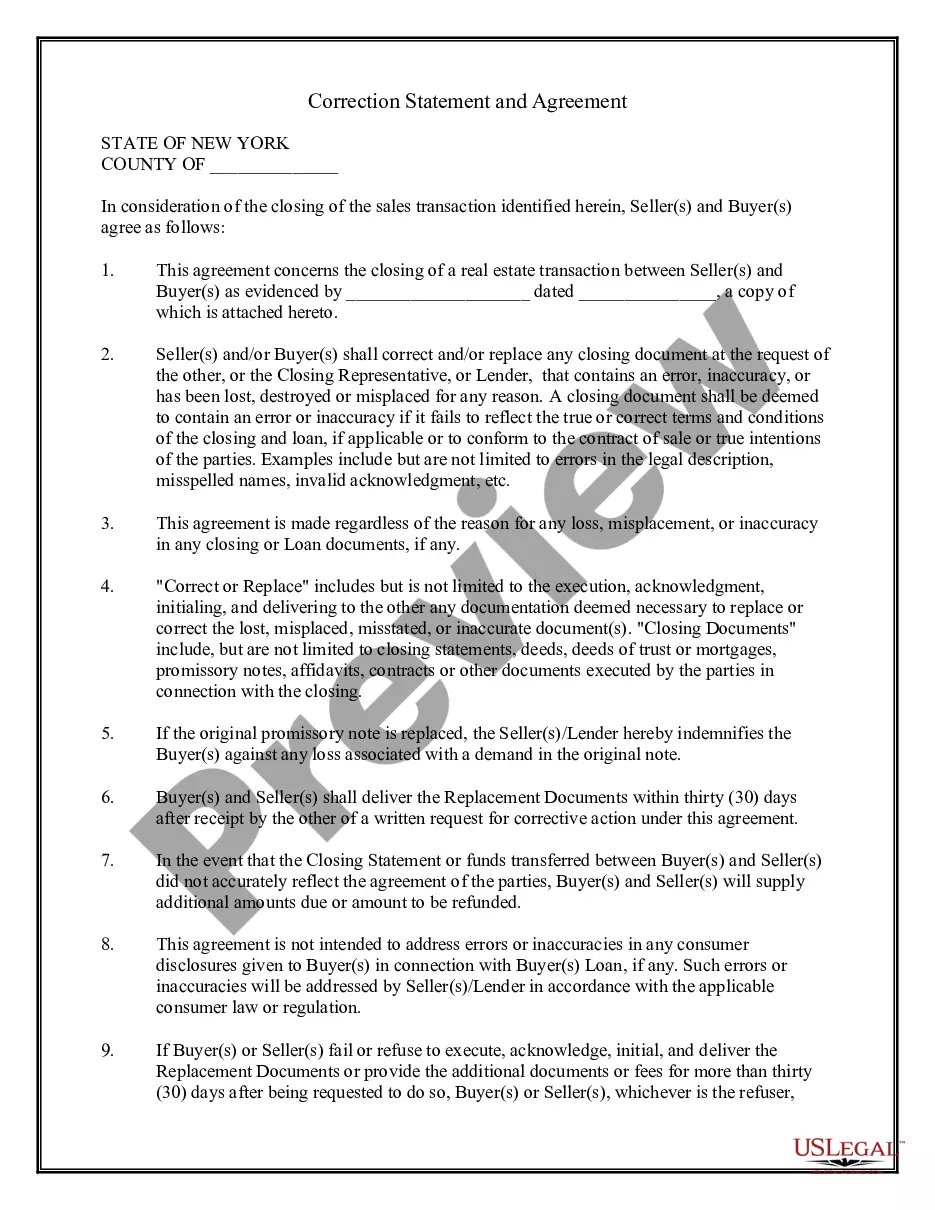

New York Correction Statement and Agreement

Description

How to fill out New York Correction Statement And Agreement?

When it comes to completing New York Correction Statement and Agreement, you most likely visualize an extensive procedure that involves getting a suitable form among countless similar ones and after that having to pay a lawyer to fill it out for you. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific form within clicks.

For those who have a subscription, just log in and then click Download to have the New York Correction Statement and Agreement form.

In the event you don’t have an account yet but want one, follow the step-by-step guideline below:

- Be sure the file you’re getting is valid in your state (or the state it’s needed in).

- Do so by looking at the form’s description and by visiting the Preview option (if offered) to see the form’s information.

- Click on Buy Now button.

- Choose the proper plan for your budget.

- Sign up to an account and select how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Professional attorneys work on drawing up our templates so that after downloading, you don't need to worry about modifying content outside of your personal information or your business’s information. Join US Legal Forms and receive your New York Correction Statement and Agreement document now.

Form popularity

FAQ

The Tax Department accepts electronically filed amended returns. Advantages of electronic filing include: faster refunds.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

If you need to change or amend an accepted New York State Income Tax Return for the current or previous Tax Year you need to complete Form IT 201-X. Form IT 201-X is a Form used for the Tax Return and Tax Amendment.

Although the IRS appreciates when taxpayers file an amended return to correct a mistake, they can still assess a penalty or charge interest for not paying the proper amount when the taxes were originally due.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

Yes. Biennial Statements may still be filed online on the Department's website. If the Biennial Statement cannot be filed online, you may request a paper form by contacting the Statement Unit of the Department of State's Division of Corporations. You may contact the Statement Unit by fax at (518) 486-4680 or by E-mail.

File Form 1040-X to amend. Taxpayers must file using Form 1040-X, Amended U.S. Individual Income Tax Return, to correct their tax return. If they are filing an amend 1040 or 1040-SR for 2019, they can now file electronically using commercial tax-filing software.

If you need to change or amend an accepted New York State Income Tax Return for the current or previous Tax Year you need to complete Form IT 201-X. Form IT 201-X is a Form used for the Tax Return and Tax Amendment.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.