Title: Nevada Sample Letter for Cash Advances: A Comprehensive Guide to Understanding and Utilizing Cash Advances in Nevada Introduction: In the fast-paced world we live in, financial emergencies can arise unexpectedly, leaving us feeling financially overwhelmed. Cash advances act as a convenient and short-term solution to bridge the gap between expenses and available funds. Nevada, a state known for its vibrant casinos and bustling tourism industry, offers a variety of cash advance options to help residents and visitors when facing unexpected financial challenges. In this article, we will delve into the various types of Nevada sample letters for cash advances, shedding light on their benefits and usage. 1. Payday Cash Advances: Payday cash advances are one of the most common types of cash advances in Nevada. These short-term loans are designed to provide immediate financial relief to individuals who have a regular source of income. A sample letter for a payday cash advance typically includes personal details, loan amount, repayment terms, interest rates, and any applicable fees. 2. Installment Cash Advances: Installment cash advances are another option available to Nevada residents. Unlike payday advances, installment loans are repaid over a longer duration through periodic installments. A sample letter for an installment cash advance will outline the loan amount, repayment schedule, interest rates, and any associated costs. 3. Online Cash Advances: With the advent of technology, online cash advances have gained popularity in Nevada. These cash advances can be acquired by filling out an online application form and providing the necessary documents electronically. A sample letter for an online cash advance will typically include details about the requested loan amount, repayment terms, interest rates, and digital signature requirements. 4. Title Loans: Title loans are a specific type of cash advance where the borrower uses the title of their vehicle as collateral in exchange for immediate cash. These loans have gained popularity in Nevada due to their accessibility. A sample letter for a title loan will enumerate the loan amount, repayment terms, interest rates, vehicle details, and any potential consequences of loan default. Conclusion: Navigating the world of cash advances can be daunting, especially if you are unfamiliar with the processes and documentation involved. In Nevada, various types of cash advances, such as payday loans, installment loans, online cash advances, and title loans, provide borrowers with the flexibility to choose the most suitable option for their needs. Remember to exercise caution when considering a cash advance, understanding the terms, interest rates, and repayment requirements to make an informed decision. Seek professional advice and always borrow responsibly to avoid financial pitfalls.

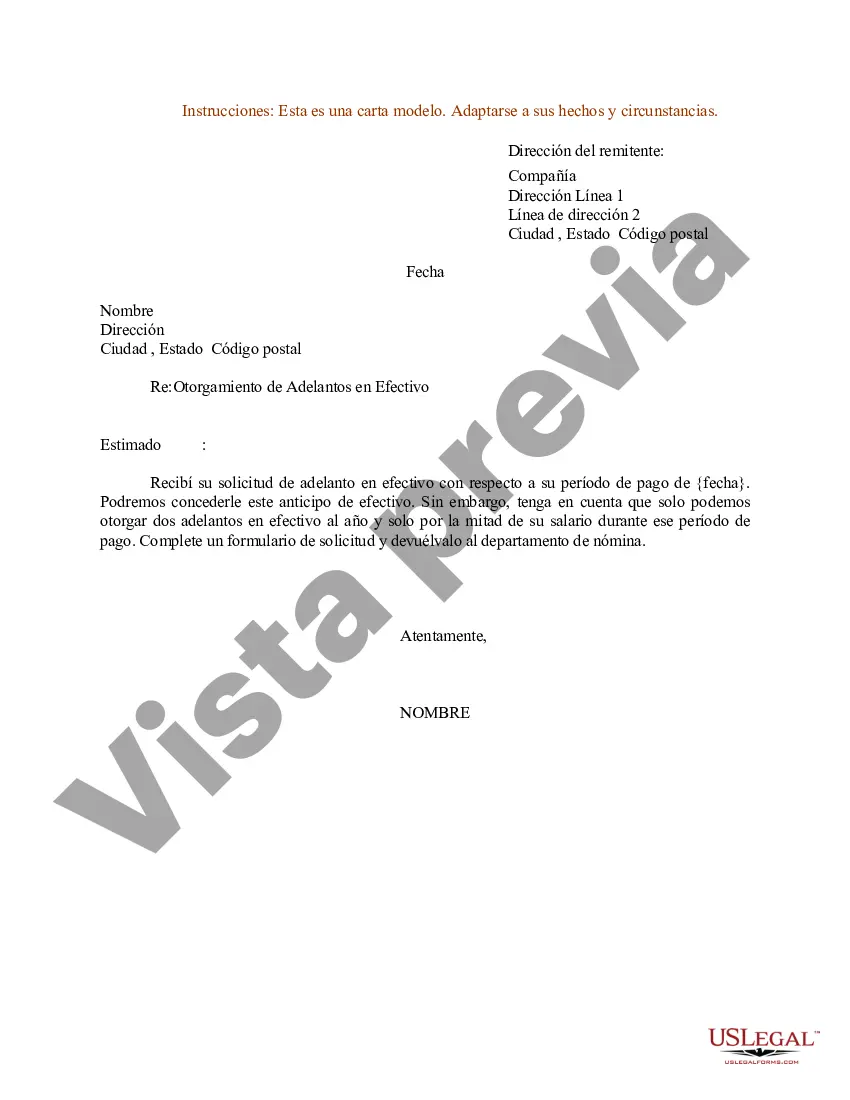

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Modelo de carta para adelantos en efectivo - Sample Letter for Cash Advances

Description

How to fill out Nevada Modelo De Carta Para Adelantos En Efectivo?

You may commit several hours on the Internet looking for the legal record format which fits the state and federal specifications you need. US Legal Forms gives a huge number of legal forms that happen to be analyzed by pros. You can easily obtain or printing the Nevada Sample Letter for Cash Advances from the support.

If you already possess a US Legal Forms account, it is possible to log in and then click the Obtain button. Following that, it is possible to comprehensive, revise, printing, or indicator the Nevada Sample Letter for Cash Advances. Every single legal record format you purchase is yours for a long time. To acquire another copy associated with a acquired kind, proceed to the My Forms tab and then click the related button.

If you work with the US Legal Forms site the first time, follow the basic directions beneath:

- Initial, ensure that you have selected the proper record format for your region/area that you pick. Read the kind outline to ensure you have picked out the right kind. If readily available, utilize the Review button to appear throughout the record format as well.

- In order to get another edition of the kind, utilize the Look for industry to obtain the format that meets your needs and specifications.

- After you have discovered the format you would like, click Purchase now to continue.

- Pick the pricing prepare you would like, type in your credentials, and register for a free account on US Legal Forms.

- Total the transaction. You may use your bank card or PayPal account to cover the legal kind.

- Pick the formatting of the record and obtain it to the gadget.

- Make adjustments to the record if possible. You may comprehensive, revise and indicator and printing Nevada Sample Letter for Cash Advances.

Obtain and printing a huge number of record layouts utilizing the US Legal Forms site, which offers the greatest selection of legal forms. Use specialist and state-certain layouts to tackle your organization or specific requirements.