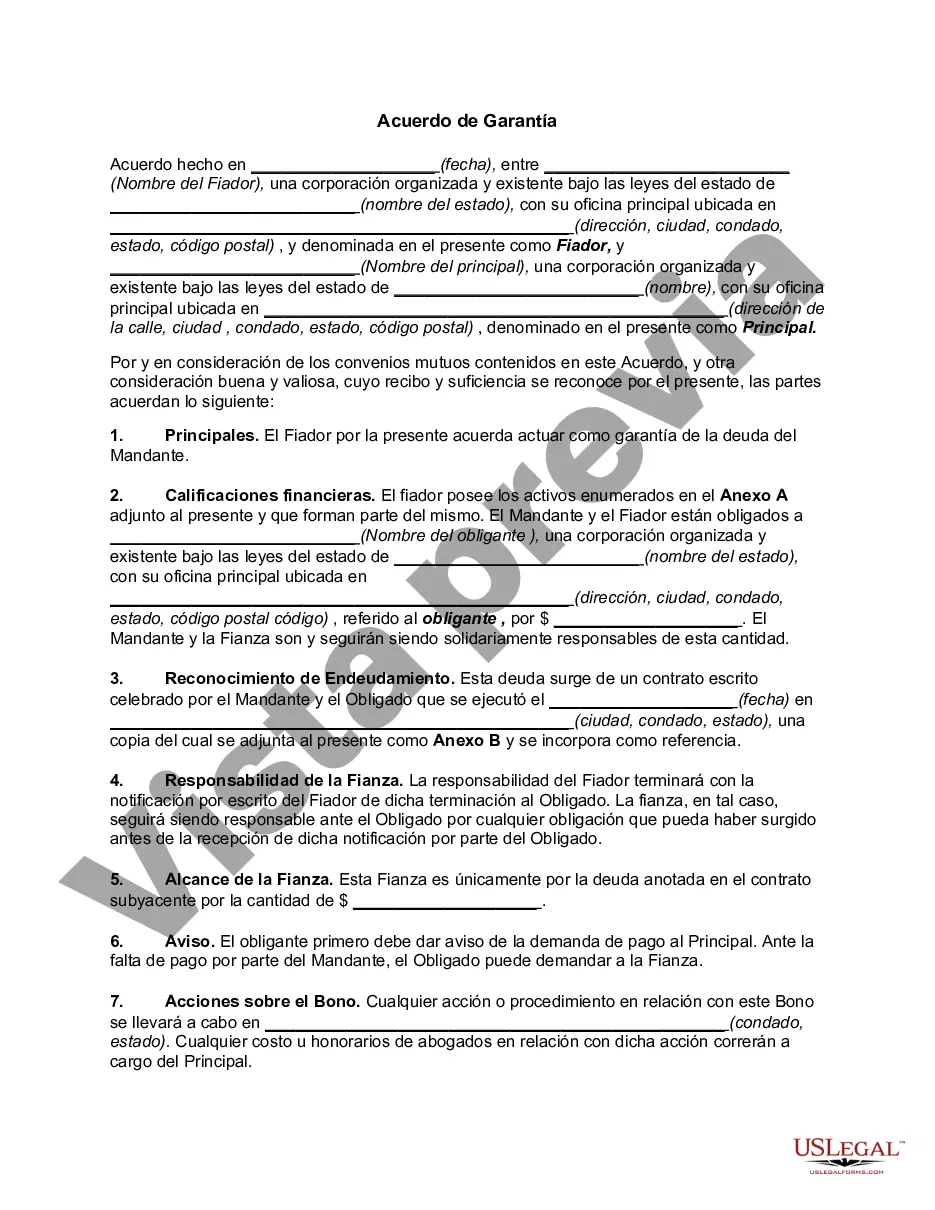

A Nevada Surety Agreement is a legally binding contract between three parties: the principal (the person or entity required to provide the surety), the obliged (the person or entity that requires the surety), and the surety company (a third party that guarantees the performance or fulfillment of an obligation). This agreement serves as a guarantee to protect the obliged from any financial loss in case the principal fails to fulfill their duties, obligations, or promises. It creates a legal obligation for the surety company to step in and provide compensation to the obliged if the principal cannot or does not fulfill their obligations. Nevada Surety Agreements are commonly used in various industries and situations where financial security is required, such as construction projects, government contracts, licensing requirements, and more. In the construction industry, for example, contractors or subcontractors may be required to obtain a surety bond to ensure they complete the project as agreed and pay their subcontractors, suppliers, and laborers. Different types of Nevada Surety Agreements may include performance bonds, payment bonds, and maintenance bonds. Performance bonds guarantee that the principal will complete a project as specified in the contract, while payment bonds ensure that the principal will pay subcontractors, suppliers, and laborers involved in the project. Maintenance bonds, on the other hand, provide a guarantee that the principal will maintain or repair the completed project for a specified period. Nevada Surety Agreements are governed by Nevada state laws and regulations. It is essential for all parties involved to understand the terms and conditions outlined in the agreement. The surety company typically assesses the financial stability and track record of the principal before issuing the bond. The amount of the bond is determined based on the project's size, complexity, and potential risk involved. In summary, a Nevada Surety Agreement is a crucial tool used to mitigate financial risks and protect the interests of the obliged. It provides assurance that the principal will fulfill their obligations and ensures financial compensation if they fail to do so. Different types of surety bonds exist depending on the specific requirements of different industries and situations, such as performance bonds, payment bonds, and maintenance bonds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Acuerdo de Garantía - Surety Agreement

Description

How to fill out Nevada Acuerdo De Garantía?

Are you presently inside a placement that you need to have files for possibly organization or personal reasons nearly every day? There are plenty of authorized papers layouts available on the net, but finding types you can trust isn`t easy. US Legal Forms gives a large number of develop layouts, just like the Nevada Surety Agreement, that happen to be written to meet state and federal needs.

When you are presently familiar with US Legal Forms site and get an account, simply log in. Afterward, you may down load the Nevada Surety Agreement web template.

If you do not have an account and need to begin using US Legal Forms, follow these steps:

- Get the develop you need and make sure it is for the proper town/region.

- Utilize the Preview key to examine the shape.

- Read the explanation to ensure that you have selected the right develop.

- In case the develop isn`t what you`re seeking, use the Look for discipline to find the develop that fits your needs and needs.

- When you get the proper develop, just click Purchase now.

- Opt for the costs strategy you desire, submit the desired information to make your account, and purchase the order utilizing your PayPal or Visa or Mastercard.

- Choose a practical document file format and down load your version.

Locate each of the papers layouts you have purchased in the My Forms menu. You may get a further version of Nevada Surety Agreement any time, if needed. Just click on the needed develop to down load or produce the papers web template.

Use US Legal Forms, by far the most extensive variety of authorized types, to save time and steer clear of mistakes. The service gives skillfully made authorized papers layouts that you can use for a range of reasons. Make an account on US Legal Forms and begin producing your daily life easier.