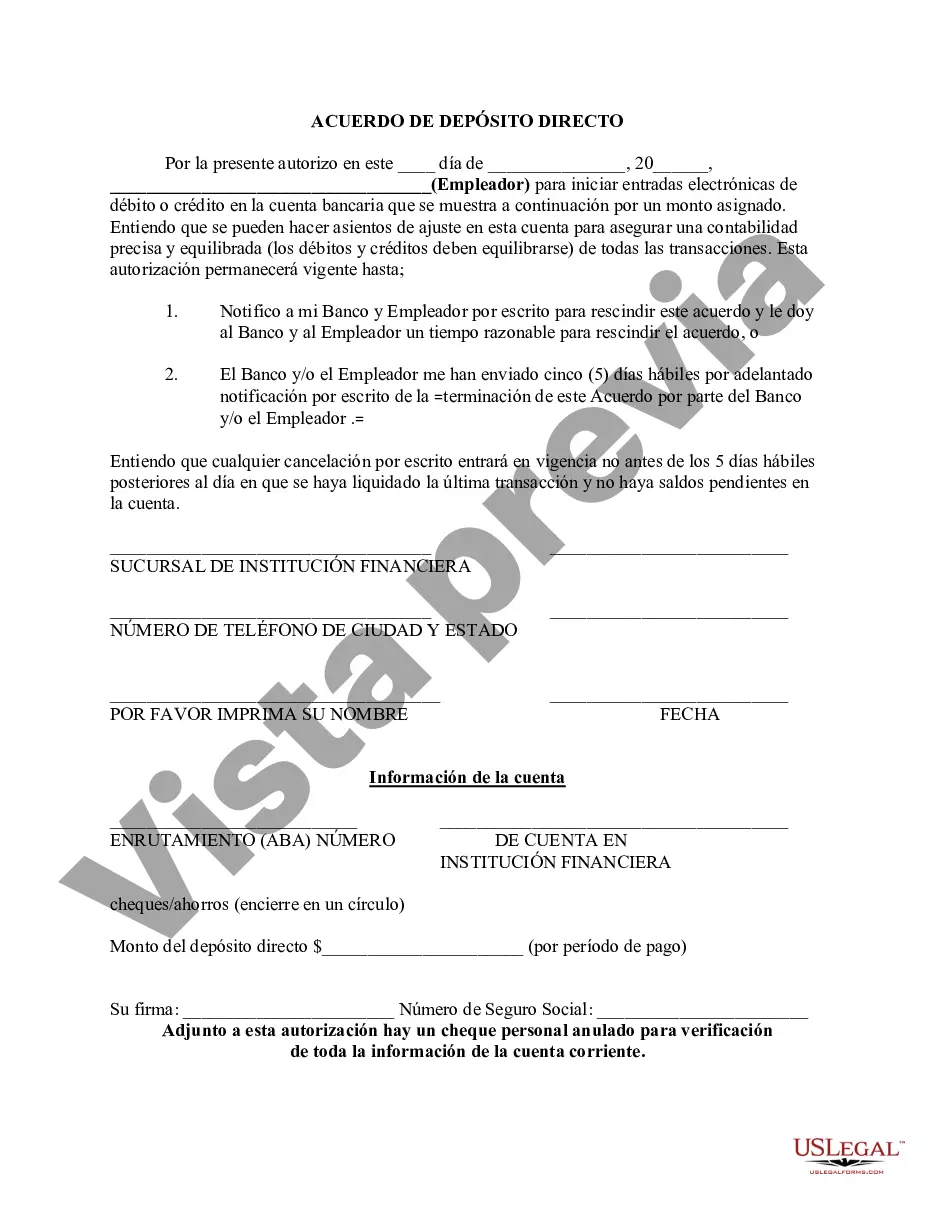

The New York Direct Deposit Form for Bank of America is a document that allows account holders in New York to provide their bank with authorization to deposit funds directly into their Bank of America account. This form eliminates the need for paper checks and is commonly used for receiving regular payments such as paychecks, pensions, government benefits, and refunds. The New York Direct Deposit Form for Bank of America typically requires the account holder to provide their personal information, including their name, address, social security number, contact details, and Bank of America account number. This information is necessary to ensure that the funds are deposited into the correct account. Apart from personal information, the form also requires the account holder to provide the name and address of the company or organization responsible for making the direct deposit, such as an employer, government agency, or pension fund. This ensures that the correct entity initiates the direct deposit process. The New York Direct Deposit Form may contain fields for the account holder's signature and date, signifying their consent to authorize the direct deposit. By signing the form, the account holder acknowledges that they are the owner of the account and have the authority to initiate direct deposits. It is important to note that there may be different types of New York Direct Deposit Forms for Bank of America, depending on the specific purpose of the direct deposit. For example, forms may be categorized based on the type of payment being received, such as payroll, government benefits, or tax refunds. These forms may contain additional fields specific to the type of payment, providing further information related to the payment source. Additionally, there could be separate forms for different account types, such as personal checking accounts, business accounts, or savings accounts. These forms may require account holders to provide additional information relevant to their specific account type. It is essential for New York Bank of America account holders to carefully fill out and submit the appropriate direct deposit form to ensure seamless and timely deposits into their accounts. This process eliminates the need for manual check deposits, providing convenience and security for both the account holder and the depositing entity.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New York Formulario de depósito directo para Bank America - Direct Deposit Form for Bank America

Description

How to fill out New York Formulario De Depósito Directo Para Bank America?

US Legal Forms - one of the largest libraries of lawful kinds in America - gives a wide range of lawful record layouts you are able to download or produce. Using the website, you may get a large number of kinds for enterprise and specific purposes, categorized by classes, claims, or keywords and phrases.You will find the newest variations of kinds much like the New York Direct Deposit Form for Bank America within minutes.

If you already have a monthly subscription, log in and download New York Direct Deposit Form for Bank America from the US Legal Forms catalogue. The Obtain switch will appear on every single type you perspective. You have accessibility to all previously downloaded kinds inside the My Forms tab of your own accounts.

In order to use US Legal Forms the first time, listed below are straightforward instructions to get you began:

- Be sure to have chosen the proper type for the area/area. Click the Preview switch to examine the form`s content. See the type outline to actually have chosen the proper type.

- In case the type doesn`t suit your specifications, use the Look for area on top of the display to get the one that does.

- When you are happy with the form, affirm your decision by clicking on the Purchase now switch. Then, opt for the rates strategy you want and give your credentials to sign up on an accounts.

- Procedure the transaction. Make use of your credit card or PayPal accounts to perform the transaction.

- Select the file format and download the form on your own gadget.

- Make alterations. Complete, revise and produce and indicator the downloaded New York Direct Deposit Form for Bank America.

Every web template you included with your account lacks an expiry time and it is yours forever. So, in order to download or produce another version, just go to the My Forms segment and click on the type you will need.

Obtain access to the New York Direct Deposit Form for Bank America with US Legal Forms, the most substantial catalogue of lawful record layouts. Use a large number of professional and state-certain layouts that fulfill your small business or specific requires and specifications.