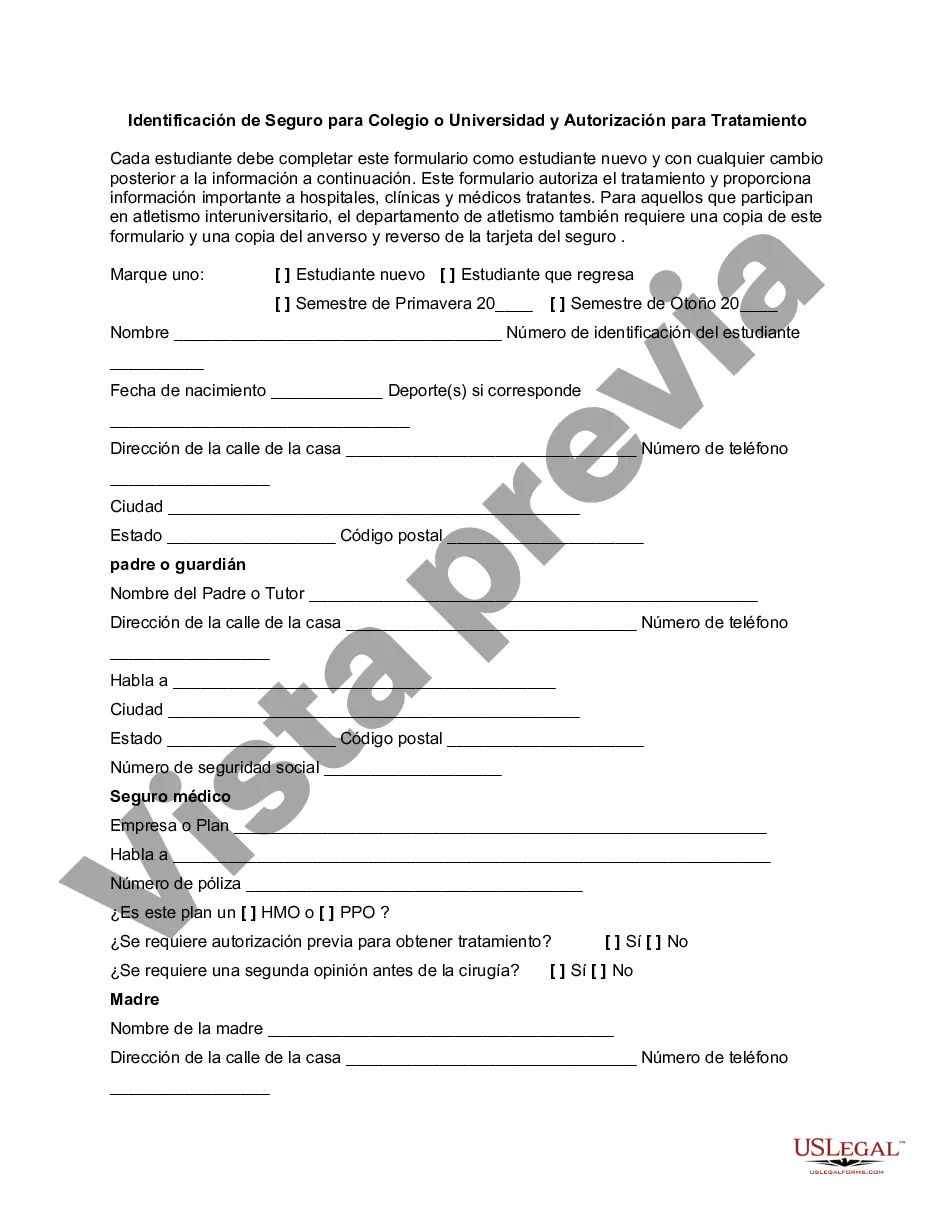

This form authorizes treatment for athletes and students of a college and university and provides important information to hospitals, clinics and attending physicians. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Identification of Insurance for College or University and Authorization is a crucial document that verifies the existence and coverage of insurance policies held by educational institutions within the state of Nevada. This identification serves as proof that a particular college or university has obtained the necessary insurance coverage to protect its students, staff, faculty, and property from potential risks and liabilities. The Nevada Identification of Insurance for College or University and Authorization typically includes detailed information about the insurance policies such as the name of the insurance carrier, policy number, effective dates, and coverage limits. Additionally, it specifies the types of insurance coverage obtained by the institution, which may vary depending on the specific needs of the college or university. Keywords: Nevada, identification of insurance, college, university, authorization, insurance policies, coverage, educational institutions, proof, students, staff, faculty, property, risks, liabilities, insurance carrier, policy number, effective dates, coverage limits. Types of Nevada Identification of Insurance for College or University and Authorization: 1. General Liability Insurance: This type of insurance provides coverage for claims arising from bodily injury, property damage, or personal injury that occur on the college or university premises. It protects against lawsuits and other liability-related costs. 2. Professional Liability Insurance: This insurance, also known as errors and omissions insurance, covers claims related to professional negligence, errors, or omissions made by faculty, staff, or administrators. It safeguards the institution's employees against legal expenses and damages resulting from their professional services. 3. Property Insurance: This policy provides protection for the physical assets owned by the college or university, including buildings, equipment, and supplies. It covers damages caused by fire, vandalism, theft, natural disasters, or other specified perils. 4. Workers' Compensation Insurance: Workers' compensation insurance is mandatory for employers in most states, including Nevada. It provides coverage for medical expenses, lost wages, and rehabilitation costs for employees who sustain work-related injuries or illnesses. 5. Automobile Insurance: If the college or university owns vehicles for transportation purposes, such as campus shuttles or other vehicles used for official business, having adequate automobile insurance is essential. It covers liability, property damage, and physical damage expenses in case of accidents involving these vehicles. 6. Cyber Liability Insurance: In the digital age, educational institutions are increasingly vulnerable to cyber threats and data breaches. Cyber Liability Insurance protects against expenses related to data breaches, cybersecurity incidents, and identity theft occurring within the college or university's digital systems. It's important for colleges and universities in Nevada to maintain valid and up-to-date Identification of Insurance documents, as they may be required to provide proof of insurance coverage when entering into contracts, leasing facilities, or applying for grants or loans.Nevada Identification of Insurance for College or University and Authorization is a crucial document that verifies the existence and coverage of insurance policies held by educational institutions within the state of Nevada. This identification serves as proof that a particular college or university has obtained the necessary insurance coverage to protect its students, staff, faculty, and property from potential risks and liabilities. The Nevada Identification of Insurance for College or University and Authorization typically includes detailed information about the insurance policies such as the name of the insurance carrier, policy number, effective dates, and coverage limits. Additionally, it specifies the types of insurance coverage obtained by the institution, which may vary depending on the specific needs of the college or university. Keywords: Nevada, identification of insurance, college, university, authorization, insurance policies, coverage, educational institutions, proof, students, staff, faculty, property, risks, liabilities, insurance carrier, policy number, effective dates, coverage limits. Types of Nevada Identification of Insurance for College or University and Authorization: 1. General Liability Insurance: This type of insurance provides coverage for claims arising from bodily injury, property damage, or personal injury that occur on the college or university premises. It protects against lawsuits and other liability-related costs. 2. Professional Liability Insurance: This insurance, also known as errors and omissions insurance, covers claims related to professional negligence, errors, or omissions made by faculty, staff, or administrators. It safeguards the institution's employees against legal expenses and damages resulting from their professional services. 3. Property Insurance: This policy provides protection for the physical assets owned by the college or university, including buildings, equipment, and supplies. It covers damages caused by fire, vandalism, theft, natural disasters, or other specified perils. 4. Workers' Compensation Insurance: Workers' compensation insurance is mandatory for employers in most states, including Nevada. It provides coverage for medical expenses, lost wages, and rehabilitation costs for employees who sustain work-related injuries or illnesses. 5. Automobile Insurance: If the college or university owns vehicles for transportation purposes, such as campus shuttles or other vehicles used for official business, having adequate automobile insurance is essential. It covers liability, property damage, and physical damage expenses in case of accidents involving these vehicles. 6. Cyber Liability Insurance: In the digital age, educational institutions are increasingly vulnerable to cyber threats and data breaches. Cyber Liability Insurance protects against expenses related to data breaches, cybersecurity incidents, and identity theft occurring within the college or university's digital systems. It's important for colleges and universities in Nevada to maintain valid and up-to-date Identification of Insurance documents, as they may be required to provide proof of insurance coverage when entering into contracts, leasing facilities, or applying for grants or loans.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.