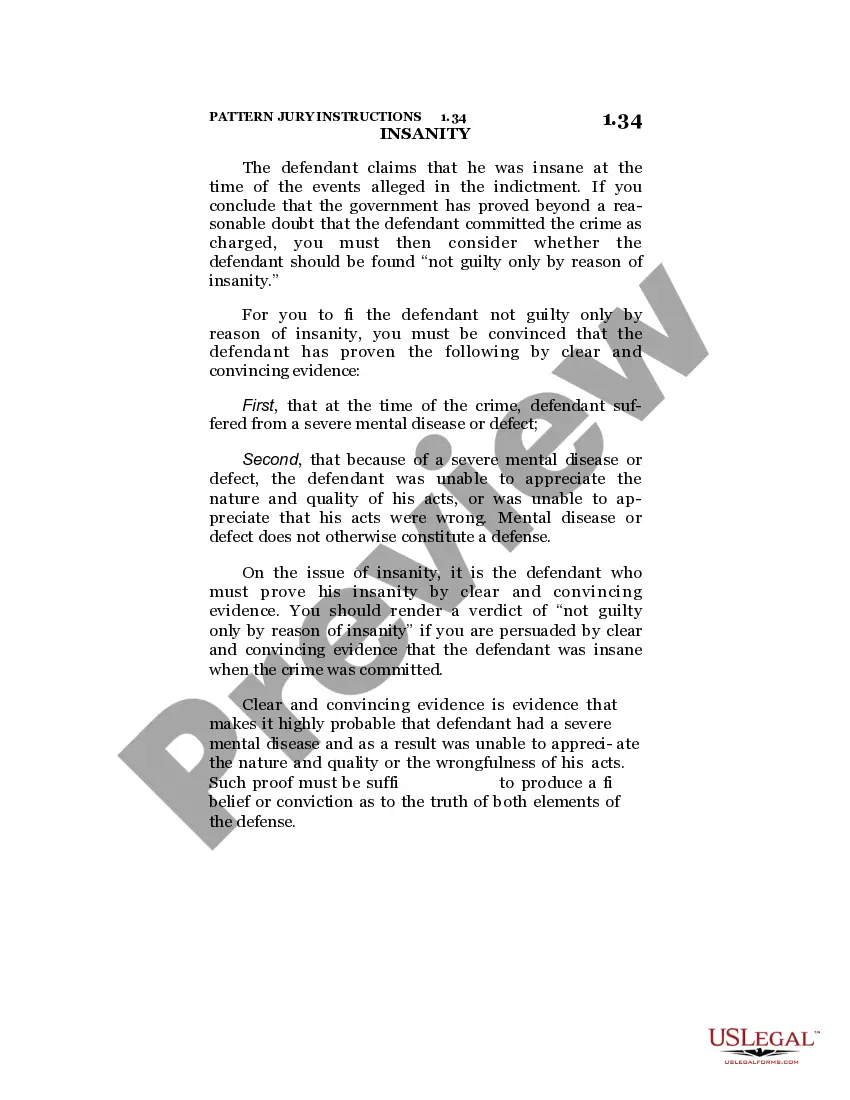

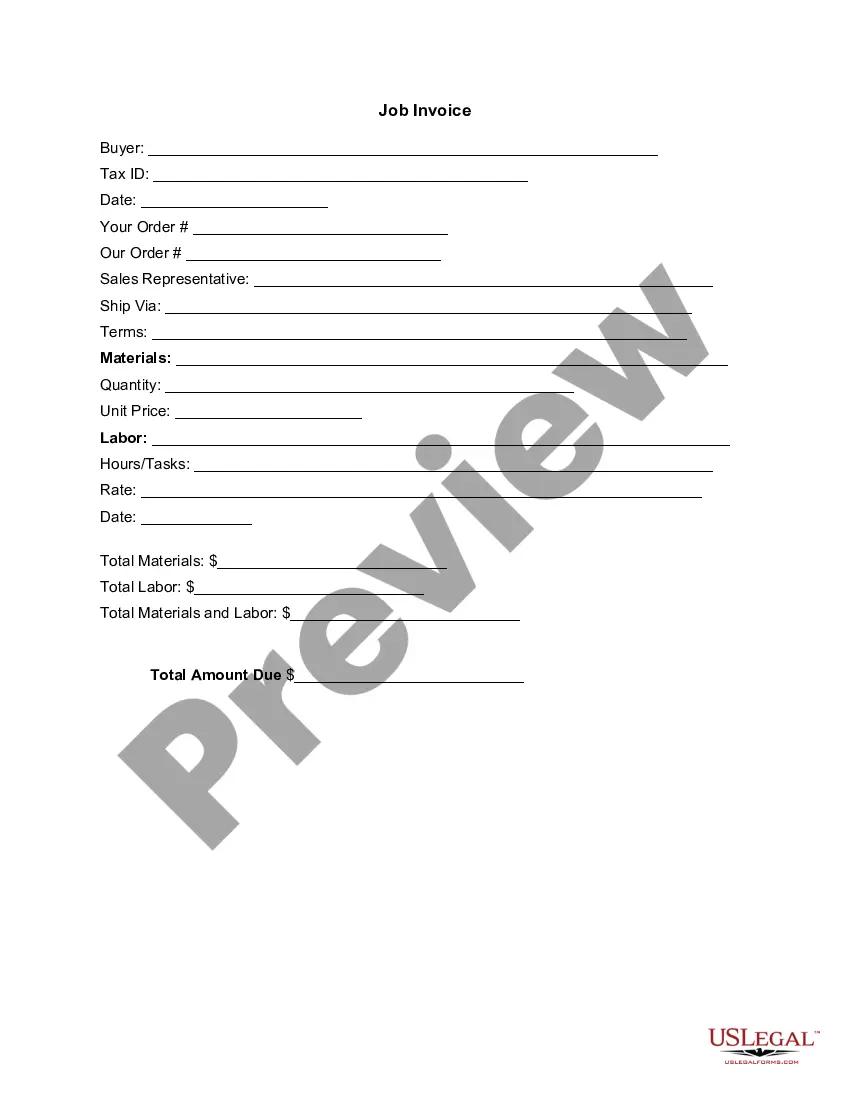

The New York M-2 Salesperson Statement (70.1 KB PDF) is a form used by New York State salespersons to report their sales tax liabilities to the Department of Taxation and Finance. The statement is divided into two parts: the Salesperson Schedule and the Salesperson Return. The Salesperson Schedule includes information such as taxable sales, exemptions, deductions, and tax due. The Salesperson Return is used to report total sales, exemptions, deductions, and tax due. There are two types of New York M-2 Salesperson Statements: the regular statement and the self-employed statement. The regular statement is used by salespersons who are employees of a business and the self-employed statement is used by salespersons who are independent contractors. Both statements must be completed and filed with the Department of Taxation and Finance by the 15th of the month following the month of sale. The New York M-2 Salesperson Statement (70.1 KB PDF) is used to report taxable sales, exemptions, deductions, and tax due to the State of New York.

New York M-2 Salesperson Statement (70.1KB PDF)

Description

How to fill out New York M-2 Salesperson Statement (70.1KB PDF)?

How much time and resources do you often spend on drafting formal documentation? There’s a greater option to get such forms than hiring legal experts or spending hours browsing the web for an appropriate blank. US Legal Forms is the premier online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the New York M-2 Salesperson Statement (70.1KB PDF).

To get and prepare an appropriate New York M-2 Salesperson Statement (70.1KB PDF) blank, follow these easy steps:

- Look through the form content to make sure it meets your state requirements. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your needs, find a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the New York M-2 Salesperson Statement (70.1KB PDF). If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely safe for that.

- Download your New York M-2 Salesperson Statement (70.1KB PDF) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trusted web services. Join us now!