Nevada Home Based Worker Checklist: A Comprehensive Guide to Set Up a Successful Home-Based Business in Nevada Are you considering becoming a home-based worker in Nevada? To ensure a smooth and productive journey, it is crucial to have a well-planned checklist to follow. The Nevada Home Based Worker Checklist serves as a step-by-step guide, covering all the essential aspects you need to consider while setting up your home-based business in the state. Here are some keywords that are relevant to the Nevada Home Based Worker Checklist: 1. Legal Requirements: The checklist includes the legal obligations you must fulfill as a home-based worker in Nevada. It covers gathering necessary permits, licenses, and registrations such as a Nevada State Business License and registering your business name with the Secretary of State. 2. Business Structure: It helps you determine and understand different business structures available in Nevada, such as a sole proprietorship, partnership, Limited Liability Company (LLC), or a corporation. Choosing the right structure affects your taxation, liability, and legal aspects of your business. 3. Taxation: Nevada Home Based Worker Checklist provides guidance on understanding and managing taxes that apply to home-based businesses. Key topics covered include sales tax, federal income tax, state income tax, self-employment tax, and any specific tax considerations for your type of business. 4. Home Office Setup: This section advises on creating an efficient and productive workspace at home. It includes ergonomic considerations, equipment and technology requirements, internet connectivity, and ensuring compliance with zoning laws if you plan to meet clients or customers at your home. 5. Insurance: Understanding the importance of suitable insurance coverage is vital. The checklist explains various types of insurance relevant to home-based businesses, including liability insurance, property insurance, and professional liability insurance. 6 6. Accounting and Bookkeeping: Proper bookkeeping and accounting practices are crucial to managing your finances. The checklist provides guidance on setting up a bookkeeping system, tracking expenses, understanding deductions, and creating a budget. 7. Marketing and Promotion: To succeed as a home-based worker, marketing and promotion play a vital role. The checklist offers strategies for establishing an online presence, creating a website, utilizing social media platforms, and developing effective marketing campaigns to reach your target audience. Types of Nevada Home Based Worker Checklist: 1. Startup Checklist: A comprehensive guide specifically tailored for entrepreneurs who are just starting their home-based businesses in Nevada. It covers everything from the initial setup to legal requirements, taxation, insurance, and marketing. 2. Compliance Checklist: This checklist is designed for home-based workers who want to ensure they are meeting all the legal obligations and compliance requirements set by the state of Nevada. It covers permits, licenses, registrations, and any specific industry regulations. 3. Financial Management Checklist: This checklist focuses on the financial aspects of running a home-based business in Nevada. It assists in organizing your finances, tracking income and expenses, understanding tax obligations, and managing cash flow effectively. By following the Nevada Home Based Worker Checklist, you can confidently navigate the process of starting and running your home-based business in Nevada. Whether you are a budding entrepreneur or an experienced professional seeking a flexible work environment, this checklist serves as your go-to resource for success in the Silver State.

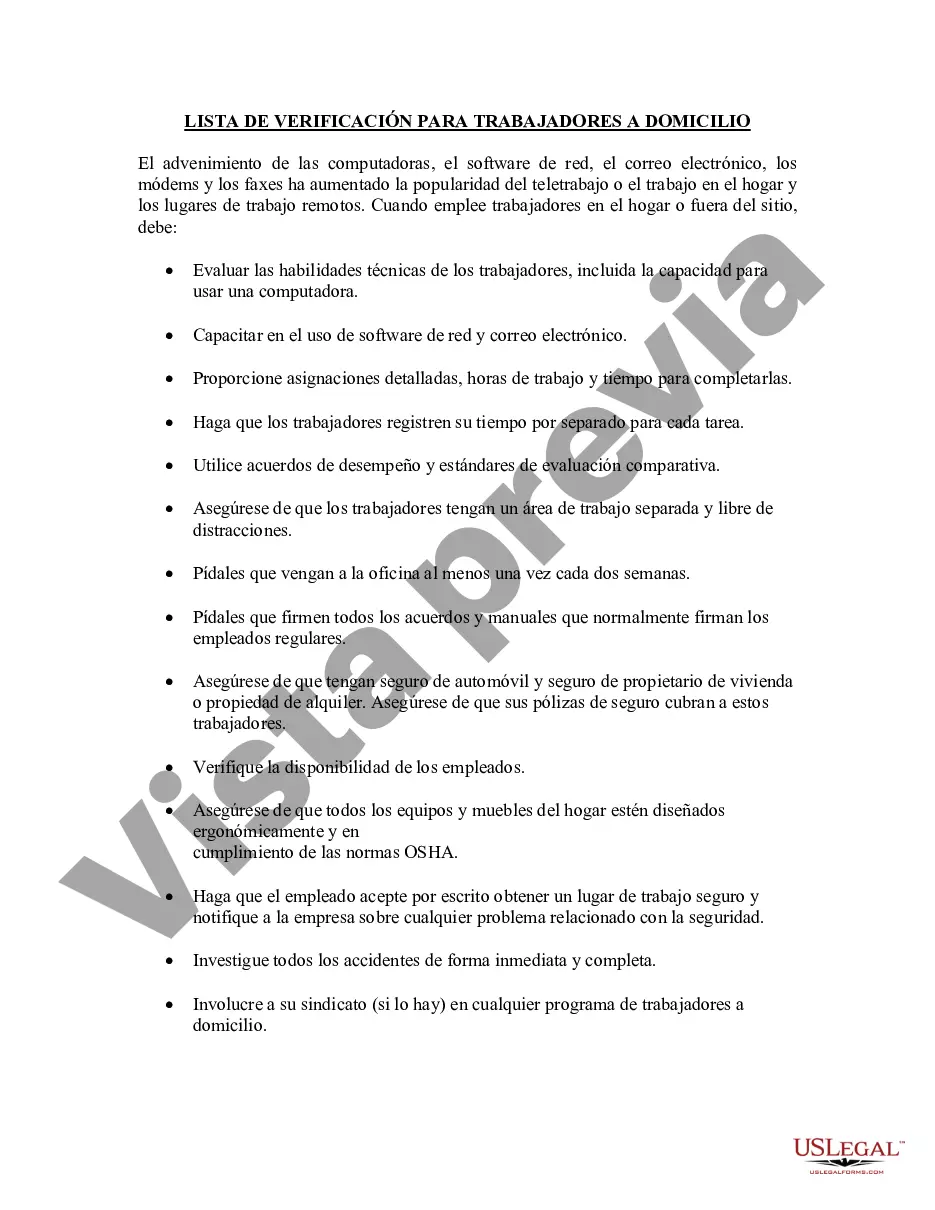

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Lista de verificación para trabajadores a domicilio - Home based Worker Checklist

Description

How to fill out Nevada Lista De Verificación Para Trabajadores A Domicilio?

If you want to total, download, or printing legal papers web templates, use US Legal Forms, the largest assortment of legal varieties, which can be found on the web. Utilize the site`s simple and easy hassle-free lookup to get the papers you will need. Numerous web templates for enterprise and person purposes are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to get the Nevada Home based Worker Checklist in just a couple of click throughs.

In case you are currently a US Legal Forms client, log in to your bank account and click the Down load key to get the Nevada Home based Worker Checklist. Also you can entry varieties you earlier acquired from the My Forms tab of your bank account.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for your appropriate city/land.

- Step 2. Use the Review method to look through the form`s information. Do not neglect to read through the explanation.

- Step 3. In case you are not satisfied together with the type, take advantage of the Lookup area on top of the monitor to find other models of the legal type design.

- Step 4. When you have identified the form you will need, select the Acquire now key. Choose the costs plan you like and put your accreditations to sign up for the bank account.

- Step 5. Approach the financial transaction. You may use your charge card or PayPal bank account to finish the financial transaction.

- Step 6. Select the formatting of the legal type and download it on your system.

- Step 7. Total, edit and printing or indication the Nevada Home based Worker Checklist.

Every legal papers design you get is your own permanently. You may have acces to each and every type you acquired with your acccount. Select the My Forms area and choose a type to printing or download yet again.

Contend and download, and printing the Nevada Home based Worker Checklist with US Legal Forms. There are millions of expert and status-distinct varieties you can utilize to your enterprise or person requirements.