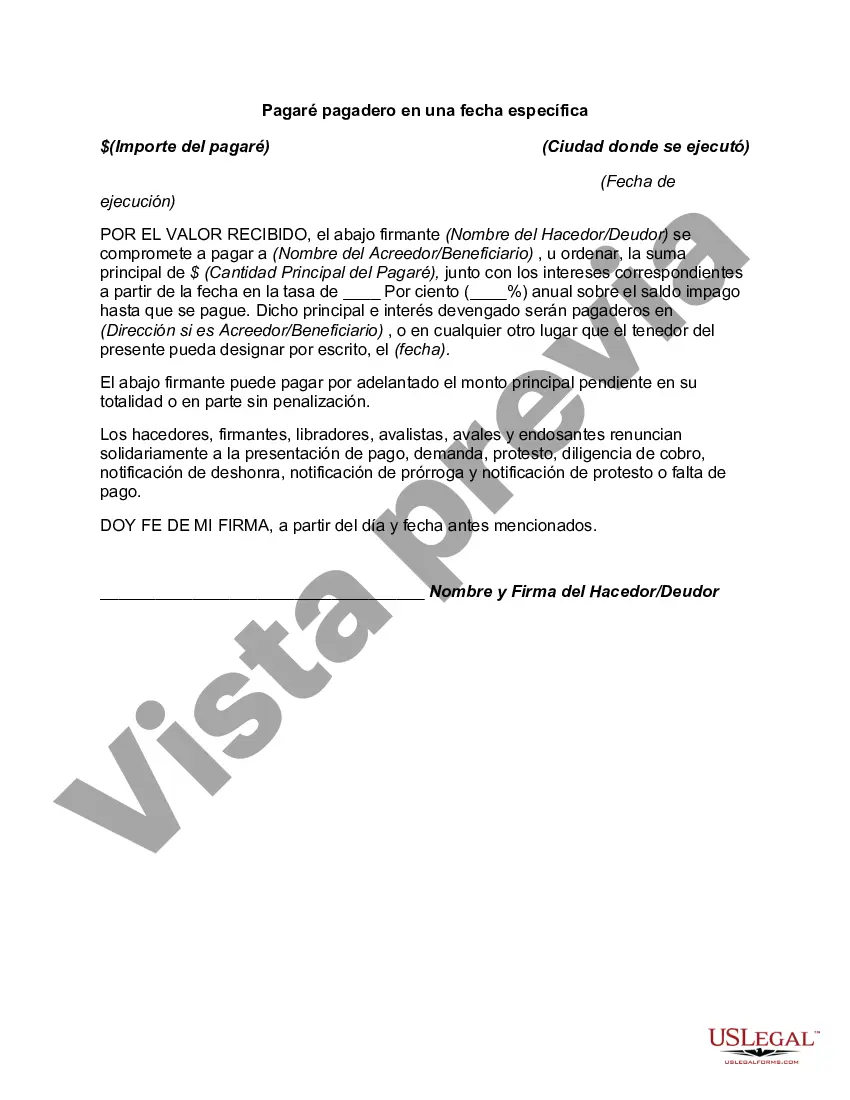

A Nevada Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions under which one party agrees to repay a loan to another party by a predetermined date. This type of promissory note is commonly used in Nevada for various financial transactions, including personal loans, business loans, and real estate transactions. Key components of a Nevada Promissory Note Payable on a Specific Date include: 1. Parties involved: The note identifies the lender (also known as the payee) and the borrower (also known as the maker) involved in the loan agreement. 2. Principal Amount: The note specifies the initial amount borrowed, also known as the principal, which the borrower is obligated to repay to the lender. 3. Interest Rate: Nevada law allows parties to determine the interest rate to be charged on the loan. The promissory note may specify a fixed or variable interest rate, which determines the additional cost the borrower must pay for borrowing the money. 4. Repayment Terms: The note outlines the repayment terms, including the date by which the borrower must repay the loan in full. It may specify a specific calendar date or a specific period, such as "within six months from the date of signing this note." 5. Installments: If the loan repayment is divided into installments, the note will outline the frequency (monthly, quarterly, etc.), the amount of each payment, and the due date for each installment. 6. Late Fees and Penalties: The note may outline any penalties or late fees that will be imposed if the borrower fails to repay the loan on time, as well as any grace period allowed. 7. Collateral: In some cases, the note may include information about collateral, such as real estate or personal property, that the borrower pledges as security for the loan. This provides the lender with an additional layer of protection in case of default. Types of Nevada Promissory Note Payable on a Specific Date may vary based on the purpose and terms of the loan. Common types include: 1. Personal Promissory Note: It is an agreement between individuals, such as friends or family members, for personal loans. 2. Business Promissory Note: Used in business transactions, this note documents loans made to a business entity for various purposes, such as capital expenses, inventory purchases, or expansion plans. 3. Real Estate Promissory Note: Specifically designed for real estate transactions, this note outlines the terms of a loan made to finance the purchase, construction, or renovation of a property. Overall, a Nevada Promissory Note Payable on a Specific Date serves as a legally binding contract, protecting both the lender's rights to repayment and the borrower's obligations to repay the loan within a specified time frame. It is important for both parties to thoroughly understand and agree to the terms outlined in the document before signing it.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out Nevada Pagaré Pagadero En Una Fecha Específica?

Are you currently inside a position in which you will need documents for possibly company or personal uses just about every working day? There are a lot of legal document layouts available online, but locating versions you can rely isn`t effortless. US Legal Forms delivers thousands of form layouts, just like the Nevada Promissory Note Payable on a Specific Date, that happen to be created to satisfy federal and state demands.

When you are previously acquainted with US Legal Forms site and have your account, simply log in. Next, you can down load the Nevada Promissory Note Payable on a Specific Date web template.

Should you not come with an accounts and want to start using US Legal Forms, abide by these steps:

- Find the form you will need and ensure it is for that proper area/region.

- Make use of the Preview button to examine the shape.

- Browse the description to actually have chosen the right form.

- If the form isn`t what you are searching for, utilize the Research field to discover the form that meets your needs and demands.

- When you obtain the proper form, click on Acquire now.

- Choose the pricing program you desire, fill out the desired details to create your account, and purchase the transaction with your PayPal or charge card.

- Choose a hassle-free data file file format and down load your duplicate.

Find every one of the document layouts you may have bought in the My Forms menus. You may get a more duplicate of Nevada Promissory Note Payable on a Specific Date any time, if necessary. Just select the essential form to down load or print out the document web template.

Use US Legal Forms, the most extensive collection of legal varieties, to save time and steer clear of blunders. The assistance delivers expertly created legal document layouts which you can use for a variety of uses. Generate your account on US Legal Forms and commence creating your lifestyle a little easier.