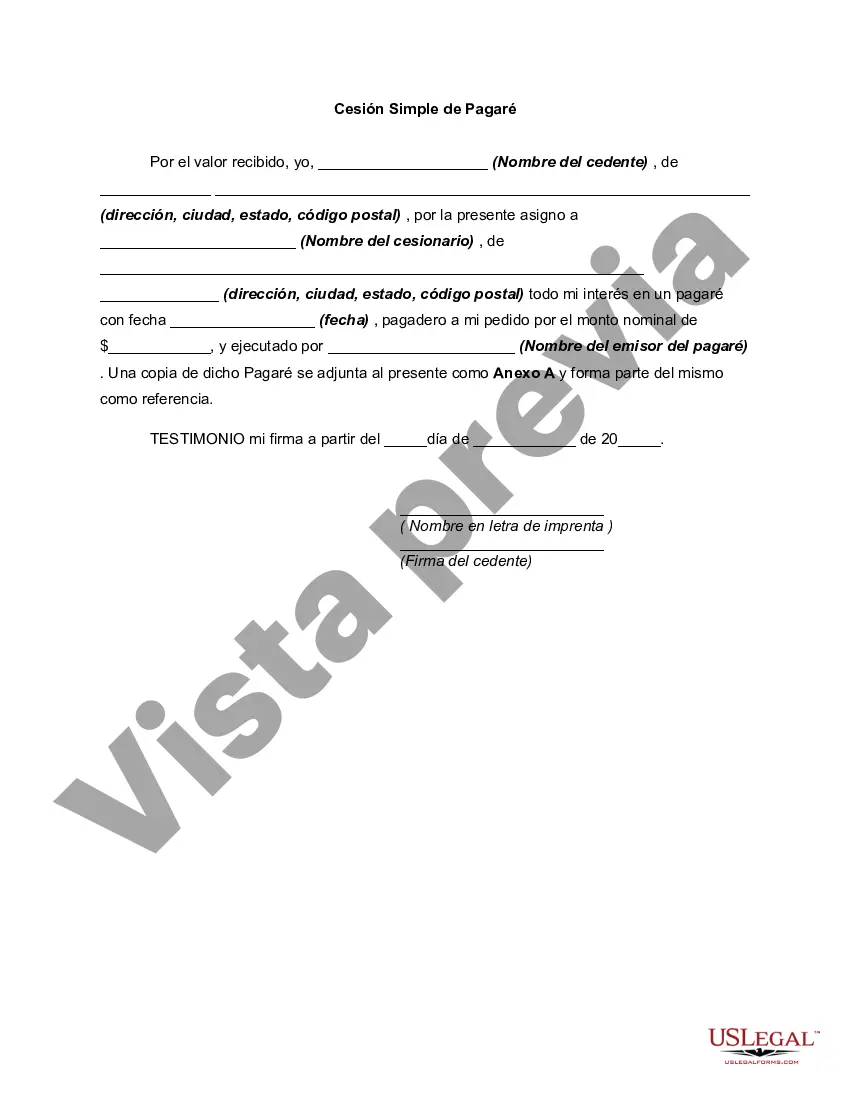

A Nevada Simple Promissory Note for Family Loan is a legally binding document that outlines the terms and conditions of a loan agreement between family members in the state of Nevada. This type of promissory note is specifically designed for family loans, allowing them to formalize and enforce financial arrangements in a clear and transparent manner. The Nevada Simple Promissory Note for Family Loan contains several essential components. Firstly, it includes the names and contact information of the parties involved, outlining the lender (often a family member) and the borrower. It also includes the loan amount, specifying the exact sum of money that is being lent. Furthermore, this document includes the repayment terms for the loan, such as the interest rate (if applicable) and the repayment schedule. It outlines whether the loan will be repaid in equal monthly installments or through a lump sum payment at a specified future date. The promissory note may also mention any late payment penalties or other consequences for defaulting on the loan. Nevada offers different types of Simple Promissory Notes for Family Loans to cater to various loan arrangements. Some common variations include: 1. Lump Sum Repayment Promissory Note: This type of promissory note states that the loan will be repaid in one single payment on a predetermined future date. It specifies the loan amount and any applicable interest rate or charges. 2. Installment Repayment Promissory Note: This variation divides the loan amount into equal monthly installments, including the principal amount and any interest due. It outlines the number of installments and their due dates, providing a structured repayment plan. 3. Interest-Free Promissory Note: In some cases, the family loan might not involve any interest charges. This type of promissory note clarifies that the loan is interest-free and will be repaid in either a lump sum or through scheduled installments. The Nevada Simple Promissory Note for Family Loan is crucial in safeguarding the interests of both the lender and borrower, ensuring transparent and fair financial dealings within the family. It serves as legal evidence of the loan agreement and can be used for enforcement purposes if necessary. Whether the loan is for personal expenses, education, or other financial needs, this promissory note provides a solid foundation for securing family loans effectively and professionally.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Nevada Pagaré Simple Para Préstamo Familiar?

Finding the right legal papers format could be a battle. Naturally, there are tons of templates available on the net, but how can you obtain the legal develop you need? Utilize the US Legal Forms internet site. The services provides a large number of templates, including the Nevada Simple Promissory Note for Family Loan, that you can use for company and private demands. Every one of the types are examined by pros and fulfill federal and state specifications.

Should you be currently registered, log in to your accounts and click the Obtain button to get the Nevada Simple Promissory Note for Family Loan. Utilize your accounts to check from the legal types you might have purchased previously. Visit the My Forms tab of your own accounts and acquire yet another copy in the papers you need.

Should you be a whole new end user of US Legal Forms, listed here are basic recommendations so that you can stick to:

- First, make sure you have selected the proper develop for the metropolis/area. You may examine the form making use of the Preview button and read the form description to make sure this is the best for you.

- In the event the develop is not going to fulfill your requirements, utilize the Seach area to find the appropriate develop.

- When you are sure that the form would work, click the Buy now button to get the develop.

- Select the prices strategy you need and type in the essential information and facts. Design your accounts and purchase your order using your PayPal accounts or bank card.

- Pick the submit formatting and download the legal papers format to your device.

- Total, change and print out and indication the received Nevada Simple Promissory Note for Family Loan.

US Legal Forms is definitely the greatest catalogue of legal types for which you will find different papers templates. Utilize the service to download professionally-made paperwork that stick to express specifications.