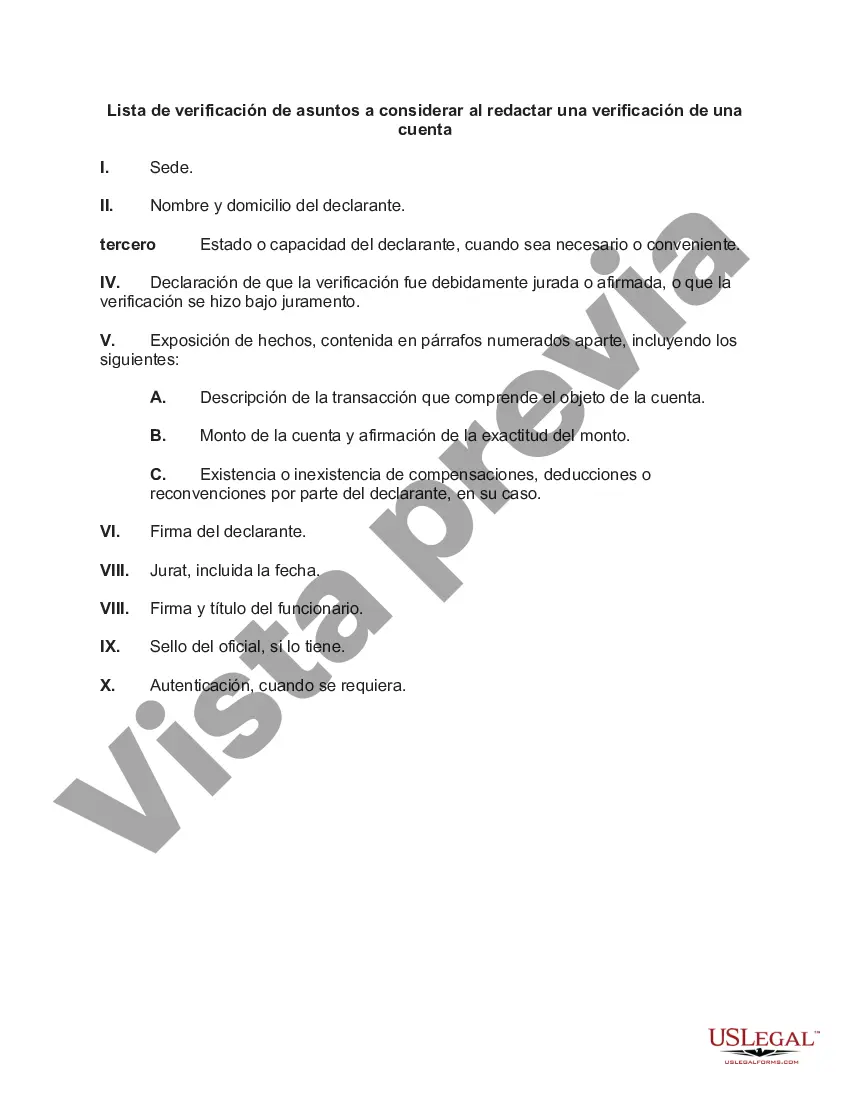

Title: Nevada Checklist of Matters to be Considered in Drafting a Verification of an Account Introduction: A Verification of an Account in Nevada is a legal document used to confirm the accuracy and authenticity of financial statements or accounts. This checklist outlines the key considerations essential when drafting a verification of an account in Nevada. It ensures compliance with the specific legal requirements and guarantees a comprehensive and valid verification process. Key Considerations in Drafting a Verification of an Account in Nevada: 1. Language and Structure: — Use clear, concise, and unambiguous language. — Ensure that the verification statement is written in the first person. — Include a formal title and heading for the document. — Structure the document in a logical and organized manner. 2. Parties involved: — Clearly identify the parties involved in the verification process, i.e., the account holder and the verifying entity. — Specify their full legal names, addresses, and contact details. 3. Description of Account: — Provide a detailed description of the account being verified, including the type of account (e.g., bank account, investment account), account number, and financial institution's name. 4. Date and Period Covered: — Indicate the date on which the verification is made. — Clearly state the period covered by the account statement being verified. 5. Verification Statement: — Include a clear and unambiguous statement affirming the accuracy and authenticity of the account. — Specify the authority under which the verification is made. — State any limitations on the verification, if applicable. 6. Signatures and Sworn Oaths: — Include spaces for the account holder and the verifying entity to sign and date the verification. — Ensure that the signatures are acknowledged before a notary public or other authorized individual. — Consider including a sworn oath section where the parties confirm under penalty of perjury that the information provided is true and accurate. Types of Nevada Checklists of Matters to be Considered in Drafting a Verification of an Account: 1. Personal Accounts: — This checklist covers verifications of personal financial accounts, such as bank accounts, credit card statements, and mortgage accounts. 2. Business Accounts: — This checklist focuses on verifications of business-related accounts, including bank accounts, investment accounts, and financial statements pertaining to a company. 3. Legal and Court-Related Accounts: — This checklist is specific to verification of accounts required in legal proceedings or court filings, such as trust account verifications or estate account verifications. Conclusion: Drafting a Verification of an Account in Nevada requires careful adherence to legal requirements and attention to detail. By following the Nevada Checklist of Matters to be Considered in Drafting a Verification of an Account, individuals and businesses can ensure a thorough and accurate verification process. Compliance with these key considerations will contribute to the credibility and reliability of the verification document in legal and financial contexts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Nevada Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

You are able to commit time on-line attempting to find the legitimate document format that fits the state and federal requirements you will need. US Legal Forms offers thousands of legitimate varieties that are reviewed by pros. You can easily acquire or printing the Nevada Checklist of Matters to be Considered in Drafting a Verification of an Account from your service.

If you currently have a US Legal Forms accounts, you can log in and click on the Obtain option. Following that, you can complete, modify, printing, or signal the Nevada Checklist of Matters to be Considered in Drafting a Verification of an Account. Every single legitimate document format you purchase is yours for a long time. To acquire one more duplicate for any acquired form, check out the My Forms tab and click on the corresponding option.

If you use the US Legal Forms website the very first time, adhere to the simple directions listed below:

- Very first, make sure that you have selected the correct document format for that state/town of your choice. Look at the form explanation to ensure you have chosen the correct form. If readily available, take advantage of the Preview option to check throughout the document format as well.

- In order to find one more version of your form, take advantage of the Look for area to obtain the format that fits your needs and requirements.

- After you have located the format you want, just click Acquire now to carry on.

- Pick the pricing plan you want, type in your qualifications, and register for your account on US Legal Forms.

- Total the financial transaction. You should use your bank card or PayPal accounts to fund the legitimate form.

- Pick the format of your document and acquire it for your product.

- Make changes for your document if needed. You are able to complete, modify and signal and printing Nevada Checklist of Matters to be Considered in Drafting a Verification of an Account.

Obtain and printing thousands of document themes utilizing the US Legal Forms Internet site, which provides the greatest collection of legitimate varieties. Use specialist and state-certain themes to deal with your organization or person requirements.