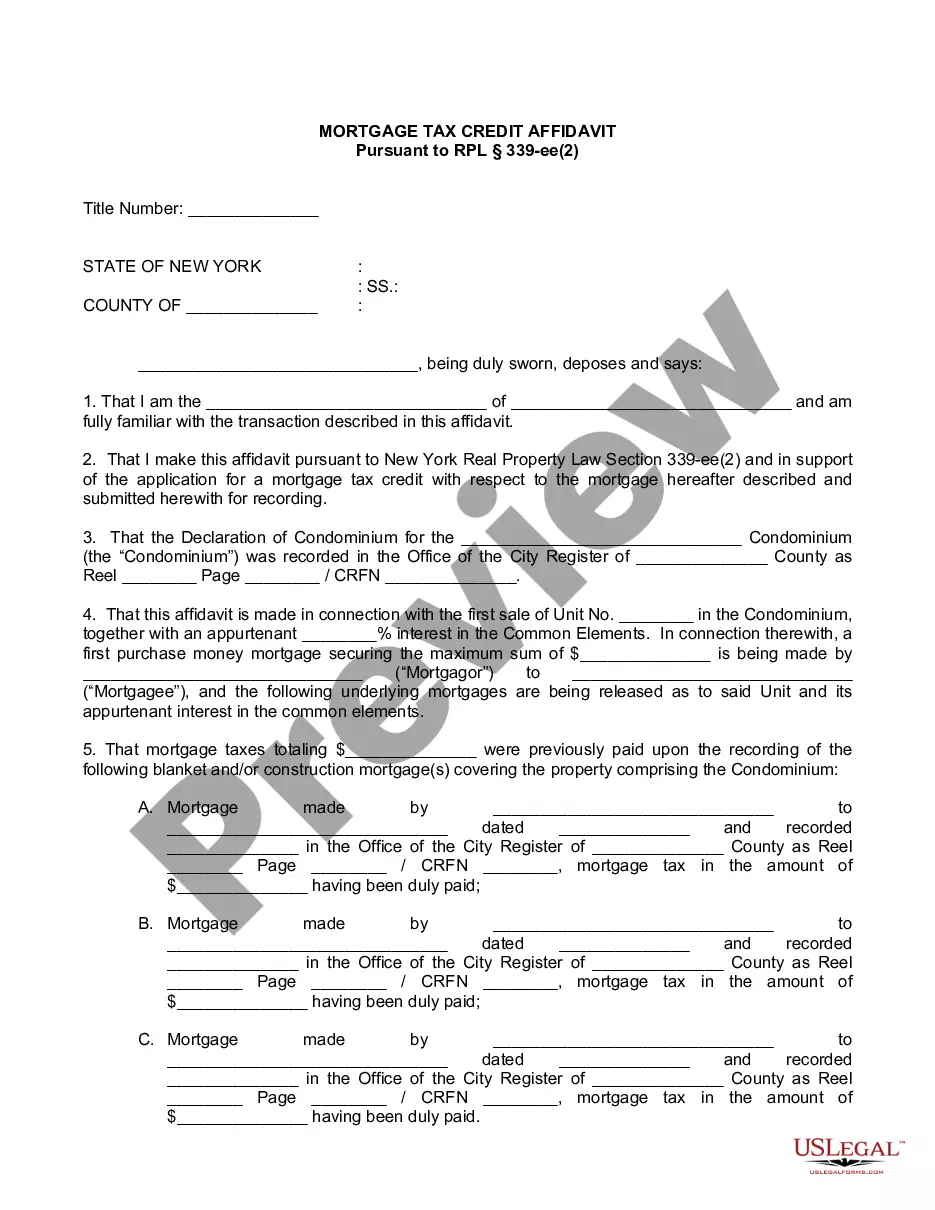

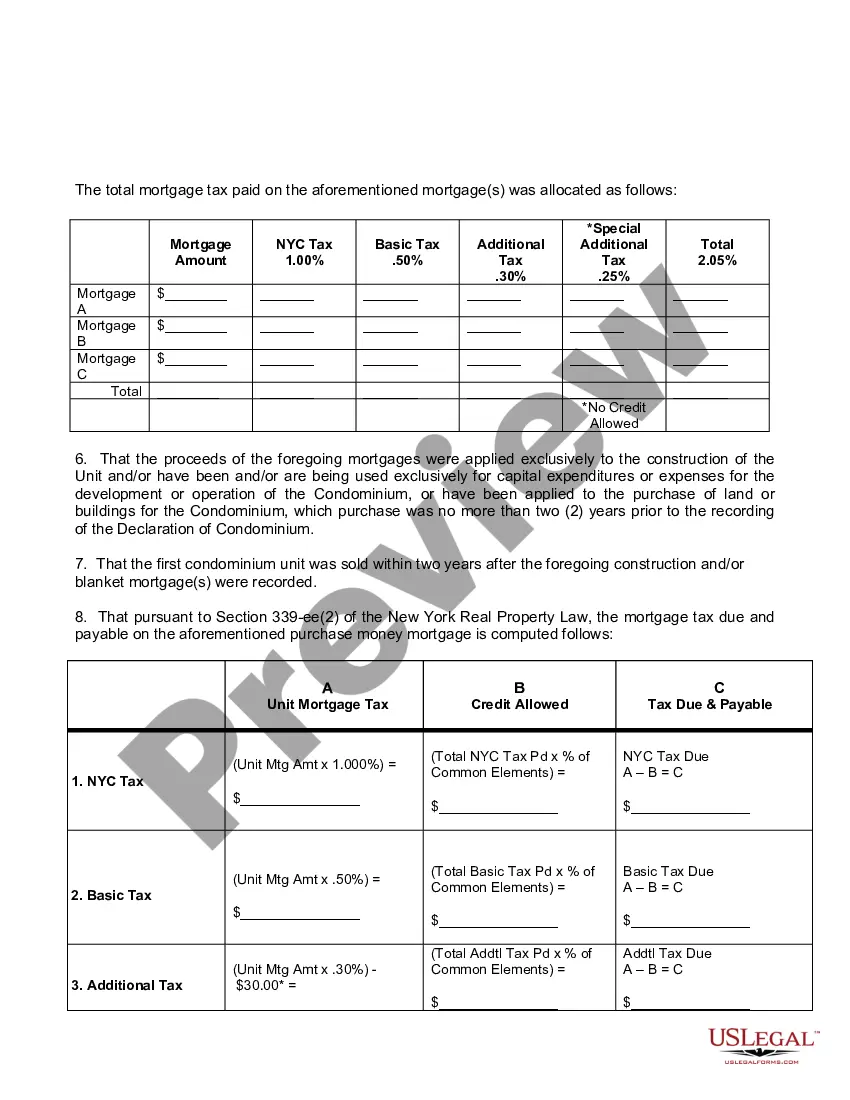

A New York Mortgage Tax Credit Affidavit is a legal document that consists of two parts — a Certificate of Eligibility and a Disclosure Statement. The Certificate of Eligibility is signed by a borrower and lender, and states that the borrower is eligible for a mortgage tax credit in the state of New York. The Disclosure Statement is then signed by the borrower and lender, and sets out the details of the mortgage tax credit, including the amount of the credit, the rate of interest, the term of the loan, and any other pertinent information. There are two types of New York Mortgage Tax Credit Affidavits. The first is the Standard New York Mortgage Tax Credit Affidavit, which is used for all home purchases and refinances. The second is the Enhanced New York Mortgage Tax Credit Affidavit, which is used for purchases of homes in certain designated areas.

Mortgage Tax Form

Description Mortgage Tax Credit

How to fill out New York Mortgage Tax Credit Affidavit?

When it comes to completing New York City Veterans Property Tax Exemption Form, you almost certainly visualize an extensive process that consists of finding a ideal sample among hundreds of very similar ones and after that being forced to pay out a lawyer to fill it out for you. In general, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific document within just clicks.

If you have a subscription, just log in and click Download to find the New York City Veterans Property Tax Exemption Form sample.

In the event you don’t have an account yet but need one, keep to the point-by-point guideline below:

- Be sure the file you’re downloading is valid in your state (or the state it’s needed in).

- Do this by looking at the form’s description and by clicking the Preview option (if offered) to view the form’s content.

- Simply click Buy Now.

- Select the appropriate plan for your financial budget.

- Join an account and select how you want to pay out: by PayPal or by credit card.

- Download the document in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Professional legal professionals work on creating our templates to ensure after saving, you don't need to worry about editing and enhancing content material outside of your personal info or your business’s information. Be a part of US Legal Forms and get your New York City Veterans Property Tax Exemption Form sample now.