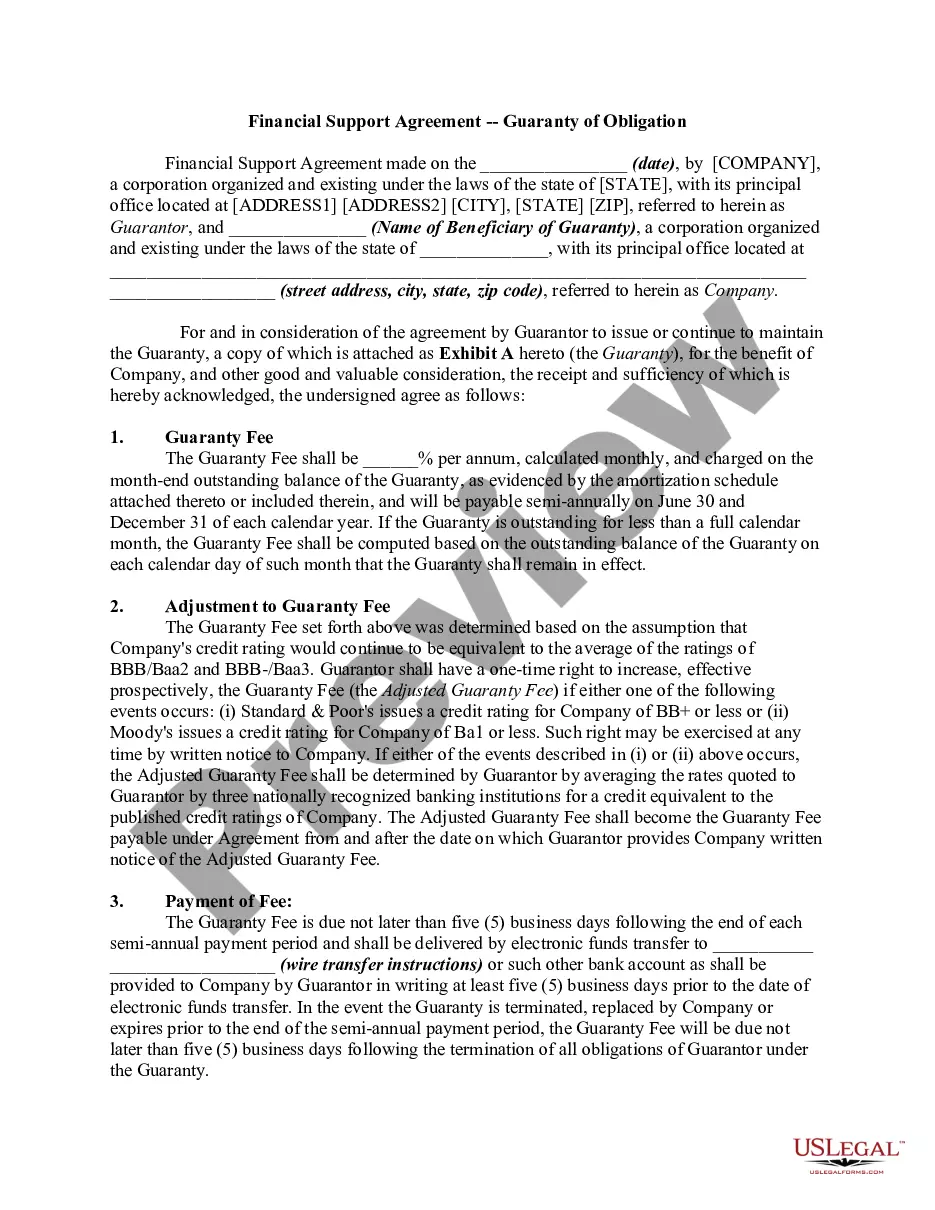

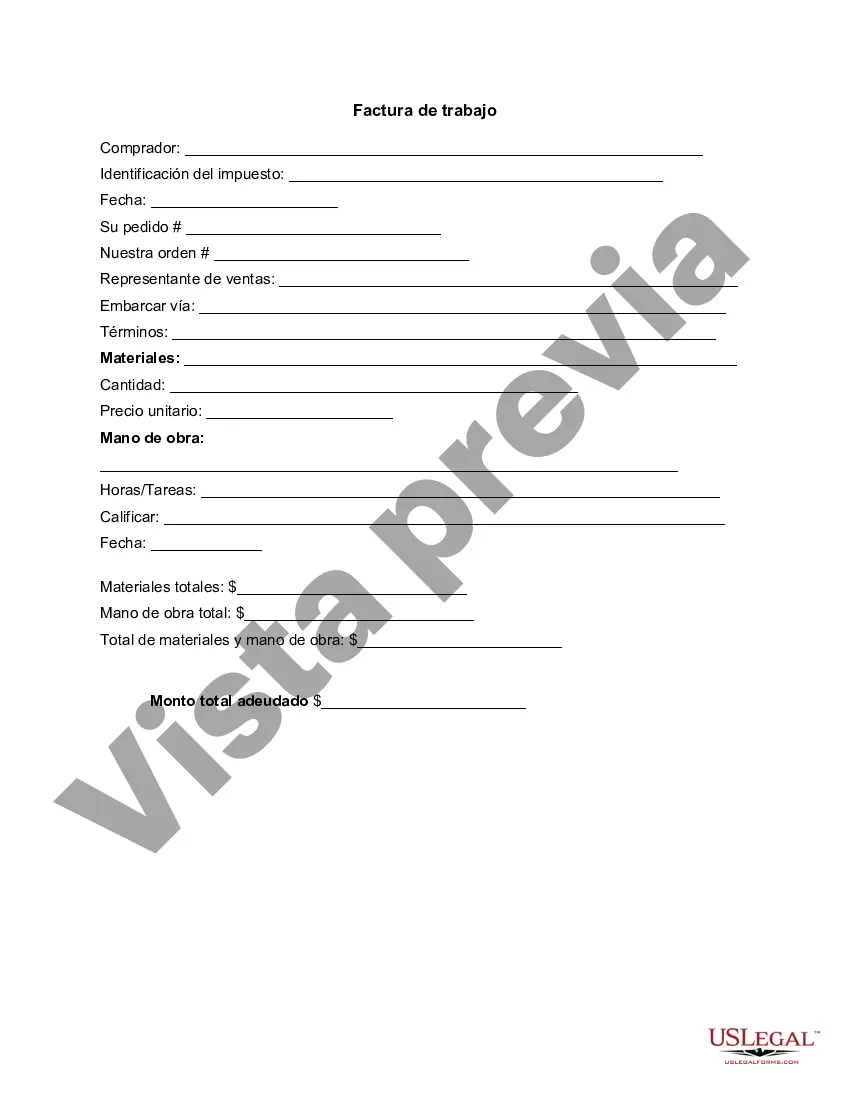

Nevada Invoice Template for Independent Contractor: A Comprehensive Guide In Nevada, an invoice template for independent contractors serves as a crucial tool to document and ensure the smooth flow of business transactions. This detailed description aims to provide valuable insights into what a Nevada invoice template for independent contractors entails and highlights its significance for professionals in the state. Key Features of a Nevada Invoice Template for Independent Contractor: 1. Professional Design: A well-crafted invoice template projects a professional image for independent contractors operating in Nevada. It typically includes a header section containing the contractor's business name, logo, and contact details, instilling confidence and credibility in clients. 2. Contractor and Client Information: The template includes sections to input both the contractor's and client's relevant details. This includes names, addresses, contact numbers, and email addresses, ensuring accurate communication and effortless record-keeping. 3. Invoice Number and Date: Each invoice generated should have a unique identification number assigned to it, enabling efficient tracking and organization of invoices. Alongside the invoice number, the template includes the date on which the invoice was created to maintain a clear timeline of business transactions. 4. Description of Services: This section allows contractors to outline the services provided in detail, including the quantity, rate, and total cost for each service. It aids in clear communication, ensuring transparency and avoiding any confusions or disputes pertaining to the services rendered. 5. Payment Terms and Methods: The Nevada invoice template includes a section where independent contractors can specify their preferred payment terms, such as payment due date, accepted modes of payment (e.g., check, bank transfer, online payment platforms), and any penalties for late payments. This ensures everyone is on the same page regarding payment expectations. 6. Itemized Expenses and Taxes: For meticulous record-keeping and taxation purposes, the template should have sections to itemize additional expenses incurred during service delivery, such as travel expenses or material costs. A separate line for taxes (e.g., sales tax or any applicable Nevada taxes) should also be included, if applicable. Different Types of Nevada Invoice Templates for Independent Contractors: 1. Basic Invoice Template: Suitable for independent contractors who provide simple services, this template includes essential sections such as contractor and client information, scope of services, rates, and payment details. 2. Hourly Rate Invoice Template: Ideal for contractors who charge based on an hourly rate, this template calculates the total cost by multiplying the hours worked by the respective rate. It ensures clarity on the time spent on each task and the corresponding charges. 3. Fixed Price Invoice Template: This type of invoice template is suitable when the contractor provides services at a set price. The template typically includes project details, deliverables, and a lump sum amount, simplifying the billing process. 4. Retainer Invoice Template: For contractors who receive a retainer fee, this template outlines the agreed-upon retainer amount, relevant service details, and any additional charges or deductions as specified in the retainer agreement. In conclusion, a Nevada invoice template for independent contractors is an essential tool for ensuring efficient financial management and maintaining professionalism. By utilizing these templates, contractors can create accurate, clear, and legally compliant invoices while streamlining their invoicing processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Plantilla de factura para contratista independiente - Invoice Template for Independent Contractor

Description

How to fill out Nevada Plantilla De Factura Para Contratista Independiente?

You can invest time on-line attempting to find the legal record design that fits the federal and state needs you will need. US Legal Forms supplies thousands of legal types which are evaluated by specialists. It is simple to acquire or print out the Nevada Invoice Template for Independent Contractor from our assistance.

If you already possess a US Legal Forms account, you can log in and click on the Acquire key. Following that, you can full, modify, print out, or sign the Nevada Invoice Template for Independent Contractor. Each and every legal record design you purchase is your own permanently. To get one more version of the acquired form, go to the My Forms tab and click on the related key.

If you are using the US Legal Forms web site for the first time, adhere to the simple recommendations beneath:

- First, make certain you have chosen the correct record design for that county/area of your liking. Read the form outline to make sure you have selected the proper form. If readily available, utilize the Review key to appear with the record design also.

- If you wish to discover one more model of your form, utilize the Lookup discipline to obtain the design that suits you and needs.

- Upon having found the design you desire, simply click Buy now to carry on.

- Find the pricing plan you desire, type in your qualifications, and register for your account on US Legal Forms.

- Full the purchase. You should use your Visa or Mastercard or PayPal account to pay for the legal form.

- Find the format of your record and acquire it to your product.

- Make adjustments to your record if required. You can full, modify and sign and print out Nevada Invoice Template for Independent Contractor.

Acquire and print out thousands of record themes while using US Legal Forms website, that provides the greatest collection of legal types. Use specialist and state-particular themes to handle your organization or personal demands.