Title: Understanding the Nevada Notice of Adverse Action — Non-Employmen— - Due to Credit Report Introduction: The Nevada Notice of Adverse Action — Non-Employmen— - Due to Credit Report is a legal document utilized by businesses in Nevada when making decisions based on an individual's credit report that result in adverse action. Adverse action refers to any negative consequences taken against an applicant, such as denial of credit, rental application rejection, or insurance policy cancellation, due to the information found in their credit report. This detailed description will outline the purpose, key components, and different types of Nevada Notice of Adverse Action — Non-Employmen— - Due to Credit Report. 1. Purpose of the Nevada Notice of Adverse Action — Non-Employmen— - Due to Credit Report: The primary purpose of this notice is to inform individuals about the adverse action taken against them based on the information found in their credit report. The notice serves as a means of providing transparency, ensuring compliance with federal and state regulations, and offering the affected party an opportunity to rectify any potential inaccuracies in their credit report. 2. Key Components of the Nevada Notice of Adverse Action — Non-Employmen— - Due to Credit Report: a. Clearly Identifying Information: The notice should include the name, address, and contact information of the business or entity responsible for taking the adverse action. b. Specific Reasons for Adverse Action: The notice must clearly state the reasons directly relating to the individual's credit report that led to the adverse action. c. Disclosure of Credit Reporting Agency: The notice should provide the name, address, and contact information of the credit reporting agency from which the credit report was obtained. d. Importance of Credit Reports: The notice may include a brief overview of the significance of credit reports, emphasizing its role in decision-making processes for credit, rental applications, and insurance. e. Instructions for Obtaining Free Credit Reports: The notice should inform the individual about their right to obtain a free copy of their credit report within a specified timeframe. f. Instructions to Dispute Inaccuracies: The notice must outline steps for disputing any inaccuracies found in the credit report and include the contact details of the credit reporting agency for initiating the dispute process. 3. Different Types of Nevada Notice of Adverse Action — Non-Employmen— - Due to Credit Report: a. Nevada Notice of Adverse Action — Non-Employmen— - Credit Denial: This type of notice is issued when an applicant's credit report is used as a basis for denying credit or financing, such as a loan, credit card application, or mortgage. b. Nevada Notice of Adverse Action — Non-Employmen— - Rental Application Rejection: This notice is utilized by landlords or property management companies to inform rental applicants of their rejection due to negative entries in their credit report. c. Nevada Notice of Adverse Action — Non-Employmen— - Insurance Cancellation: Insurance companies issue this notice when canceling or non-renewing an insurance policy based on adverse details found in the individual's credit report. Conclusion: The Nevada Notice of Adverse Action — Non-Employmen— - Due to Credit Report is an essential tool for businesses and entities to comply with relevant regulations, inform individuals about adverse action decisions, and provide avenues for dispute resolution. Understanding these notices helps individuals comprehend their rights and take appropriate actions to rectify credit report inaccuracies.

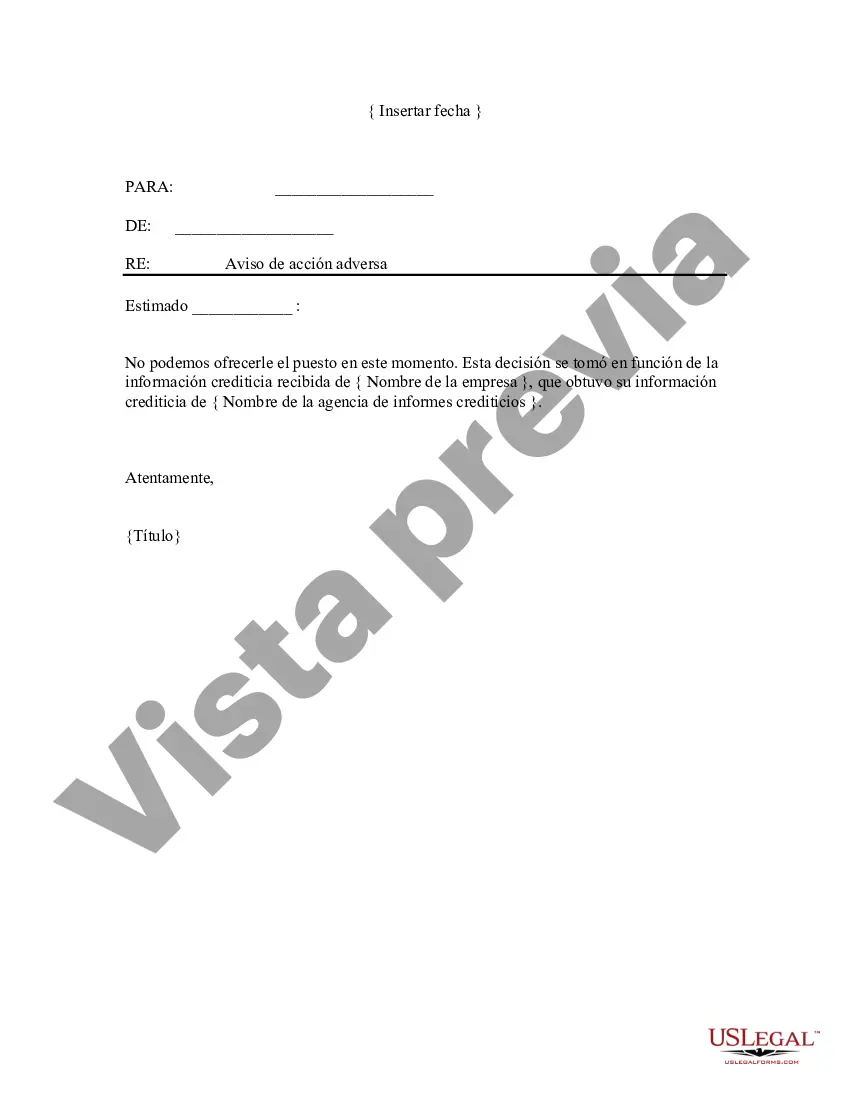

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Aviso de Acción Adversa - No Laboral - Debido a Reporte de Crédito - Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

How to fill out Nevada Aviso De Acción Adversa - No Laboral - Debido A Reporte De Crédito?

You are able to invest hrs on the Internet attempting to find the authorized file web template which fits the federal and state specifications you want. US Legal Forms provides a large number of authorized forms which can be evaluated by specialists. You can actually download or print out the Nevada Notice of Adverse Action - Non-Employment - Due to Credit Report from the service.

If you already possess a US Legal Forms account, you are able to log in and then click the Obtain option. Afterward, you are able to full, change, print out, or signal the Nevada Notice of Adverse Action - Non-Employment - Due to Credit Report. Every authorized file web template you purchase is the one you have forever. To acquire an additional duplicate of the obtained develop, check out the My Forms tab and then click the related option.

If you use the US Legal Forms internet site the first time, stick to the basic instructions beneath:

- Very first, ensure that you have chosen the best file web template for the area/town that you pick. Read the develop explanation to make sure you have selected the appropriate develop. If readily available, make use of the Review option to search from the file web template too.

- In order to find an additional model of your develop, make use of the Search discipline to discover the web template that fits your needs and specifications.

- After you have identified the web template you need, just click Get now to proceed.

- Choose the pricing program you need, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You can use your Visa or Mastercard or PayPal account to pay for the authorized develop.

- Choose the file format of your file and download it for your product.

- Make changes for your file if necessary. You are able to full, change and signal and print out Nevada Notice of Adverse Action - Non-Employment - Due to Credit Report.

Obtain and print out a large number of file layouts utilizing the US Legal Forms website, which offers the largest collection of authorized forms. Use professional and condition-distinct layouts to deal with your organization or specific requirements.