A Nevada Irrevocable Pot Trust Agreement is a legal document that establishes a trust fund in the state of Nevada, which holds assets for the benefit of designated beneficiaries. This irrevocable trust agreement provides protection for the assets, ensuring they are managed and distributed according to the predetermined terms. Nevada offers various types of Irrevocable Pot Trust Agreements to cater to individuals' specific needs: 1. Nevada Medicaid Asset Protection Trust: This type of trust is designed to protect assets from being counted towards an individual's eligibility for Medicaid long-term care assistance. By transferring assets into this trust, individuals can potentially protect their wealth while still qualifying for Medicaid benefits. 2. Nevada Special Needs Trust: This trust is established to benefit individuals with disabilities or special needs. It allows them to receive additional assistance and support without jeopardizing their eligibility for government benefits, such as Medicaid or Supplemental Security Income (SSI). 3. Nevada Spendthrift Trust: A Spendthrift Trust safeguards assets from creditors and provides controlled distributions to beneficiaries over time. This type of trust is helpful when beneficiaries lack financial management skills, have a history of debt issues, or need protection against potential creditors. 4. Nevada Dynasty Trust: A Dynasty Trust is designed to benefit multiple generations of a family, enabling them to pass down wealth while minimizing estate taxes. By allowing the transfer of substantial assets to the trust, future generations can enjoy the income and growth of those assets without incurring significant tax burdens. 5. Nevada Charitable Remainder Trust: This trust benefits both a charitable organization and a non-charitable beneficiary. It allows individuals to donate assets to a trust, receive income from the trust during their lifetime, and ultimately, transfer the remaining assets to the designated charity. Overall, a Nevada Irrevocable Pot Trust Agreement provides individuals with flexibility, asset protection, and the ability to distribute wealth to beneficiaries according to their specific wishes. These trusts can address various concerns related to Medicaid, special needs, asset protection, multi-generational wealth transfer, and charitable giving. Consulting with an experienced attorney is essential to understand which type of Irrevocable Pot Trust Agreement in Nevada best suits an individual's unique circumstances and goals.

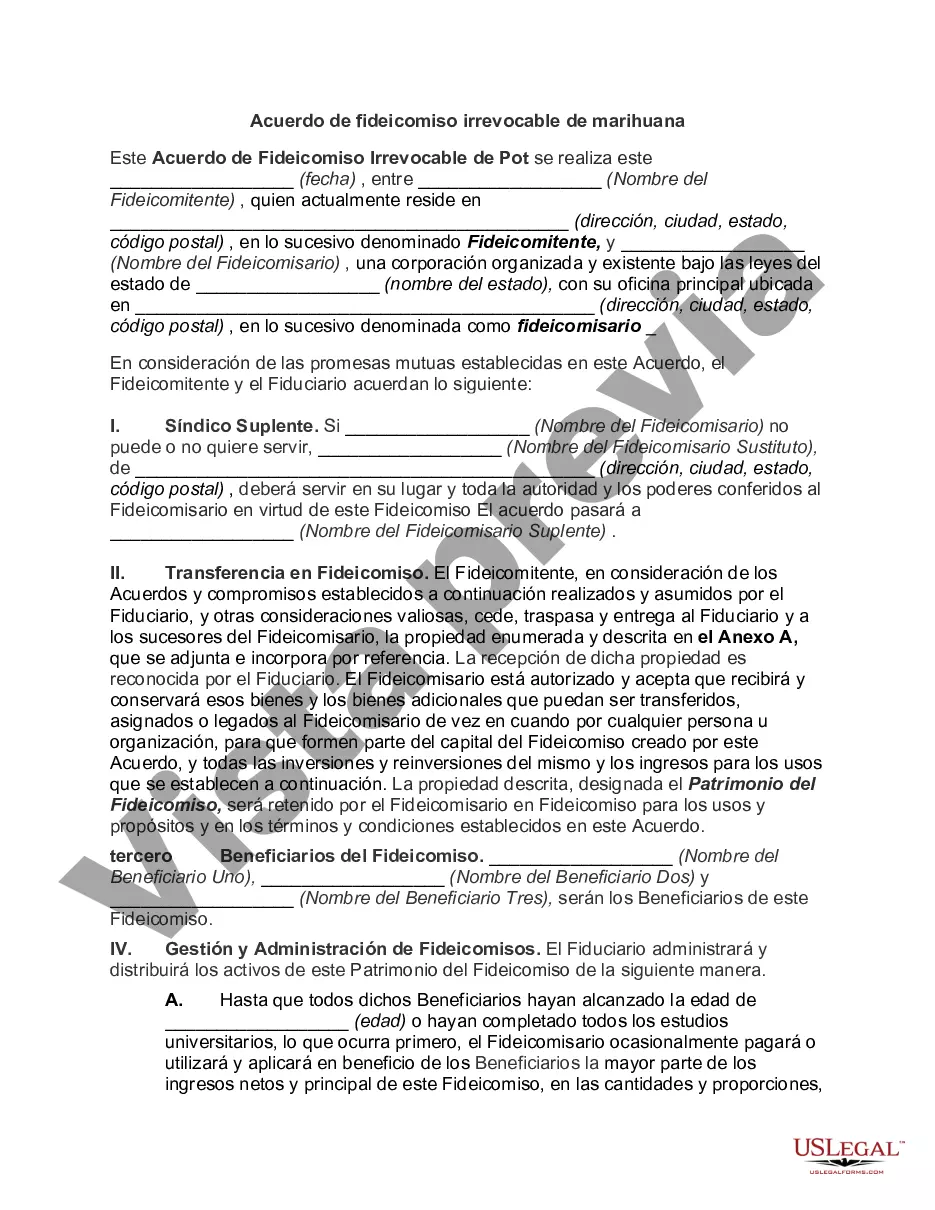

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Acuerdo de fideicomiso irrevocable de marihuana - Irrevocable Pot Trust Agreement

Description

How to fill out Nevada Acuerdo De Fideicomiso Irrevocable De Marihuana?

US Legal Forms - one of many most significant libraries of lawful forms in the United States - gives an array of lawful file templates you are able to acquire or print out. Making use of the web site, you can get thousands of forms for organization and individual reasons, sorted by groups, states, or search phrases.You can find the most up-to-date versions of forms much like the Nevada Irrevocable Pot Trust Agreement in seconds.

If you already have a subscription, log in and acquire Nevada Irrevocable Pot Trust Agreement in the US Legal Forms catalogue. The Download button will show up on every single form you perspective. You have accessibility to all in the past saved forms in the My Forms tab of your own account.

In order to use US Legal Forms initially, here are easy recommendations to obtain started off:

- Be sure you have chosen the best form for your personal city/region. Click the Preview button to examine the form`s articles. Browse the form description to actually have chosen the right form.

- If the form does not match your requirements, make use of the Look for field near the top of the monitor to discover the one that does.

- Should you be happy with the form, validate your choice by clicking the Acquire now button. Then, select the prices prepare you want and give your accreditations to register for an account.

- Method the deal. Utilize your Visa or Mastercard or PayPal account to complete the deal.

- Pick the file format and acquire the form on your own gadget.

- Make changes. Fill up, modify and print out and sign the saved Nevada Irrevocable Pot Trust Agreement.

Each template you included in your account does not have an expiry date which is yours for a long time. So, if you want to acquire or print out another backup, just visit the My Forms segment and click on on the form you need.

Obtain access to the Nevada Irrevocable Pot Trust Agreement with US Legal Forms, probably the most comprehensive catalogue of lawful file templates. Use thousands of specialist and status-certain templates that fulfill your company or individual needs and requirements.