Title: New York Promissory Note — Satisfaction and Release: A Comprehensive Guide Introduction: A New York Promissory Note — Satisfaction and Release is a legal document used to acknowledge the fulfillment of a promissory note obligation and release the borrower from any further liability. It serves as a proof of complete debt repayment, providing both parties involved with legal protection and ensuring all obligations have been met in accordance with the promissory note. Keywords: New York, Promissory Note, Satisfaction, Release, legal document, debt repayment Types of New York Promissory Note — Satisfaction and Release: 1. Full Satisfaction and Release: In this type of release, the lender acknowledges the borrower's complete repayment of the promissory note, thereby releasing the borrower from any further financial obligation. It is essential to ensure that all terms and conditions of the promissory note have been faithfully fulfilled before executing a Full Satisfaction and Release. 2. Conditional Satisfaction and Release: Sometimes, certain conditions may be negotiated as part of a promissory note agreement. A Conditional Satisfaction and Release acknowledges that the borrower has fulfilled specific conditions agreed upon by both parties. Once these conditions are satisfied, the lender releases the borrower from any further liability. 3. Partial Satisfaction and Release: If a borrower is unable to fully repay the promissory note, they may negotiate a Partial Satisfaction and Release. This document acknowledges the partial repayment of the debt and provides specific terms for the remaining balance. By signing this release, the borrower is relieved from the portion of the debt that has been repaid. 4. Installment Satisfaction and Release: In cases where the borrower made payments in installments rather than in a lump sum, an Installment Satisfaction and Release could be used to acknowledge the completion of each installment. It enables the lender to release the borrower from the particular obligation related to each installment, while the overall debt balance may still remain. Benefits and Importance: a. Legal Protection: By executing a New York Promissory Note — Satisfaction and Release, both parties establish a legally binding agreement that helps protect their rights and interests. It prevents any potential future disputes regarding the repayment of the promissory note. b. Financial Closure: A Satisfaction and Release provides the borrower with peace of mind, knowing that their debt has been fully or partially repaid, depending on the agreement. It also allows the lender to close the financial transaction, ensuring the debt is properly resolved. c. Credit History Improvement: Completing a Promissory Note — Satisfaction and Release positively impacts the borrower's credit history. Upon the full repayment, the lender may notify credit reporting agencies, thus improving the borrower's credit score and demonstrating their creditworthiness. Conclusion: A New York Promissory Note — Satisfaction and Release is a crucial document that signals the successful completion of a promissory note's terms and conditions. These releases come in various types, including Full, Conditional, Partial, and Installment Satisfaction and Releases, each serving specific circumstances. Executing such a document offers legal protection, brings financial closure, and contributes to improved credit history for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New York Pagaré - Satisfacción y Liberación - Promissory Note - Satisfaction and Release

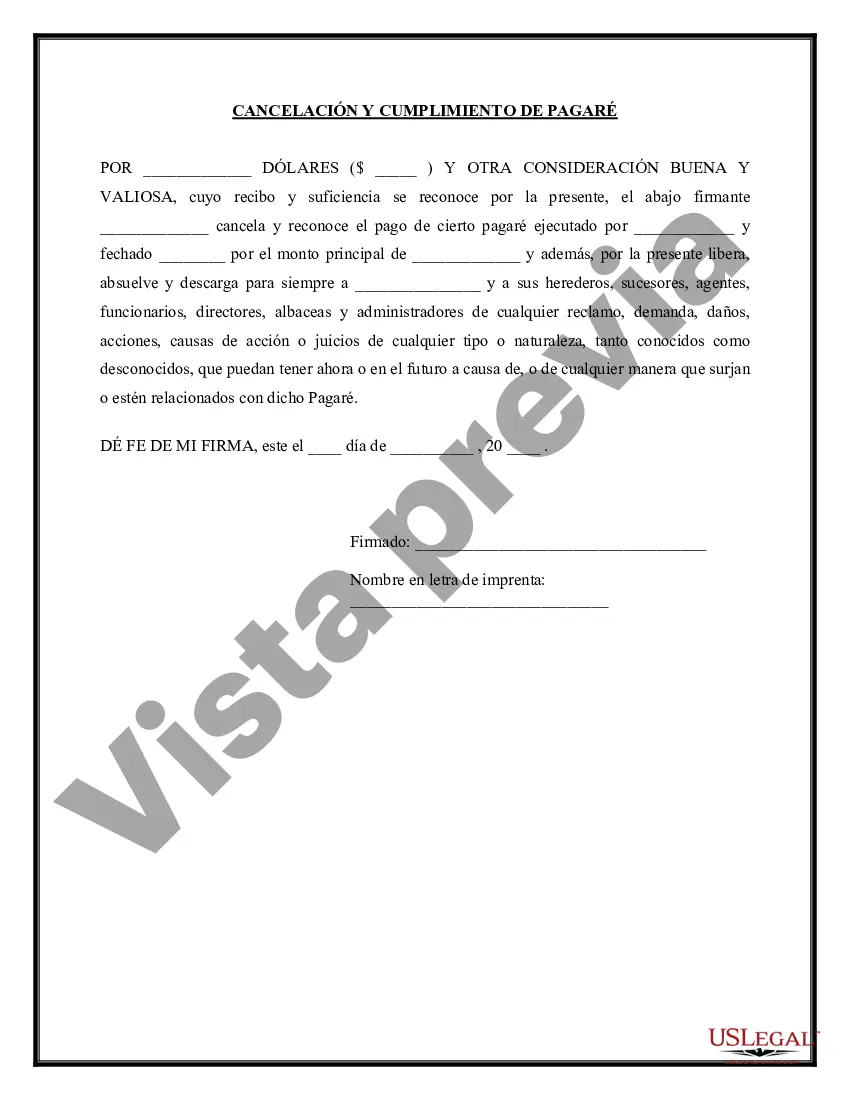

Description

How to fill out New York Pagaré - Satisfacción Y Liberación?

US Legal Forms - among the largest libraries of legitimate varieties in the States - provides a wide range of legitimate papers themes it is possible to obtain or print. Utilizing the internet site, you can get a huge number of varieties for organization and specific functions, sorted by types, claims, or keywords and phrases.You will find the latest versions of varieties like the New York Promissory Note - Satisfaction and Release within minutes.

If you already possess a membership, log in and obtain New York Promissory Note - Satisfaction and Release in the US Legal Forms collection. The Acquire switch can look on each kind you see. You get access to all formerly saved varieties in the My Forms tab of the account.

In order to use US Legal Forms the first time, listed below are easy directions to get you started off:

- Be sure you have selected the best kind for your town/area. Click on the Preview switch to review the form`s content material. Read the kind outline to ensure that you have chosen the appropriate kind.

- When the kind doesn`t fit your demands, make use of the Research field at the top of the display screen to find the one that does.

- Should you be satisfied with the form, affirm your choice by visiting the Purchase now switch. Then, pick the pricing prepare you like and give your accreditations to register to have an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the financial transaction.

- Select the structure and obtain the form on your gadget.

- Make modifications. Fill out, modify and print and signal the saved New York Promissory Note - Satisfaction and Release.

Each and every format you put into your account does not have an expiry time and is also the one you have eternally. So, if you want to obtain or print one more copy, just check out the My Forms portion and click around the kind you want.

Obtain access to the New York Promissory Note - Satisfaction and Release with US Legal Forms, by far the most comprehensive collection of legitimate papers themes. Use a huge number of expert and status-particular themes that satisfy your organization or specific requires and demands.