Nevada Invoice Template for Technician

Description

How to fill out Invoice Template For Technician?

Are you in a situation where you'll require documents for business or personal purposes nearly every workday? There are numerous legal document templates accessible online, but finding reliable ones can be challenging. US Legal Forms offers thousands of form templates, such as the Nevada Invoice Template for Technicians, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Nevada Invoice Template for Technician template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

Find all the document templates you have purchased in the My documents menu. You can obtain another copy of the Nevada Invoice Template for Technician at any time, if necessary. Just select the desired form to download or print the document template.

Utilize US Legal Forms, the largest collection of legal documents, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- Locate the form you need and ensure it is for the correct city/county.

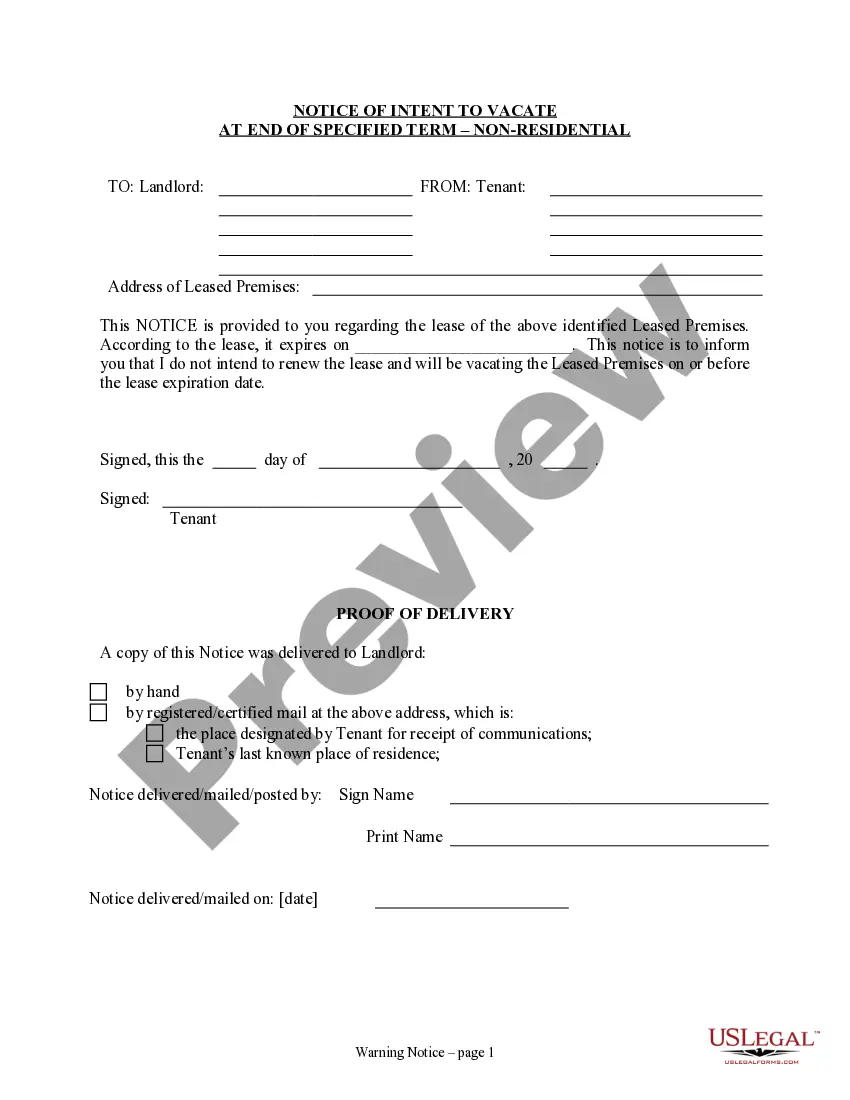

- Utilize the Preview button to check the form.

- Review the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you want, fill out the required information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient paper format and download your copy.

Form popularity

FAQ

Filling out a service invoice is simple with the help of the Nevada Invoice Template for Technician. Begin with your name and contact information, followed by a clear description of the services provided along with their charges. It is also important to include the due date and any applicable taxes or fees. By doing so, you ensure that your clients understand their responsibilities, which promotes prompt payment.

To complete a simple invoice, you can rely on the Nevada Invoice Template for Technician to guide you. Start by entering your business details at the top, followed by a description of the services or products sold. List prices individually, adding a total at the bottom for easy reference. This clarity in presentation simplifies the payment process for your clients.

Filling out an invoice template is straightforward when you use the Nevada Invoice Template for Technician. Begin by adding your company name, address, and contact details. Then, itemize the services or products delivered, along with their costs, ensuring you also include an invoice number and payment deadline. This comprehensive approach guarantees clarity and encourages timely payments from your clients.

To fill out a service invoice sample using the Nevada Invoice Template for Technician, begin by entering your business name and contact information at the top. Next, specify the services rendered along with the associated costs, including any taxes or fees if applicable. Ensure to include a unique invoice number and a clear due date to facilitate prompt payment. This structured approach helps maintain professionalism and clarity in your invoicing process.

Creating a simple invoice can be done easily using a Nevada Invoice Template for Technician. Start by including your business name, client's name, and a detailed list of services with corresponding prices. Finally, don’t forget to input payment terms and due dates, keeping the layout clean and straightforward for client readability.

To format an invoice effectively, use a clear layout that presents information in an organized manner, adopting a Nevada Invoice Template for Technician. This means including sections like your business name, client details, a list of services provided, and total due amounts. Ensure to use readable fonts and adequate spacing to make your invoice easy to understand.

Setting up an invoice template requires choosing a format that best suits your business operations, like a Nevada Invoice Template for Technician. Start by determining the elements you want included, such as your contact information, service descriptions, and payment terms. Once you’ve established these components, you can modify the template to suit any specific project or service you deliver.

To set up an invoice template, begin by downloading a Nevada Invoice Template for Technician from a reliable source, such as uslegalforms. Utilize the components included, like invoice number, date, and service descriptions, to maintain professionalism. Customize fields to capture your business identity, ensuring you include all essential details for your clients.

Yes, you can find a comprehensive Nevada Invoice Template for Technician available in Microsoft Word format. This template simplifies the process, allowing you to easily enter your details without starting from scratch. Look for templates that match your business needs, which can often be customized for any specific service you offer.

To submit an invoice for a service, first ensure you have filled out your Nevada Invoice Template for Technician correctly. Include all relevant details such as your business information, client information, a description of services rendered, and payment terms. After filling it out, you can send it electronically via email or print it out and deliver it in person, depending on your client's preference.