A Nevada Sales Receipt is a document provided to a customer after a purchase transaction has been completed in the state of Nevada. It serves as proof of the transaction and includes important details such as the date, time, and location of the sale, the name and address of the seller, a description of the items or services purchased, the quantity and price of each item, and the total amount paid. This receipt is commonly used by businesses and individuals to track sales, for record-keeping purposes, and for tax-related documentation. The different types of Nevada Sales Receipt may include: 1. Point of Sale (POS) Receipt: This type of receipt is generated instantly upon completion of a purchase at a physical retail store or a point of sale terminal. It provides a detailed breakdown of each item purchased along with any applicable taxes and discounts. 2. Online Sales Receipt: With the rise of e-commerce, online sales receipts have become prevalent. These receipts are primarily digital and are typically emailed to the customer's provided email address. They contain all the necessary information, including the seller's details, product descriptions, prices, and any applicable shipping charges. 3. Mobile Sales Receipt: Mobile sales receipts have gained popularity due to the increasing usage of mobile payment methods. These receipts can be generated and sent directly to the customer's mobile device at the time of purchase, ensuring convenience and eliminating the need for physical documents. 4. Manual Sales Receipt: In cases where a business does not have a digital point of sale system, manual sales receipts are utilized. These receipts are handwritten or printed and are manually filled out by the seller. They contain all the necessary transaction details but might lack certain automated features available in digital receipts. 5. Exempt Sales Receipt: Occasionally, certain sales in Nevada may be exempt from sales tax, such as for resellers or non-profit organizations. Exempt sales receipts are used to document these types of transactions, providing proof that sales tax was not charged. 6. Customized Sales Receipt: Many businesses choose to create their own customized sales receipts with their company logo, branding elements, and additional information specific to their operations. These customized receipts may include payment terms, return policies, or advertising messages, providing a personalized touch and reinforcing brand identity. In conclusion, a Nevada Sales Receipt is a crucial document that serves as proof of purchase and includes all relevant details about a sale transaction. These receipts can take various forms, including point of sale, online, mobile, manual, exempt, and customized receipts, offering flexibility to meet the diverse needs of businesses operating in Nevada.

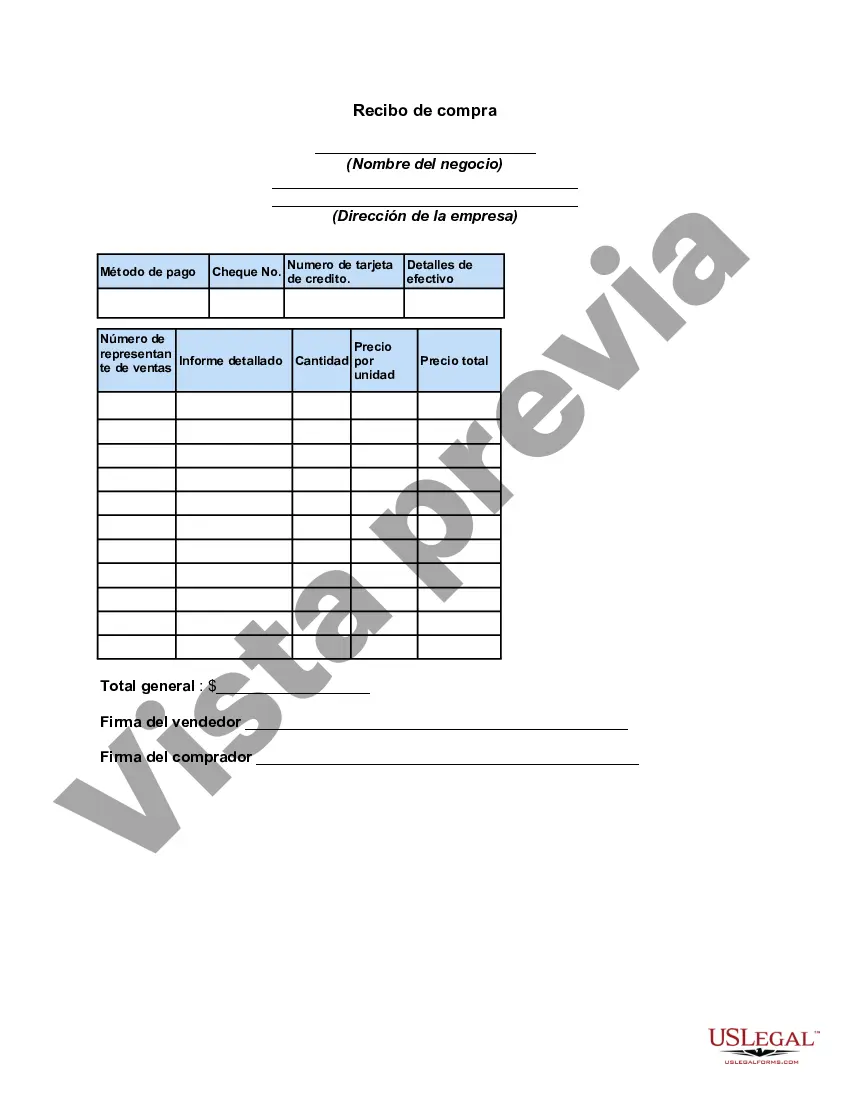

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Recibo de compra - Sales Receipt

Description

How to fill out Nevada Recibo De Compra?

You can spend several hours on the web searching for the legitimate document template that meets the state and federal specifications you want. US Legal Forms supplies 1000s of legitimate forms that happen to be evaluated by pros. It is simple to download or print the Nevada Sales Receipt from our service.

If you already possess a US Legal Forms profile, you are able to log in and click on the Down load option. After that, you are able to comprehensive, edit, print, or signal the Nevada Sales Receipt. Each and every legitimate document template you get is your own for a long time. To have yet another backup of any purchased kind, visit the My Forms tab and click on the related option.

If you use the US Legal Forms internet site for the first time, stick to the basic instructions listed below:

- Very first, be sure that you have selected the correct document template for the state/area of your choosing. See the kind explanation to make sure you have chosen the proper kind. If offered, take advantage of the Review option to appear through the document template also.

- In order to find yet another edition in the kind, take advantage of the Look for discipline to discover the template that suits you and specifications.

- Upon having found the template you desire, click on Purchase now to continue.

- Select the rates plan you desire, type in your accreditations, and sign up for an account on US Legal Forms.

- Total the deal. You may use your charge card or PayPal profile to pay for the legitimate kind.

- Select the structure in the document and download it to the product.

- Make adjustments to the document if necessary. You can comprehensive, edit and signal and print Nevada Sales Receipt.

Down load and print 1000s of document templates making use of the US Legal Forms Internet site, that offers the biggest variety of legitimate forms. Use professional and state-particular templates to handle your company or individual needs.