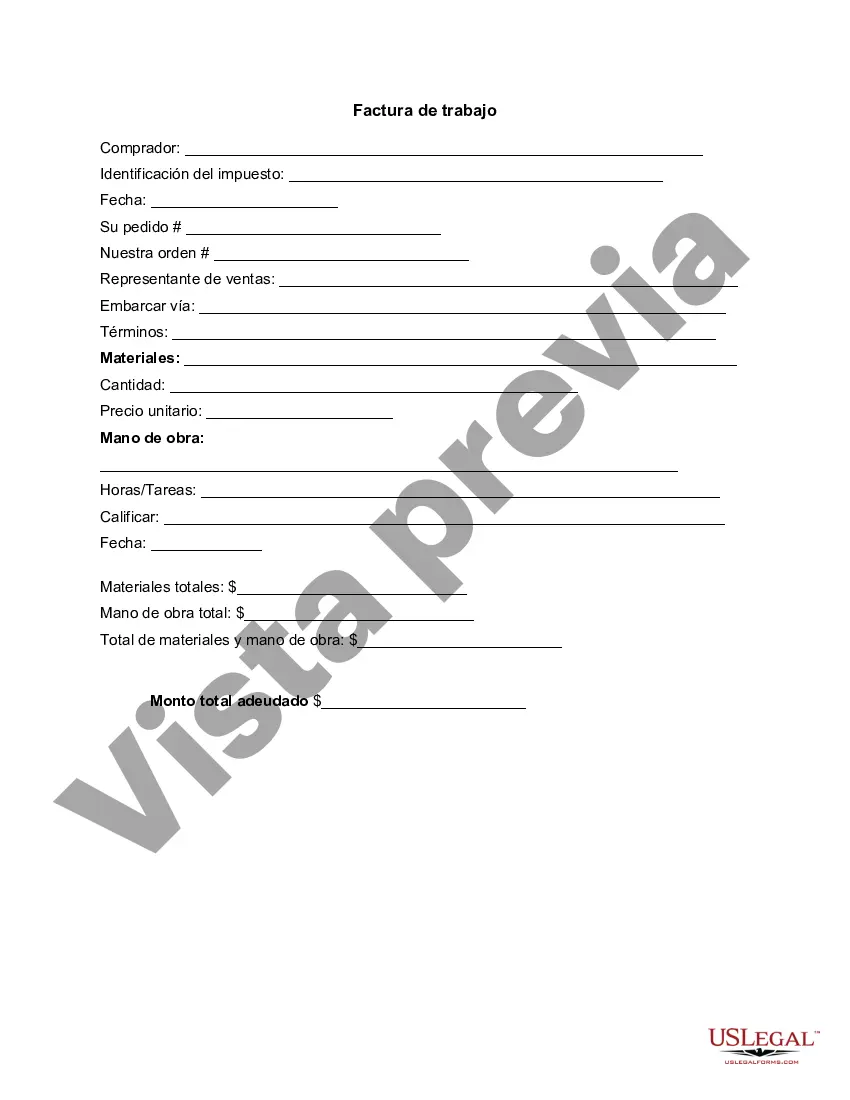

Nevada Invoice Template for Dentist: A Comprehensive Overview In the dental industry, maintaining accurate and efficient financial records is vital for successful practice management. When providing dental services in Nevada, dentists require an invoice template tailored to their specific needs and compliant with the state's regulations. The Nevada Invoice Template for Dentists serves as a valuable tool to simplify and streamline the billing process, ensuring accurate documentation and timely payment. Key Features of the Nevada Invoice Template for Dentists: 1. Customization Options: The Nevada Invoice Template for Dentists offers various customization options, allowing dental professionals to include their practice name, logo, contact information, and business registration details. Custom branding not only establishes a professional image but also promotes brand recognition. 2. Patient Information: The template includes dedicated sections to input patient details such as name, contact information, and insurance information. Efficiently recording patient demographics ensures accurate billing and enables dental offices to maintain organized patient records. 3. Itemized Services: Dentists can list services provided, including consultations, examinations, treatments, and procedures separately, making it easier to account for each service rendered. Additionally, dentists can specify any materials used during the procedure, ensuring complete transparency in itemized billing. 4. Pricing and Fee Structure: The Nevada Invoice Template for Dentists accommodates different pricing models, enabling dentists to assign fees based on pre-determined rates, insurance coverage, or personalized treatment plans. Clear presentation of costs helps patients understand their bills and reduces billing disputes. 5. Important Dates and Payment Terms: The template contains sections to record invoice creation dates, due dates, and acceptable payment methods. Dentists can specify their preferred payment terms, such as net 30 or net 60 days, to ensure timely payments and maintain healthy cash flow. 6. Tax Compliance: Nevada has specific taxation requirements, and the invoice template ensures compliance by incorporating necessary tax fields. Dentists can include state tax identification numbers and accurately calculate sales tax, if applicable, simplifying the tax filing process. 7. Multiple Template Options: Depending on the dental practice's preferences, different template designs and layouts are available, providing flexibility in selecting a visually appealing and user-friendly format. Dentists can choose from professional, modern, or minimalist templates that suit their practice's image. Different Types of Nevada Invoice Templates for Dentists: 1. Standard Nevada Invoice Template: This template includes the essential features mentioned above and serves as a versatile option for general dental practices. 2. Periodontics Invoice Template: Specifically designed for periodontists, this template caters to periodontal treatments, gum surgeries, dental implants, and other specialized services offered in this field. 3. Orthodontics Invoice Template: Suited for orthodontic practices, this template focuses on services like braces installation, retainers, aligners, and other orthodontic treatments invoicing. 4. Oral Surgery Invoice Template: This template is directed towards oral surgeons, featuring dedicated sections for complex procedures, sedation services, extractions, and other oral surgical treatments billed separately. In summary, the Nevada Invoice Template for Dentists streamlines financial processes, adheres to state regulations, and enhances the professionalism and efficiency of dental practices. With customizable options and various types available, dentists can select a template that best fits their specific requirements, ensuring accurate invoicing and maintaining a successful dental practice in Nevada.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Plantilla de factura para dentista - Invoice Template for Dentist

Description

How to fill out Nevada Plantilla De Factura Para Dentista?

US Legal Forms - one of several greatest libraries of authorized kinds in the USA - delivers an array of authorized record themes you may download or print. Making use of the site, you will get 1000s of kinds for organization and person functions, categorized by types, suggests, or search phrases.You can get the latest types of kinds like the Nevada Invoice Template for Dentist within minutes.

If you have a registration, log in and download Nevada Invoice Template for Dentist from your US Legal Forms local library. The Download option will show up on each develop you see. You gain access to all in the past downloaded kinds from the My Forms tab of your profile.

If you want to use US Legal Forms initially, here are basic directions to help you get started:

- Ensure you have picked out the proper develop for the metropolis/county. Click the Review option to check the form`s information. Browse the develop information to actually have selected the proper develop.

- If the develop doesn`t satisfy your specifications, take advantage of the Research field towards the top of the monitor to obtain the one that does.

- In case you are pleased with the shape, confirm your selection by visiting the Buy now option. Then, pick the pricing strategy you want and provide your accreditations to register on an profile.

- Procedure the financial transaction. Utilize your charge card or PayPal profile to accomplish the financial transaction.

- Pick the file format and download the shape on the gadget.

- Make modifications. Fill out, revise and print and indicator the downloaded Nevada Invoice Template for Dentist.

Each web template you included with your account does not have an expiry time and is yours forever. So, if you would like download or print yet another duplicate, just visit the My Forms section and then click about the develop you require.

Obtain access to the Nevada Invoice Template for Dentist with US Legal Forms, the most extensive local library of authorized record themes. Use 1000s of skilled and status-certain themes that meet up with your business or person needs and specifications.