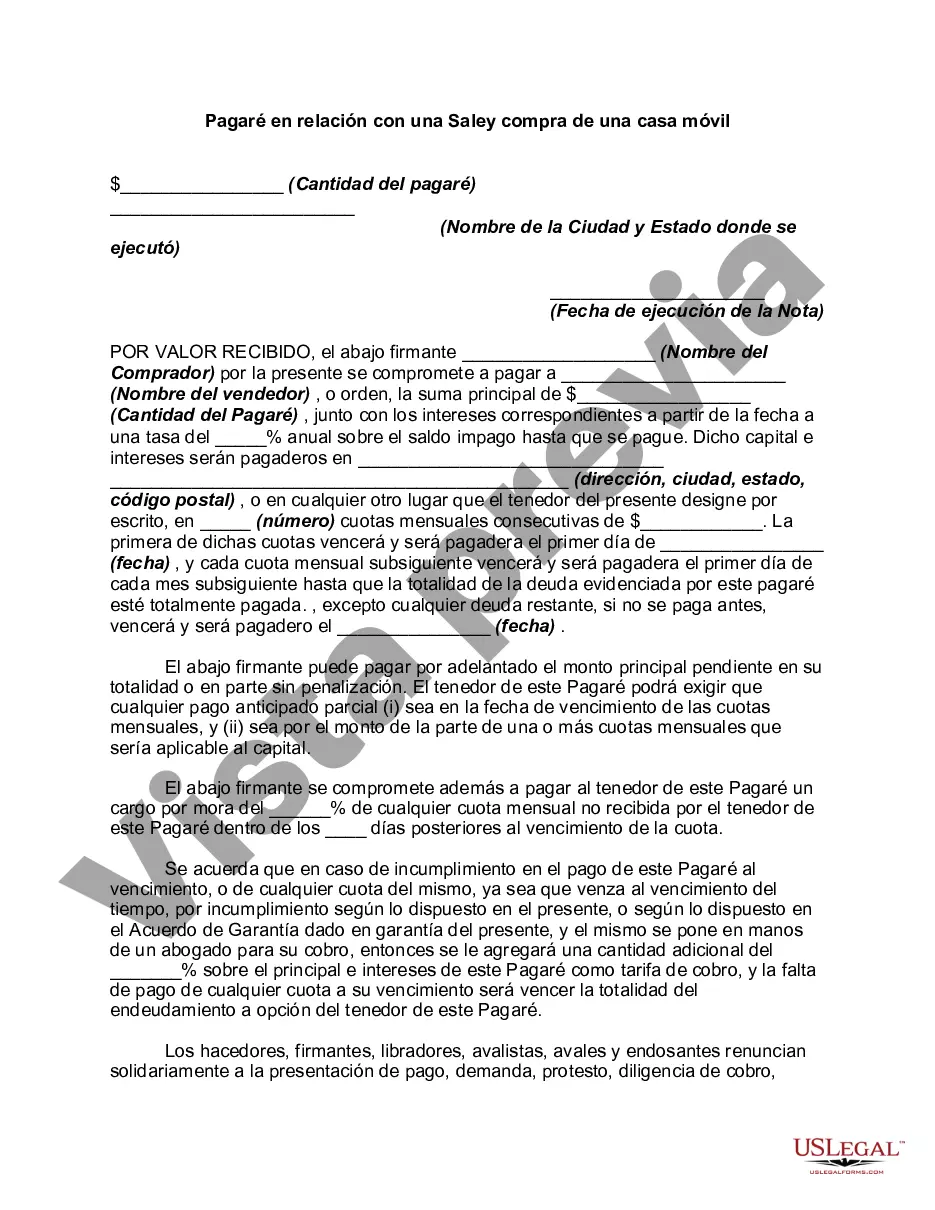

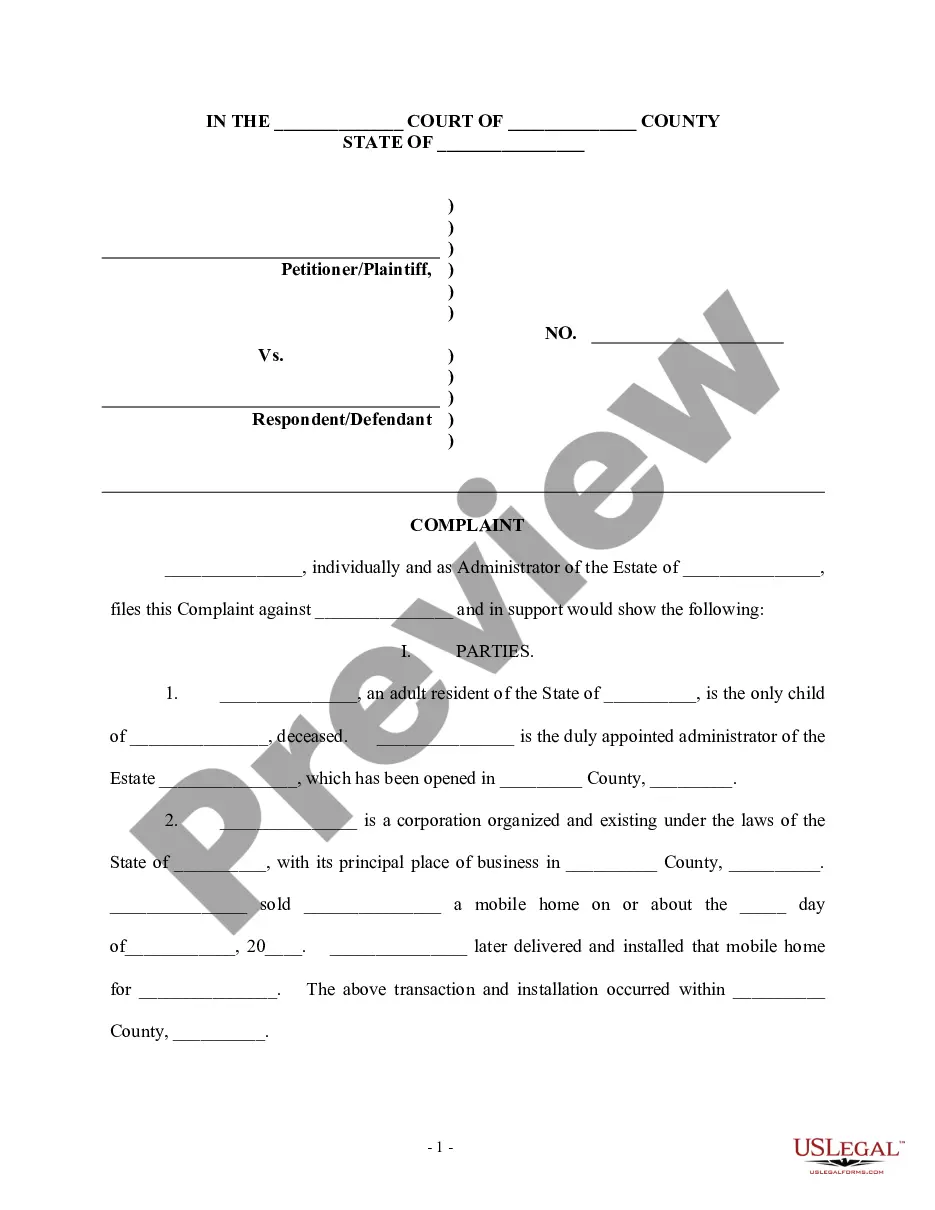

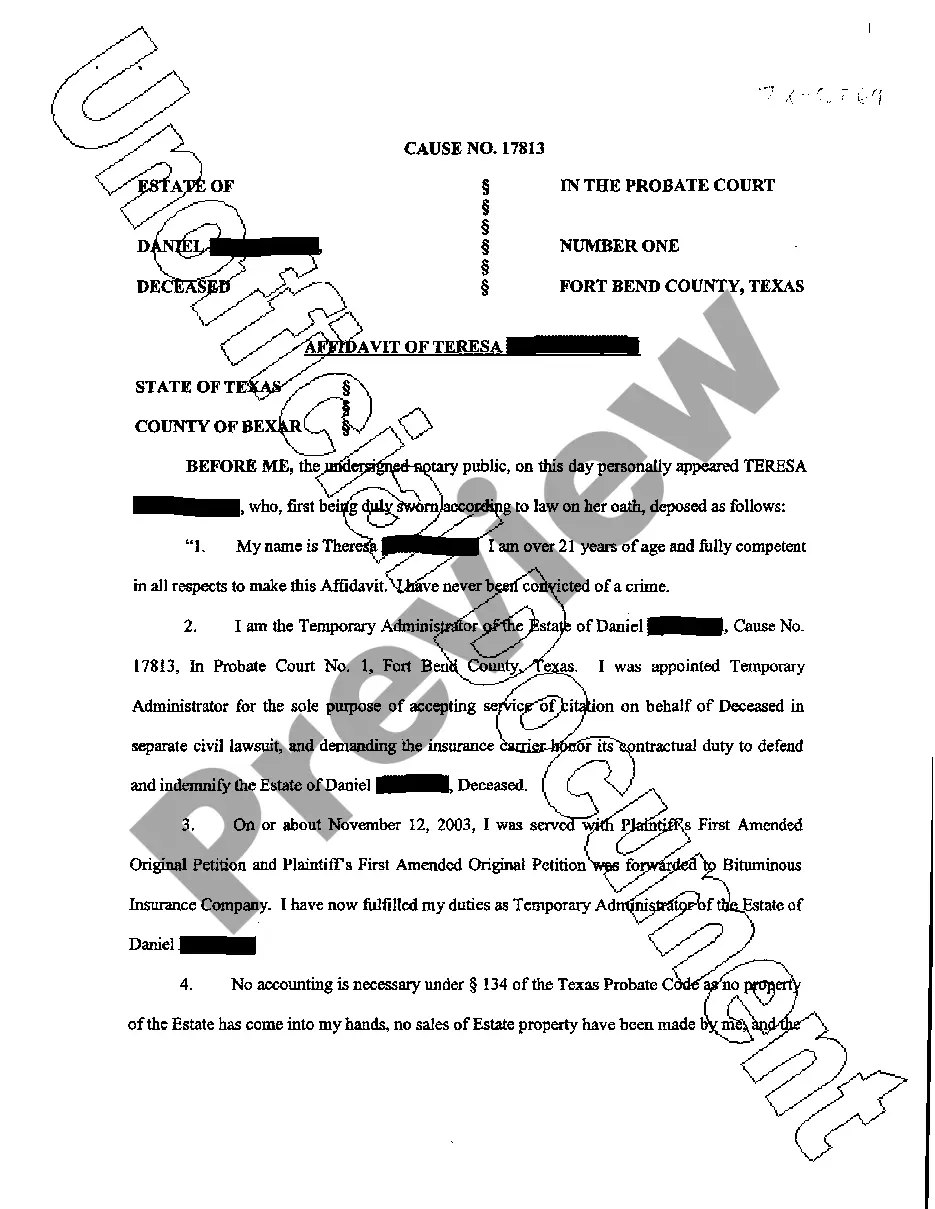

A promissory note is a legal document that outlines the terms and conditions under which one party agrees to repay a loan to another party. In the context of a sale and purchase of a mobile home in Nevada, a promissory note is often utilized to facilitate the financing of the transaction. This type of promissory note is specifically tailored to meet the needs of individuals involved in the mobile home market. Nevada promissory notes in connection with the sale and purchase of a mobile home come in different types, depending on the specific terms and requirements of the parties involved. Some common types include: 1. Installment Promissory Note: This type of promissory note outlines regular installment payments that the buyer must make to the seller in order to repay the loan amount. The note will specify the amount of each payment, the due dates, the interest rate, and any penalties for late or missed payments. 2. Balloon Promissory Note: A balloon promissory note is structured so that the buyer makes regular payments for a defined period, but a significant portion of the principal balance is due in a lump sum payment at the end of the loan term. This type of note is ideal for buyers who anticipate having greater financial stability or access to funds when the balloon payment becomes due. 3. Adjustable Rate Promissory Note: An adjustable rate promissory note incorporates an interest rate that adjusts periodically based on a specified index, such as the Prime Rate. This allows the interest rate on the loan to fluctuate over time, which can be advantageous for buyers seeking to take advantage of potentially lower interest rates in the future. 4. Secured Promissory Note: A secured promissory note is backed by collateral, such as the mobile home being purchased. If the buyer fails to make the required payments, the seller has the right to seize the collateral as a form of repayment. This type of note provides additional security for the seller in the event of default. When entering into a Nevada promissory note in connection with the sale and purchase of a mobile home, it is crucial to consult with a legal professional to ensure that all legal requirements are met, and that the terms and conditions of the note align with the specific needs and circumstances of both the buyer and seller. Knowing the different types of promissory notes available can assist individuals in making informed decisions regarding the financing of their mobile home purchase.

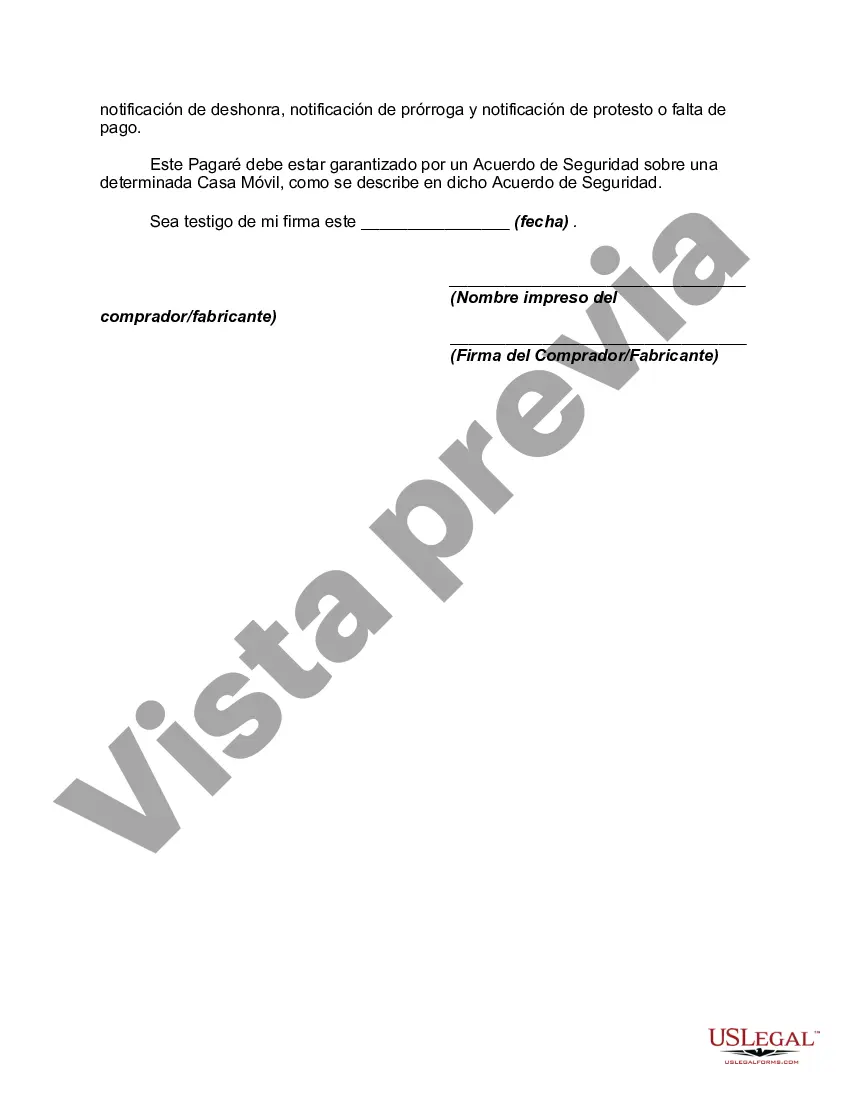

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Pagaré en relación con la compra y venta de una casa móvil - Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Nevada Pagaré En Relación Con La Compra Y Venta De Una Casa Móvil?

If you wish to full, acquire, or print out authorized file web templates, use US Legal Forms, the biggest assortment of authorized varieties, that can be found on the Internet. Use the site`s basic and practical research to discover the paperwork you need. Different web templates for organization and personal reasons are categorized by classes and suggests, or key phrases. Use US Legal Forms to discover the Nevada Promissory Note in Connection with a Sale and Purchase of a Mobile Home in just a number of mouse clicks.

If you are previously a US Legal Forms buyer, log in in your bank account and click the Download key to have the Nevada Promissory Note in Connection with a Sale and Purchase of a Mobile Home. You can even accessibility varieties you previously delivered electronically in the My Forms tab of your bank account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Ensure you have selected the form for that correct area/country.

- Step 2. Utilize the Preview option to check out the form`s articles. Never neglect to read through the outline.

- Step 3. If you are unsatisfied using the type, utilize the Look for industry at the top of the screen to discover other types from the authorized type template.

- Step 4. After you have discovered the form you need, select the Purchase now key. Pick the pricing program you choose and put your accreditations to register for an bank account.

- Step 5. Procedure the purchase. You can use your charge card or PayPal bank account to finish the purchase.

- Step 6. Pick the formatting from the authorized type and acquire it on your own gadget.

- Step 7. Total, modify and print out or indication the Nevada Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

Each and every authorized file template you buy is your own forever. You possess acces to each and every type you delivered electronically inside your acccount. Go through the My Forms area and pick a type to print out or acquire once again.

Be competitive and acquire, and print out the Nevada Promissory Note in Connection with a Sale and Purchase of a Mobile Home with US Legal Forms. There are many professional and status-particular varieties you can utilize to your organization or personal needs.