Nevada Checklist — Action to Improve Collection of Accounts: Introduction: Nevada is an American state that has established specific checklists and actions to improve the collection of accounts. These actions aim to provide guidelines to organizations and individuals involved in debt collection and ensure compliance with Nevada's laws and regulations. This detailed description will outline the various types of Nevada Checklists — Actions to Improve Collection of Accounts along with relevant keywords. 1. Consumer Debt Collection Checklist: The Consumer Debt Collection Checklist in Nevada encompasses guidelines and actions required for debt collectors when dealing with consumer accounts. It includes steps to verify debtor information, communicate with debtors responsibly, comply with state and federal laws, and maintain accurate records. Relevant keywords: consumer debt collection, debt collector duties, debtor verification, communication guidelines, compliance, record-keeping. 2. Business Debt Collection Checklist: The Business Debt Collection Checklist in Nevada provides guidelines for collecting outstanding debts from businesses. It outlines necessary actions such as properly investigating and verifying the debt, sending demand letters, negotiating settlements, and utilizing legal remedies if required. Keywords: business debt collection, debt verification, demand letters, settlement negotiation, legal remedies. 3. Medical Debt Collection Checklist: The Medical Debt Collection Checklist in Nevada focuses on actions related to the collection of unpaid medical bills. It addresses specific regulations related to medical debt, including HIPAA compliance, patient billing, handling insurance claims, and implementing fair debt collection practices. Keywords: medical debt collection, HIPAA compliance, patient billing, insurance claims, fair debt collection. 4. Government Debt Collection Checklist: The Government Debt Collection Checklist in Nevada pertains to debts owed to local, state, or federal government entities. It outlines actions for government agencies, such as properly notifying debtors, offering repayment options, enforcing tax liens and levies, and utilizing collection agencies when necessary. Keywords: government debt collection, debtor notification, repayment options, tax liens, tax levies, collection agencies. 5. Court-Ordered Debt Collection Checklist: The Court-Ordered Debt Collection Checklist focuses on actions required to enforce court-ordered debts in Nevada. It covers steps such as obtaining writs of execution, garnishing wages or bank accounts, conducting sheriff sales, and ensuring compliance with court procedures. Keywords: court-ordered debt collection, writs of execution, wage garnishment, bank account garnishment, sheriff sales, court procedures. 6. Student Loan Debt Collection Checklist: The Student Loan Debt Collection Checklist in Nevada addresses actions specifically related to the collection of unpaid student loans. It includes guidelines for loan services or collection agencies handling student loans, repayment options, rehabilitation programs, default prevention, and compliance with federal regulations. Keywords: student loan debt collection, loan services, repayment options, rehabilitation programs, default prevention, federal loan regulations. Conclusion: These various Nevada Checklists — Actions to Improve Collection of Accounts outline the necessary steps and guidelines for different types of debt collection scenarios. Adhering to these checklists ensures compliance with Nevada's laws, protects the rights of debtors, and improves the overall efficiency of debt collection processes.

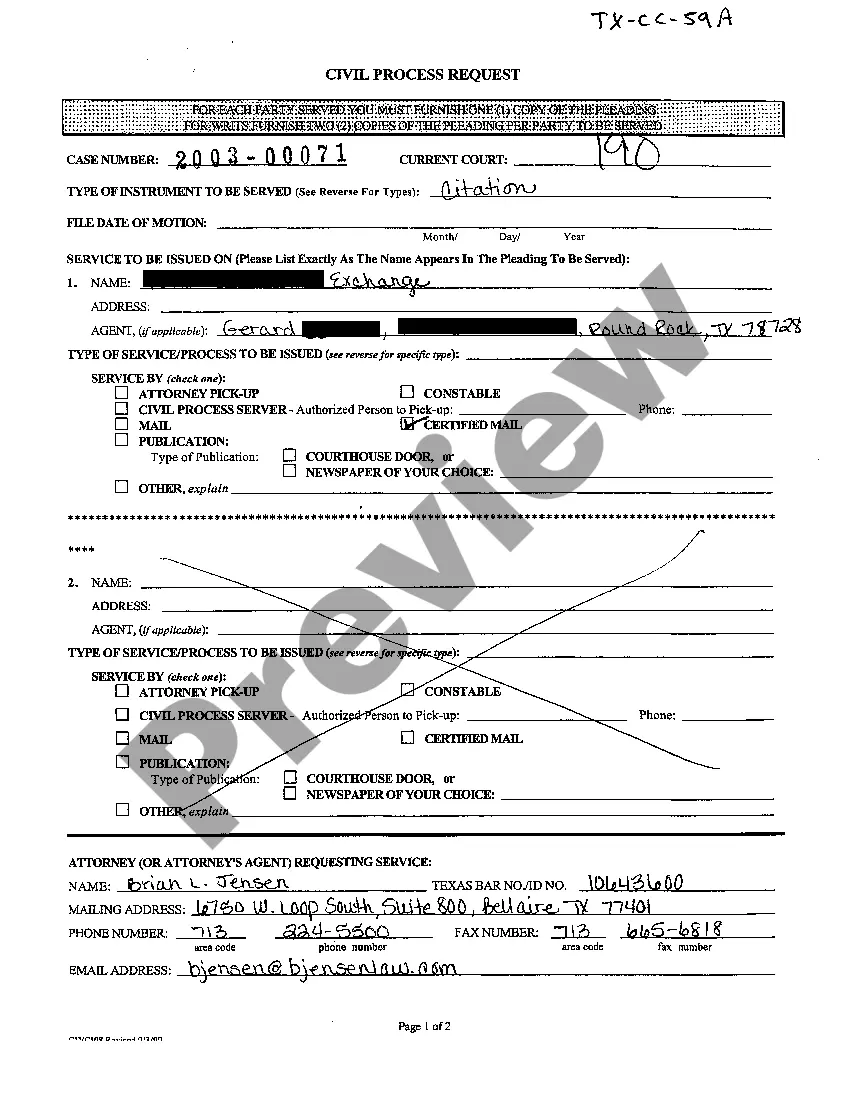

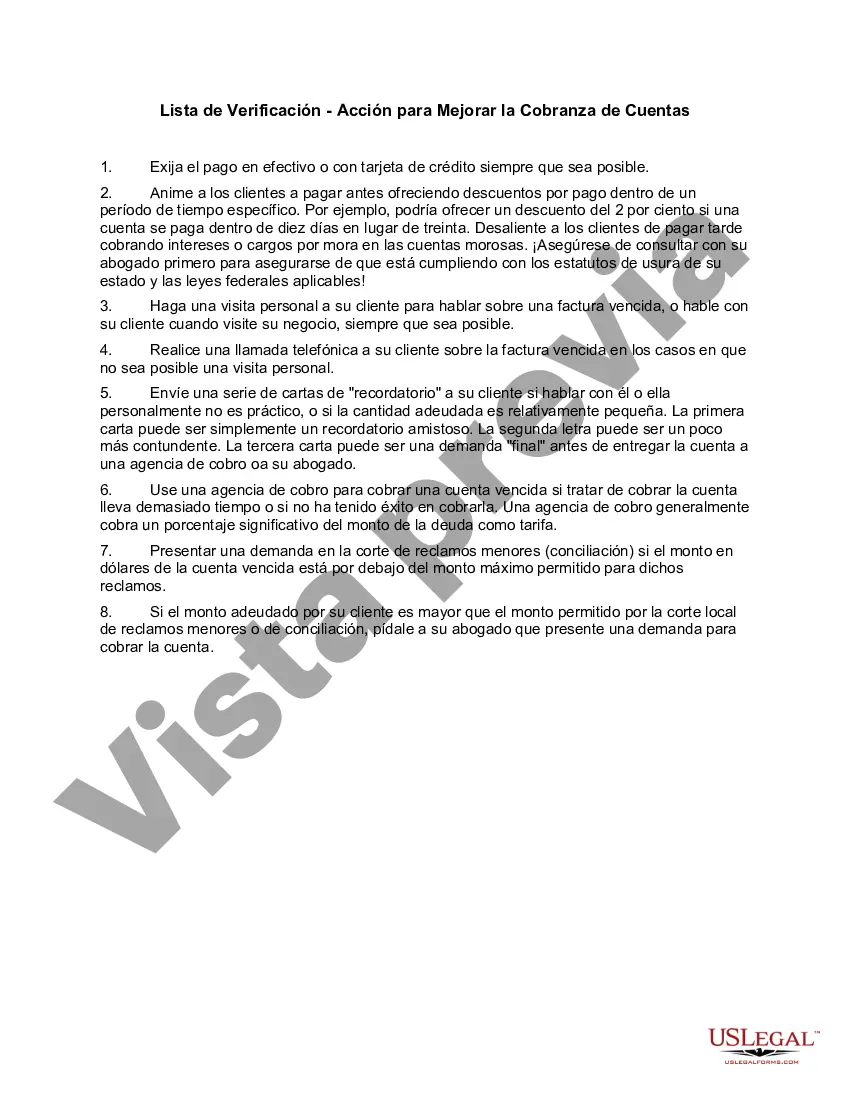

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Lista de Verificación - Acción para Mejorar la Cobranza de Cuentas - Checklist - Action to Improve Collection of Accounts

Description

How to fill out Nevada Lista De Verificación - Acción Para Mejorar La Cobranza De Cuentas?

US Legal Forms - one of several greatest libraries of authorized forms in America - delivers a wide range of authorized papers web templates you can obtain or produce. While using web site, you may get thousands of forms for business and person reasons, sorted by classes, says, or search phrases.You will find the most recent versions of forms such as the Nevada Checklist - Action to Improve Collection of Accounts in seconds.

If you already possess a registration, log in and obtain Nevada Checklist - Action to Improve Collection of Accounts from your US Legal Forms catalogue. The Down load button will show up on each type you perspective. You gain access to all previously downloaded forms inside the My Forms tab of your respective profile.

In order to use US Legal Forms the very first time, allow me to share easy recommendations to obtain started off:

- Be sure you have picked out the correct type to your metropolis/state. Select the Review button to review the form`s content. Browse the type information to actually have selected the proper type.

- In case the type does not satisfy your demands, utilize the Research discipline on top of the display to obtain the one who does.

- If you are pleased with the shape, verify your decision by clicking on the Get now button. Then, pick the pricing strategy you want and supply your accreditations to sign up for an profile.

- Method the deal. Make use of credit card or PayPal profile to accomplish the deal.

- Choose the formatting and obtain the shape in your device.

- Make changes. Complete, modify and produce and indicator the downloaded Nevada Checklist - Action to Improve Collection of Accounts.

Each and every web template you added to your bank account lacks an expiry particular date and it is the one you have forever. So, if you wish to obtain or produce yet another copy, just proceed to the My Forms segment and click on in the type you require.

Get access to the Nevada Checklist - Action to Improve Collection of Accounts with US Legal Forms, the most comprehensive catalogue of authorized papers web templates. Use thousands of skilled and condition-specific web templates that meet your organization or person requires and demands.