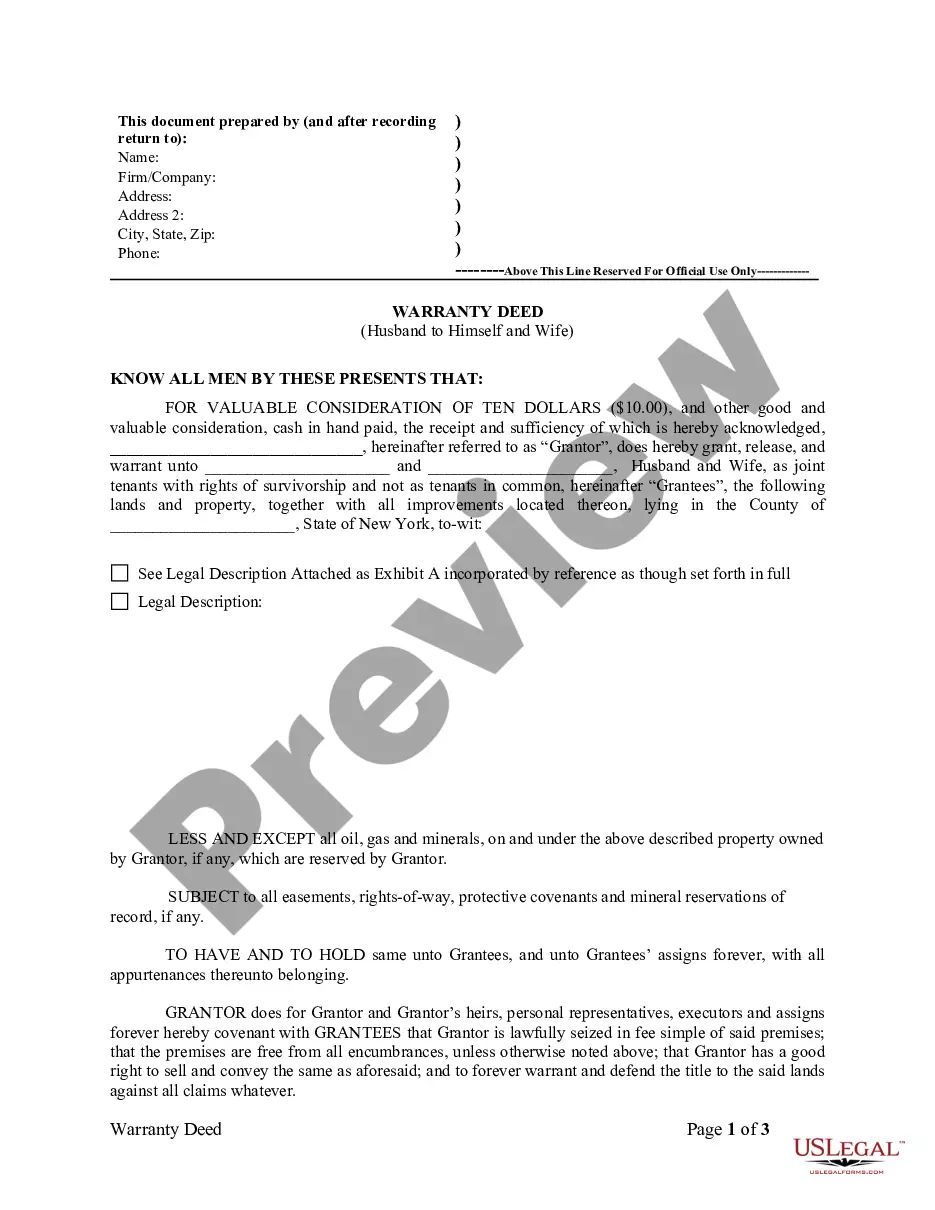

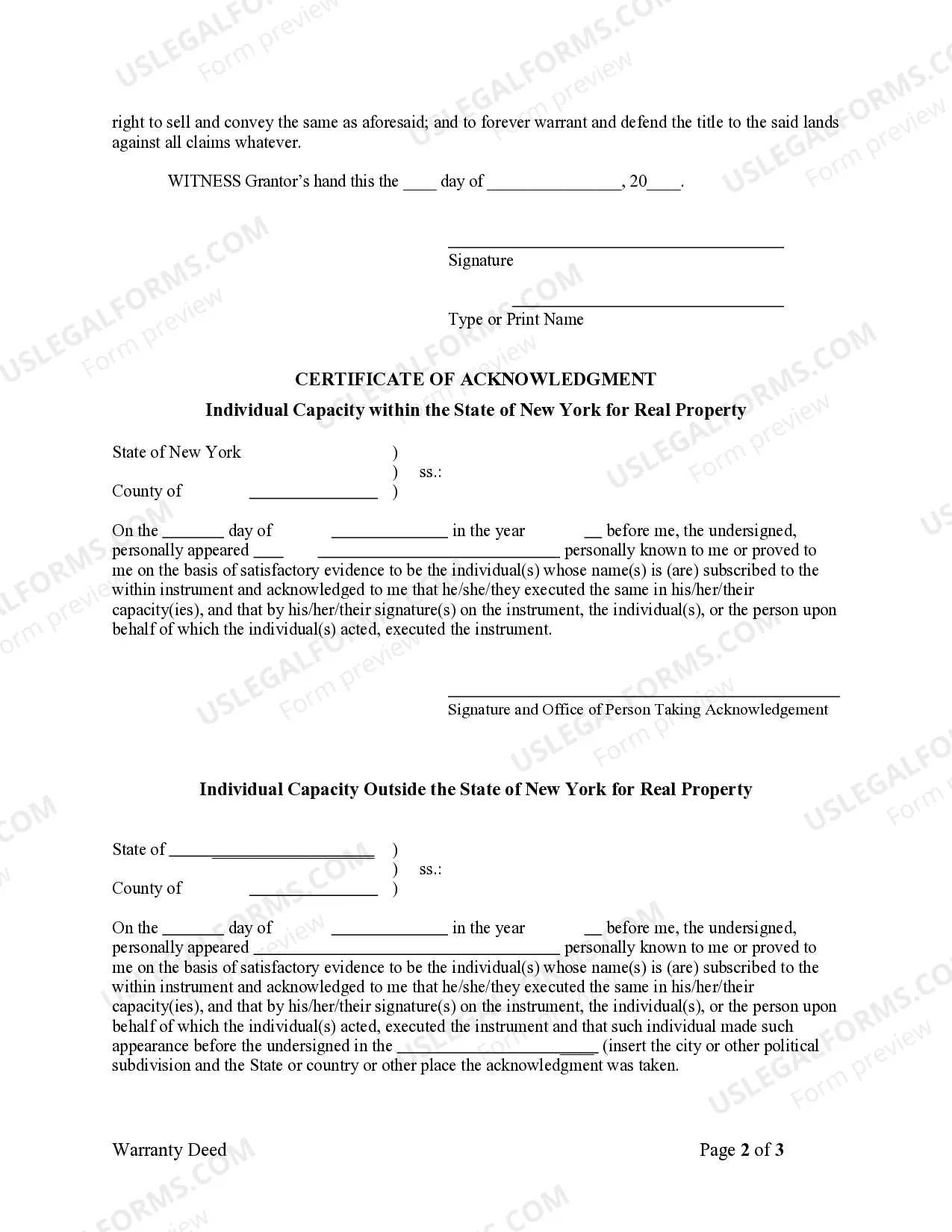

New York Warranty Deed from Husband to Himself and Wife

Description

How to fill out New York Warranty Deed From Husband To Himself And Wife?

US Legal Forms is actually a special platform where you can find any legal or tax document for submitting, such as New York Warranty Deed from Husband to Himself and Wife. If you’re tired with wasting time searching for appropriate examples and spending money on record preparation/legal professional charges, then US Legal Forms is exactly what you’re seeking.

To experience all of the service’s advantages, you don't have to install any software but simply select a subscription plan and create your account. If you have one, just log in and look for a suitable template, download it, and fill it out. Downloaded documents are saved in the My Forms folder.

If you don't have a subscription but need to have New York Warranty Deed from Husband to Himself and Wife, have a look at the instructions listed below:

- Double-check that the form you’re considering is valid in the state you want it in.

- Preview the form and look at its description.

- Click on Buy Now button to access the sign up page.

- Choose a pricing plan and proceed registering by entering some info.

- Choose a payment method to complete the registration.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, complete the document online or print it. If you feel unsure concerning your New York Warranty Deed from Husband to Himself and Wife form, speak to a legal professional to examine it before you decide to send or file it. Start hassle-free!

Form popularity

FAQ

A Survivorship Deed transfers residential or commercial property from one property owner (the grantor) to another (the grantee) while allowing them to avoid going through probate when they (the grantor) passes away. The parties transferring property in a Survivorship Deed must have full ownership of the property.

In title law, when we talk about tenants, we're talking about people who own property.When joint tenants have right of survivorship, it means that the property shares of one co-tenant are transferred directly to the surviving co-tenant (or co-tenants) upon their death.

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

With a Survivorship Deed in place, when one of the parties in a joint tenancy dies, the other party (or parties) takes over the deceased party's interest in the property instead of it passing to the deceased's heirs or beneficiaries.

A joint tenant can indeed sever the right of survivorship WITHOUT the consent of the other joint tenants.In order to sever the right of survivorship, a tenant must only record a new deed showing that his or her interest in the title is now held in a Tenancy-in-Common or as Community Property.

What Is the Difference Between a Warranty Deed & a Survivorship Deed?A warranty deed is the most comprehensive and provides the most guarantees. Survivorship isn't so much a deed as a title. It's a way to co-own property where, upon the death of one owner, ownership automatically passes to the survivor.

What Is the Difference Between a Warranty Deed & a Survivorship Deed?A warranty deed is the most comprehensive and provides the most guarantees. Survivorship isn't so much a deed as a title. It's a way to co-own property where, upon the death of one owner, ownership automatically passes to the survivor.