A Nevada invoice template for lawyers is an essential tool in managing and documenting legal services rendered to clients in the state. It provides a structured format to present billable hours, expenses, and detailed information related to the legal work performed. Designed specifically for legal professionals in Nevada, this template ensures compliance with local laws and regulations, streamlining the invoicing process and promoting transparency between attorneys and their clients. The Nevada invoice template for lawyers typically includes the following key elements: 1. Header: The header section features the law firm's name, address, contact information, and logo for brand recognition. Additionally, the lawyer's name, contact details, and bar association number are included for identification purposes. 2. Client Information: This section captures the client's name, address, contact information, and any reference number or matter number associated with the case. 3. Invoice Number and Date: Every invoice generated using this template is assigned a unique invoice number and date to facilitate easy tracking and reference. 4. Services Provided: This part of the invoice enumerates all legal services provided to the client. The template allows for a detailed description that specifies the nature of the work, such as legal research, document drafting, court appearances, consultations, and more. Each service entry should include the date, duration, and an hourly rate for billing. 5. Expenses: Lawyers often incur expenses related to client representation, such as court filing fees, travel costs, postage, photocopying, or expert witness fees. The template includes a section to itemize these expenses separately, ensuring that clients see a transparent breakdown of all costs incurred. 6. Hourly Rates: Nevada invoice templates for lawyers commonly display the attorney's hourly rates for various services. Depending on the complexity of the work, different rates may apply. These rates should adhere to the Nevada State Bar Association's guidelines for billing. 7. Subtotal and Taxes: The template calculates the subtotal by multiplying the hours spent on each service by the appropriate hourly rate. Subsequently, any applicable taxes, such as sales tax or Nevada's modified business tax, are added to the subtotal, if required. 8. Total Amount Due: The total amount due is the sum of the subtotal and taxes. This figure represents the final payment owed by the client. 9. Payment Details: This section outlines the preferred payment methods accepted by the law firm, such as check, bank transfer, or credit card. Additionally, the invoice template provides space for instructions on where clients should remit their payment. Different types of Nevada invoice templates for lawyers may exist based on specific requirements or preferences. Some variations could include: 1. Retainer Invoice Template: For attorneys who require clients to deposit a retainer upfront, a specific template might be used to outline the retainer amount, details of the retainer agreement, and how it is applied to future invoices. 2. Court-Appointed Counsel Invoice Template: Lawyers appointed by the court to represent indigent clients may use a template tailored to the court's guidelines and requirements, ensuring appropriate reimbursement for their services. 3. Pro-Bono Invoice Template: For attorneys providing free legal services, a pro bono invoice template may be utilized to document the value of services donated to clients, maintaining records for tax purposes or pro bono initiatives. Regardless of the type, Nevada invoice templates for lawyers are indispensable tools to ensure accurate, professional, and compliant billing practices in the legal field.

Nevada Invoice Template for Lawyer

Description

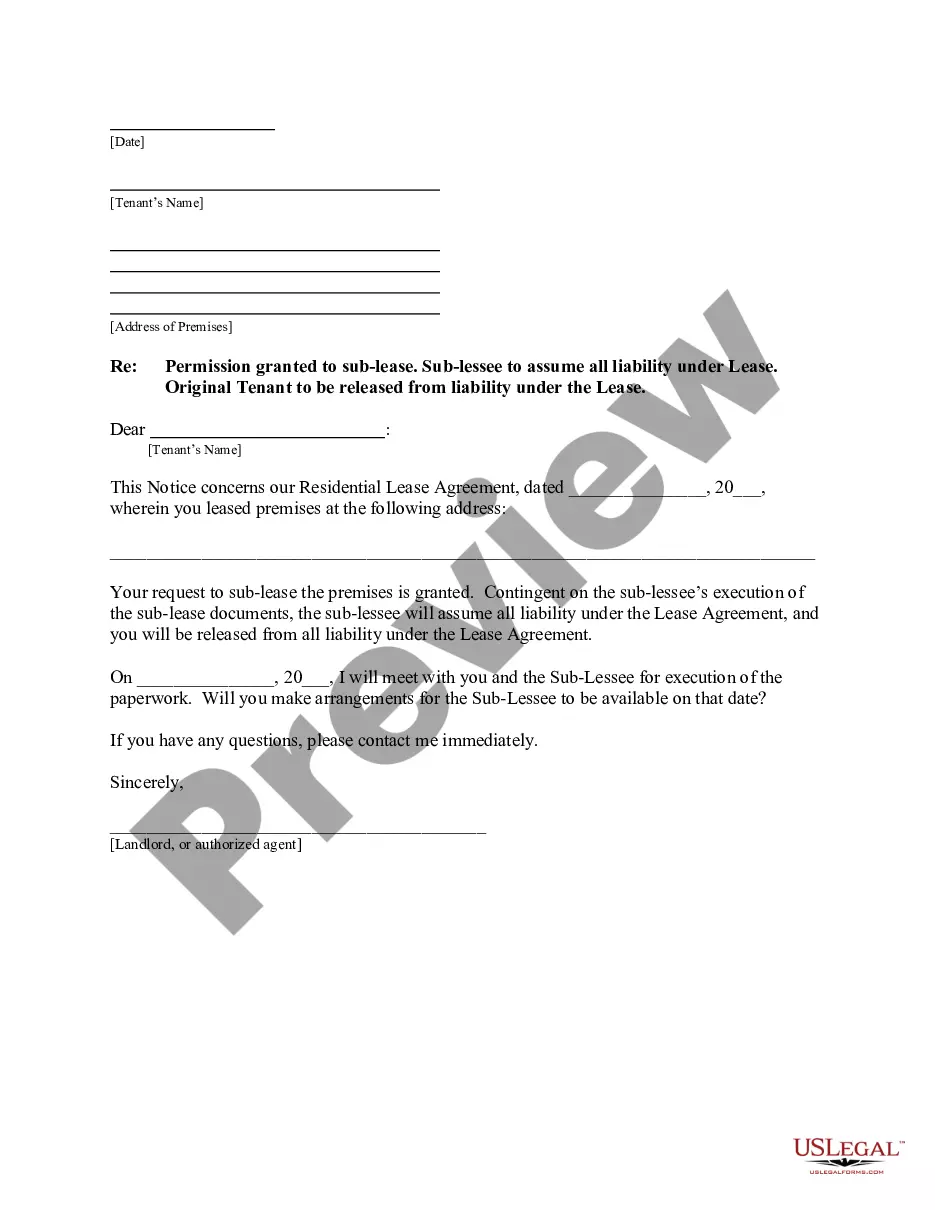

How to fill out Invoice Template For Lawyer?

You can dedicate several hours online searching for the proper document template that meets your state and federal requirements.

US Legal Forms provides a wide variety of legal forms that are vetted by professionals.

You can download or print the Nevada Invoice Template for Lawyer from our service.

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Nevada Invoice Template for Lawyer.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/town of choice.

- Review the form details to confirm that you have chosen the right one.

Form popularity

FAQ

Creating an invoice file is simple with the right tools. Start by using a Nevada Invoice Template for Lawyer to ensure your invoice meets legal standards and includes necessary details. You can customize fields such as your firm's name, client information, services provided, and payment terms. Finally, save the invoice in a preferred format, like PDF, to ensure it is easily accessible and professional-looking for your clients.

Creating an invoice for your legal services involves compiling all necessary information, such as service dates, descriptions, and costs. You can simplify this process by using a Nevada Invoice Template for Lawyer, which provides a structured layout for easy completion. This template helps you maintain consistency and professionalism in your billing practices.

In legal terms, an invoice is a document that itemizes services provided by a lawyer and requests payment from the client. It serves as a formal record of the transaction between you and your client. By using a Nevada Invoice Template for Lawyer, you can create invoices that adhere to legal standards, ensuring compliance and professionalism.

A lawyer's statement is often referred to as a billing statement or summary statement. This document summarizes the services, costs, and any outstanding amounts owed by the client. The Nevada Invoice Template for Lawyer makes it easy to create such statements, ensuring you have a clear record of all transactions.

Yes, you can generate an invoice on your own, but it’s essential to include all necessary details. A Nevada Invoice Template for Lawyer can guide you in creating a professional invoice that covers services rendered, payment terms, and any additional fees. By customizing this template, you ensure your invoice meets both your needs and those of your clients.

Lawyer billing refers to the process by which legal fees and expenses are presented to clients. This includes detailing the services rendered and the hourly rates, or flat fees. Utilizing a Nevada Invoice Template for Lawyer can streamline your billing process, allowing for clarity and transparency with your clients.

A lawyer's invoice is commonly referred to as a billing statement or invoice. This document outlines the legal services provided, along with the corresponding fees. Using a Nevada Invoice Template for Lawyer simplifies this process, ensuring that you capture all key details crucial for both you and your client.

To create an invoice for services provided, begin by selecting an appropriate template, such as a Nevada Invoice Template for Lawyer. Clearly detail the services rendered, including dates and descriptions, along with your business information and payment instructions. This clarity ensures your clients understand their charges, making payment easier and faster.

Creating an e-invoice for a service is straightforward. First, choose a reliable Nevada Invoice Template for Lawyer available on platforms like uslegalforms. Fill in your details, including the services rendered, payment terms, and client information. Finally, save and send the invoice electronically to streamline your billing process.

To fill out a service invoice sample, start by entering your contact details and the client’s information at the top. Next, input an invoice number, date, and a detailed list of services provided, including any rates or hours worked. The Nevada Invoice Template for Lawyer makes this process straightforward by offering a sample format specifically tailored for legal services, helping you present a polished document.