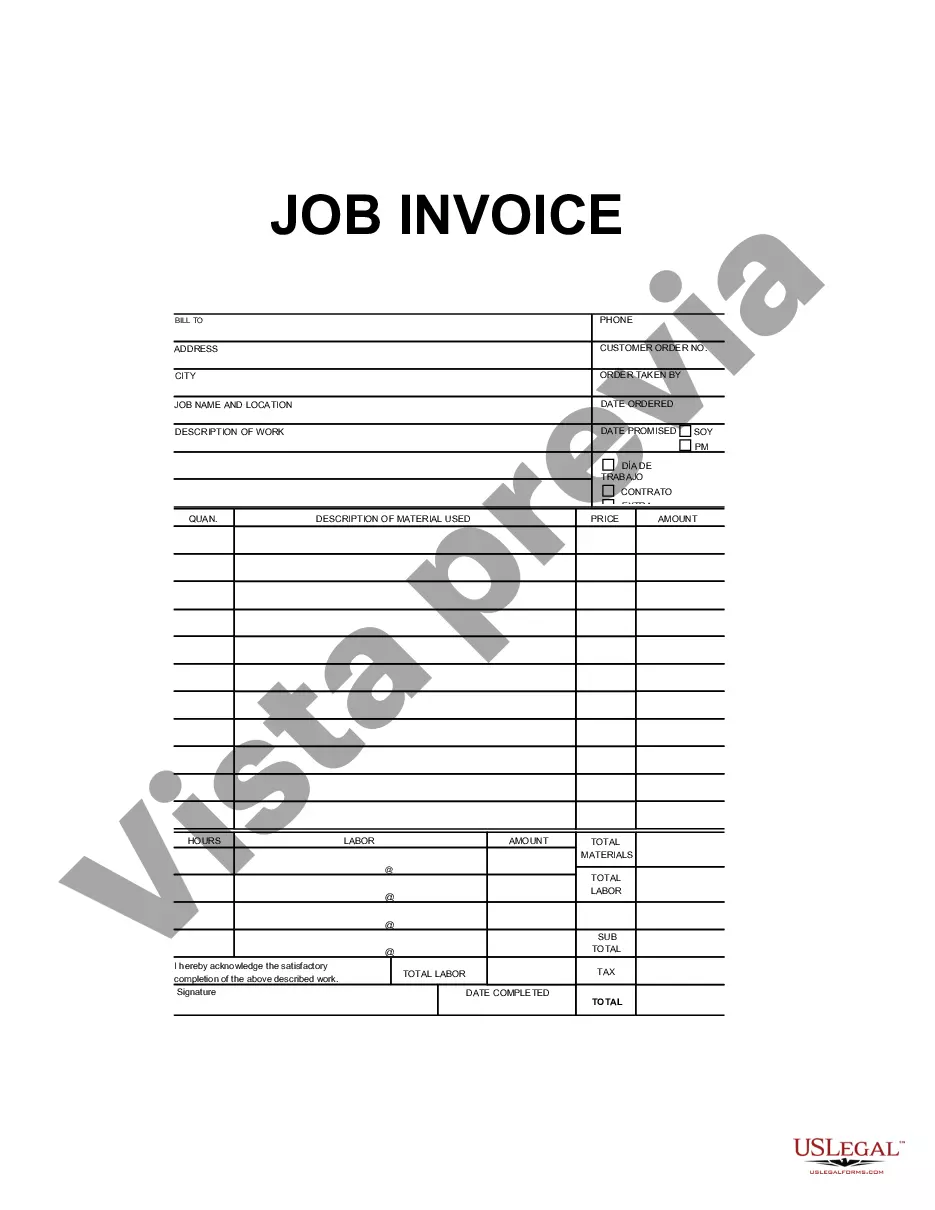

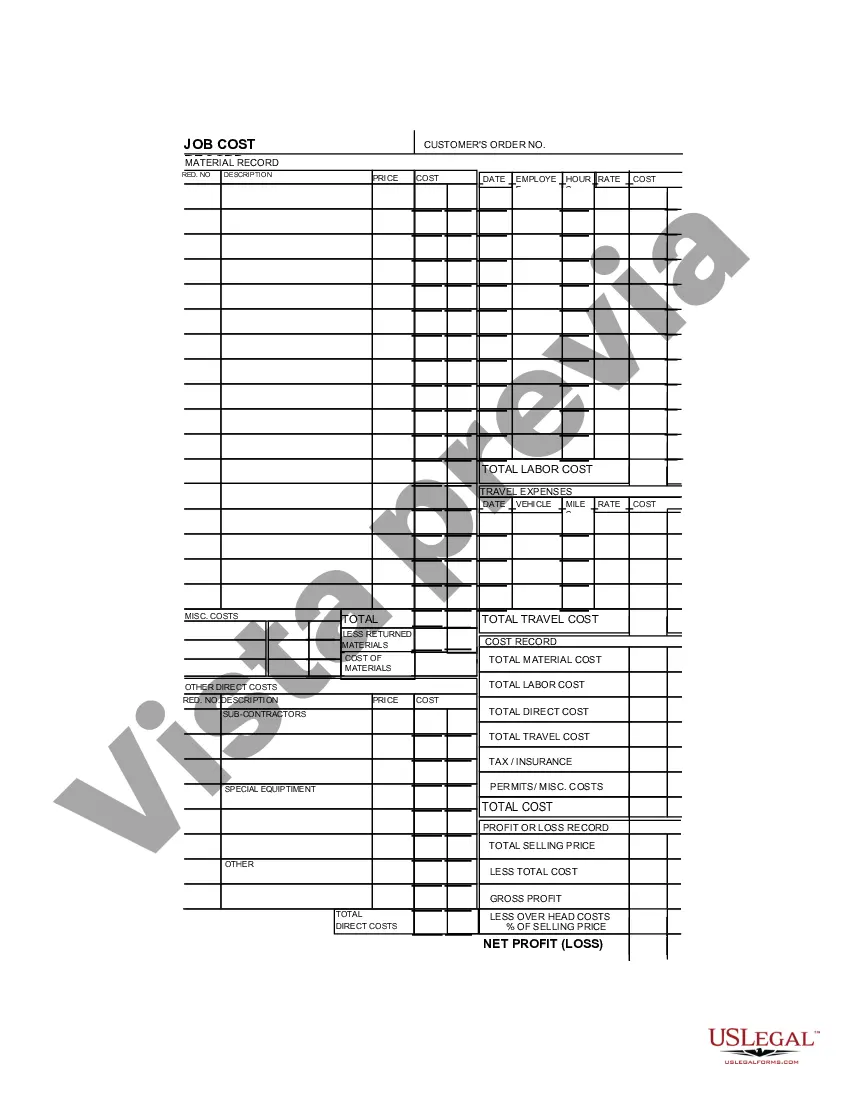

A Nevada Job Invoice — Long is a comprehensive document used in the state of Nevada to outline details of a job or project completion. This invoice type serves as an essential tool for businesses and independent contractors operating in Nevada to accurately bill clients for services rendered. It contains specific elements that ensure clarity and legal compliance for both parties involved. Key Components of a Nevada Job Invoice — Long: 1. Header: The header section typically includes the word "Invoice" prominently displayed at the top, along with the business name, contact details, and address. This information helps identify the invoicing party easily. 2. Invoice Number and Date: Each Nevada Job Invoice — Long is assigned a unique invoice number, serving as a reference for record-keeping and payment tracking. The invoice date indicates when the work was completed or the services were provided. 3. Client Information: The invoice includes detailed client information, such as their name, company name (if applicable), address, and contact details. This section ensures accurate identification of the recipient. 4. Project Description: The Nevada Job Invoice — Long provides a detailed description of the services or project completed. It specifies the nature of the work, including the tasks performed, materials used (if any), and the duration of the project. 5. Itemized List: This portion of the invoice breaks down the services provided into individual line items. Each line item includes a description of the task performed, the quantity (if applicable), the unit price, and the total amount for that specific item. 6. Labor Costs: For projects involving hourly rates, the Nevada Job Invoice — Long incorporates the hours worked, the hourly rate, and the total labor cost for each task performed. This documentation ensures transparency when billing clients for manpower. 7. Materials and Expenses: If materials or additional expenses were incurred during the project, they are listed separately along with their costs. This section helps clients understand the breakdown of charges and provides transparency regarding the procurement of materials. 8. Subtotal, Taxes, and Discounts: The invoice calculates the subtotal by summing up all the line item costs, labor costs, materials, and expenses. Applicable taxes (as per Nevada tax regulations) are added, and any discounts, if applicable, are subtracted to determine the final amount due. 9. Terms and Conditions: The Nevada Job Invoice — Long may include specific terms and conditions agreed upon by the client and the service provider. These conditions could cover details related to payment due dates, late fees, return policies, and any other relevant contractual obligations. Types of Nevada Job Invoice — Long: While there aren't specific variations of the Nevada Job Invoice — Long, it is essential to customize the invoice according to the industry and specific business needs. Depending on the nature of the work or the company's requirements, variations in design, layout, and terminology may be implemented. However, the key components mentioned above should be present in all Nevada Job Invoice — Long types to ensure compliance and accuracy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Factura de trabajo - Larga - Job Invoice - Long

Description

How to fill out Nevada Factura De Trabajo - Larga?

Choosing the best legitimate papers design could be a struggle. Needless to say, there are plenty of web templates available on the Internet, but how will you find the legitimate kind you require? Utilize the US Legal Forms web site. The services gives thousands of web templates, like the Nevada Job Invoice - Long, which can be used for company and private demands. Every one of the kinds are inspected by professionals and meet federal and state needs.

In case you are currently listed, log in to the accounts and click the Obtain option to have the Nevada Job Invoice - Long. Use your accounts to search with the legitimate kinds you might have bought previously. Go to the My Forms tab of the accounts and obtain one more copy from the papers you require.

In case you are a brand new end user of US Legal Forms, listed here are simple guidelines so that you can follow:

- Initial, make certain you have chosen the right kind for your personal town/area. It is possible to look over the form using the Review option and look at the form information to make certain this is the best for you.

- If the kind is not going to meet your expectations, take advantage of the Seach field to find the correct kind.

- Once you are certain that the form is suitable, select the Get now option to have the kind.

- Opt for the pricing program you would like and enter the essential details. Build your accounts and pay for your order making use of your PayPal accounts or Visa or Mastercard.

- Pick the document formatting and download the legitimate papers design to the system.

- Total, modify and produce and sign the received Nevada Job Invoice - Long.

US Legal Forms may be the largest library of legitimate kinds where you can see a variety of papers web templates. Utilize the company to download skillfully-created paperwork that follow state needs.