Nevada Borrowers Certification of Inventory

Description

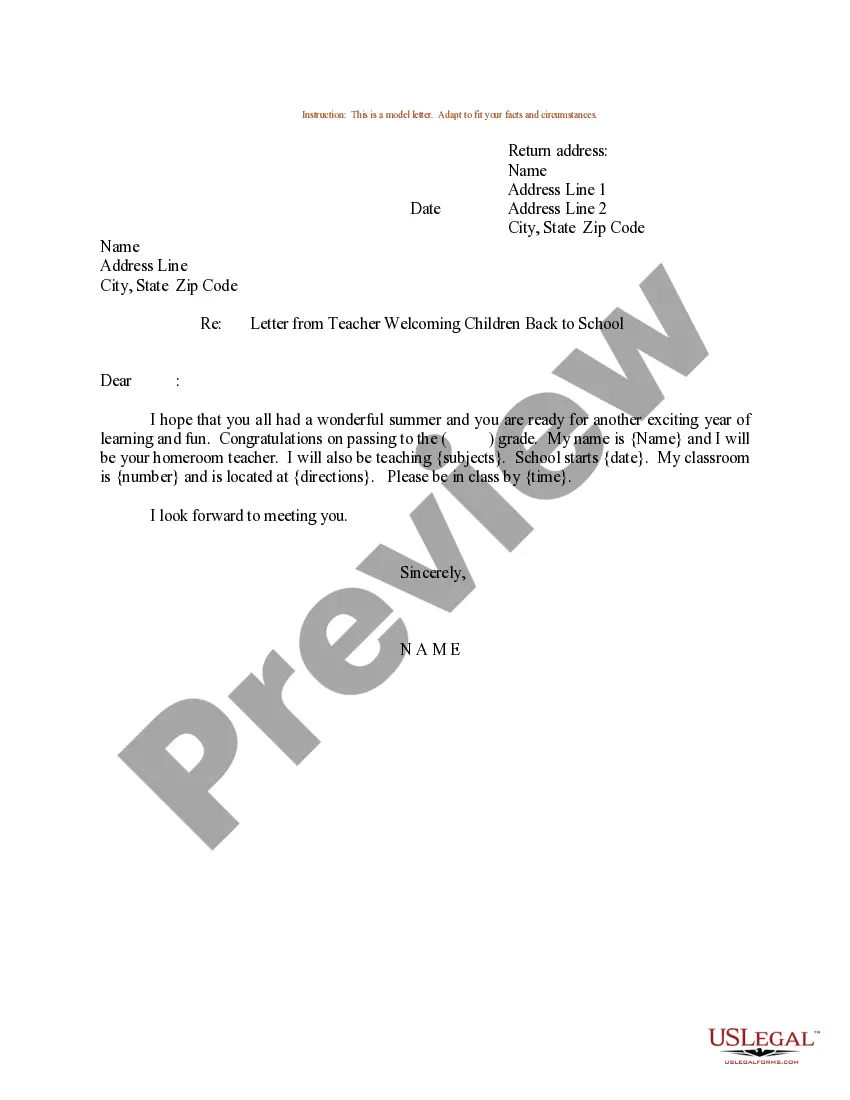

How to fill out Borrowers Certification Of Inventory?

Finding the right authorized record web template could be a have difficulties. Needless to say, there are plenty of themes accessible on the Internet, but how can you discover the authorized form you require? Make use of the US Legal Forms site. The assistance delivers a huge number of themes, such as the Nevada Borrowers Certification of Inventory, that you can use for organization and private requires. Every one of the types are inspected by specialists and meet up with federal and state requirements.

If you are already listed, log in to your bank account and click the Acquire switch to have the Nevada Borrowers Certification of Inventory. Use your bank account to look throughout the authorized types you might have purchased formerly. Proceed to the My Forms tab of the bank account and obtain an additional copy in the record you require.

If you are a whole new consumer of US Legal Forms, listed here are straightforward guidelines for you to follow:

- First, make sure you have chosen the appropriate form to your metropolis/county. You can look over the shape using the Review switch and read the shape explanation to guarantee it will be the best for you.

- When the form will not meet up with your preferences, take advantage of the Seach area to get the appropriate form.

- Once you are certain that the shape would work, click the Purchase now switch to have the form.

- Opt for the prices prepare you desire and enter in the necessary info. Design your bank account and pay for an order using your PayPal bank account or bank card.

- Pick the document format and down load the authorized record web template to your gadget.

- Total, change and print and sign the obtained Nevada Borrowers Certification of Inventory.

US Legal Forms may be the greatest library of authorized types in which you can discover various record themes. Make use of the service to down load skillfully-created files that follow condition requirements.

Form popularity

FAQ

To do business as a mortgage loan originator, you need to: Apply for an NMLS account and ID number. Complete your Nevada mortgage Pre-license Education ("PE"). Pass a licensing exam. Apply for your Nevada mortgage license though the NMLS. Complete background checks and pay all fees.

To satisfy the requirements for continuing education (CE) provided for in NRS 645B. 051 or 645B. 430 , a mortgage company or mortgage loan originator must complete at least 8 hours of approved courses of continuing education during the 12 months immediately preceding the date on which the license expires.

As a condition to maintain a state-issued MLO license, MLOs are required to complete 8 hours of annual continuing education which shall include 3 hours of Federal Law, 2 hours of Ethics (which shall include fraud, consumer protection, and fair lending), 2 hours of Non-Traditional Mortgage Lending, and 1 hour of ...

The SAFE Act mandates that state-licensed mortgage loan originators complete a minumum of 8 hours of continuing education annually.

Associate your NMLS account with an employer. 1) Create Your NMLS Account. You can get started with this step right now! ... 2) Complete Your Nevada Pre-License Education. ... 3) Pass a Licensing Exam. ... 4) Apply for a License. ... 5) Background Checks. ... 6) Get Hired.

Colorado Continuing Education Requirements: State-licensed MLOs are required to complete 8 hours of NMLS-approved mortgage education annually beginning the year they are licensed (unless PE was completed in the same year). This includes: 3 hours of federal law. 2 hours of ethics.