The Nevada Contract for the International Sale of Goods with Purchase Money Security Interest is a legal document that outlines the terms and conditions governing the purchase and sale of goods between parties located in different countries. This contract adheres to the rules and regulations set forth by the United Nations Convention on Contracts for the International Sale of Goods (CSG), as well as the Uniform Commercial Code (UCC) regulations specifically tailored for Nevada. The primary purpose of this contract is to provide a framework to ensure a smooth and secure international transaction, with special emphasis on protecting the seller's interest through a purchase money security interest (PSI). A PSI is a legal mechanism that grants the seller a security interest or lien in the goods being sold, effectively establishing the seller as a secured creditor in case of default or insolvency by the buyer. There are different types of the Nevada Contract for the International Sale of Goods with Purchase Money Security Interest, which can be customized based on the specific requirements of the parties involved. Some common variations of this contract include: 1. General Nevada Contract for the International Sale of Goods with PSI: This is the standard form of the contract, which covers the essential terms and conditions of the international sale of goods, along with the PSI provisions. 2. Nevada Contract for the International Sale of Goods with PSI and Financing Statement: This variation includes a financing statement that must be filed under the UCC regulations, providing notice of the PSI to potential creditors and securing the seller's rights. 3. Nevada Contract for the International Sale of Goods with PSI and Promissory Note: In this type of contract, a promissory note is added to facilitate the payment process. The promissory note serves as proof of the buyer's indebtedness to the seller and outlines the repayment terms. 4. Nevada Contract for the International Sale of Goods with PSI and Security Agreement: This contract variation includes a separate security agreement, which establishes the terms and conditions of the security interest granted to the seller. It details the collateral, rights, and obligations of both parties in case of default or insolvency. These are just a few examples of the different types of Nevada Contracts for the International Sale of Goods with Purchase Money Security Interest that can be tailored to meet the specific needs and requirements of the parties involved. It is essential to consult with legal professionals familiar with international trade laws and regulations, as well as those specific to Nevada, to draft a comprehensive and enforceable contract that ensures a successful and secure international business transaction.

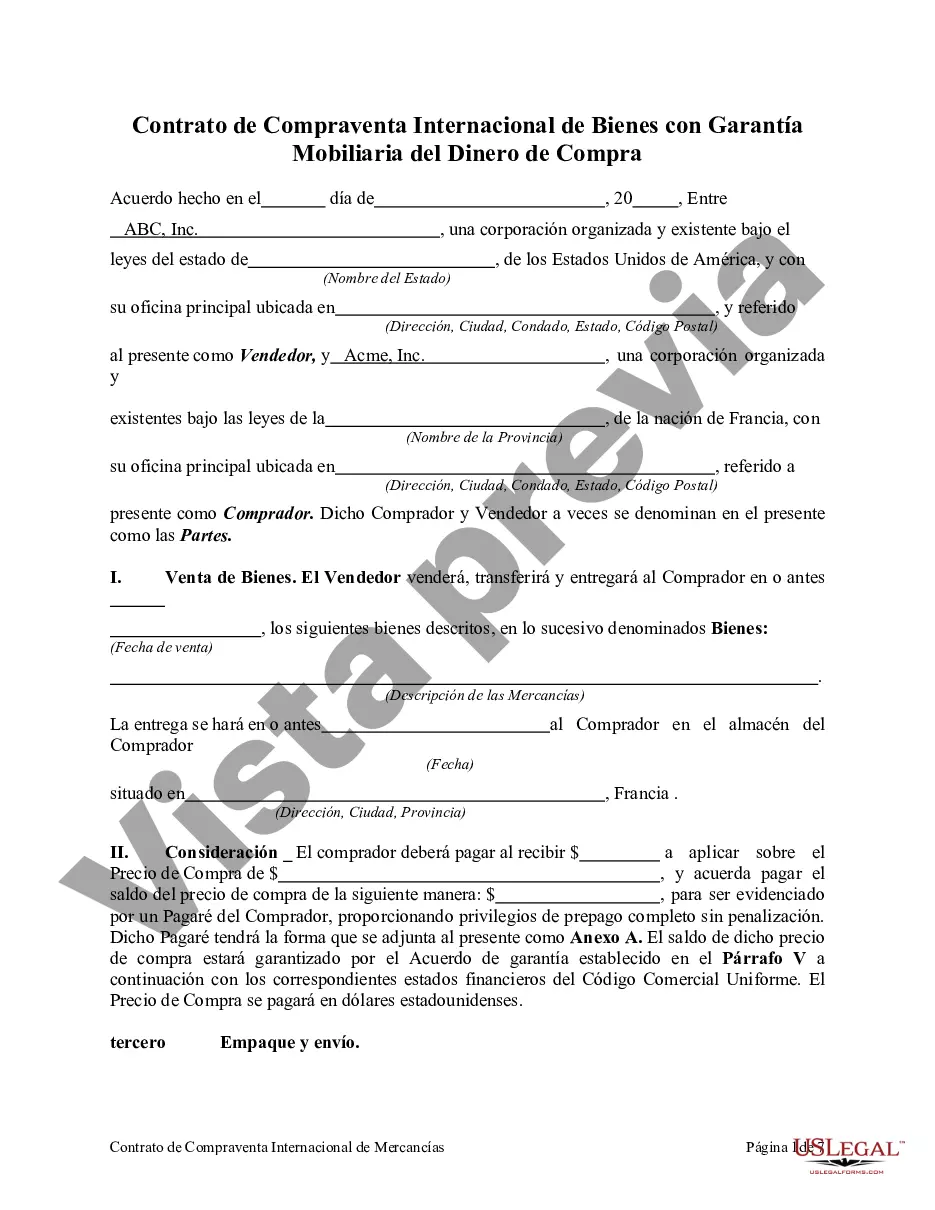

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Contrato de Compraventa Internacional de Bienes con Garantía Mobiliaria del Dinero de Compra - Contract for the International Sale of Goods with Purchase Money Security Interest

Description

How to fill out Nevada Contrato De Compraventa Internacional De Bienes Con Garantía Mobiliaria Del Dinero De Compra?

Choosing the right authorized file design can be a battle. Obviously, there are a variety of themes accessible on the Internet, but how can you discover the authorized kind you need? Make use of the US Legal Forms site. The services delivers a large number of themes, including the Nevada Contract for the International Sale of Goods with Purchase Money Security Interest, that you can use for enterprise and private demands. Every one of the kinds are inspected by experts and fulfill federal and state specifications.

If you are presently signed up, log in to your accounts and click the Acquire switch to get the Nevada Contract for the International Sale of Goods with Purchase Money Security Interest. Use your accounts to check through the authorized kinds you possess ordered previously. Proceed to the My Forms tab of your accounts and get yet another copy in the file you need.

If you are a whole new customer of US Legal Forms, here are easy guidelines so that you can follow:

- First, make sure you have selected the appropriate kind for your town/area. You are able to examine the form making use of the Preview switch and look at the form explanation to guarantee this is the best for you.

- When the kind is not going to fulfill your preferences, make use of the Seach field to discover the proper kind.

- Once you are certain that the form would work, click on the Buy now switch to get the kind.

- Choose the costs program you need and enter the essential details. Make your accounts and pay for your order utilizing your PayPal accounts or Visa or Mastercard.

- Pick the file structure and acquire the authorized file design to your gadget.

- Complete, edit and printing and indicator the attained Nevada Contract for the International Sale of Goods with Purchase Money Security Interest.

US Legal Forms will be the largest local library of authorized kinds for which you can find a variety of file themes. Make use of the service to acquire skillfully-made paperwork that follow condition specifications.