No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

New York Acceptance of Claim and Report of Past Experience with Debtor

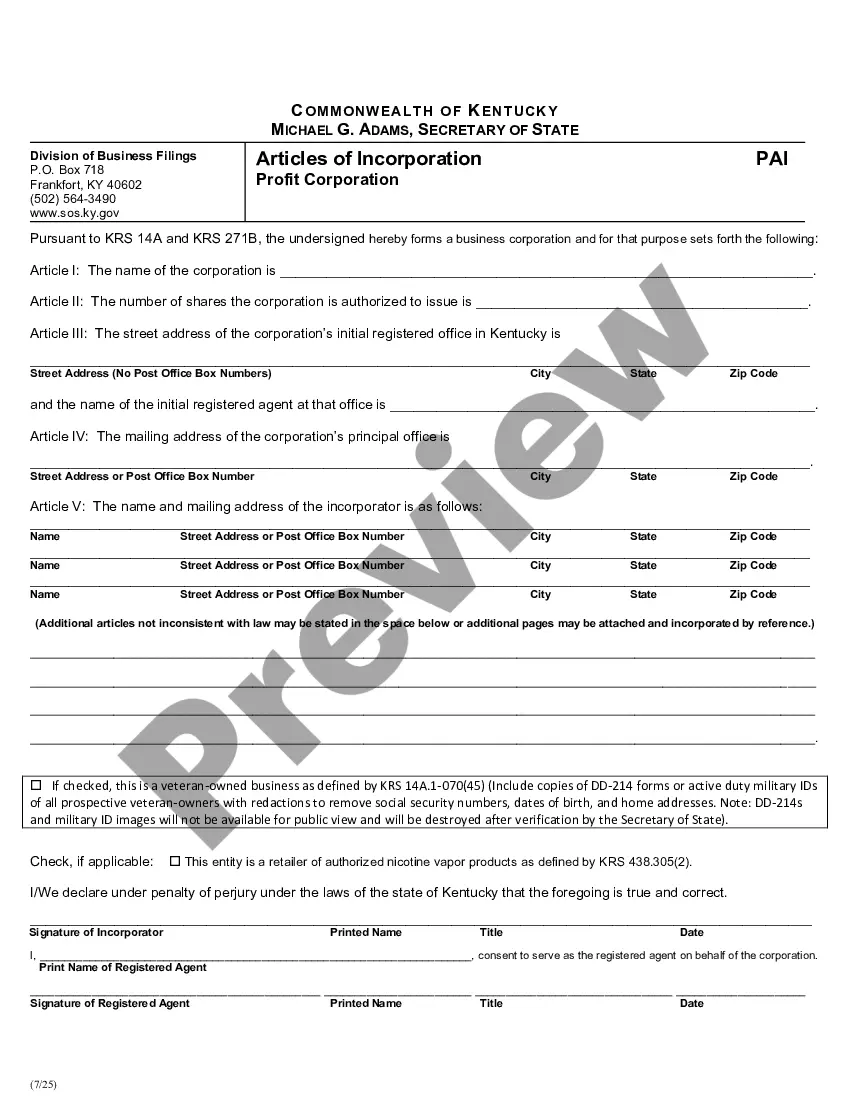

Description

How to fill out Acceptance Of Claim And Report Of Past Experience With Debtor?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad assortment of legal form templates that you can download or create.

By utilizing the website, you will discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent editions of forms like the New York Acceptance of Claim and Report of Past Experience with Debtor in moments.

If you already hold a subscription, Log In and download the New York Acceptance of Claim and Report of Past Experience with Debtor through the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms within the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to view the form’s details.

- Check the form description to confirm you have the accurate form.

- If the form does not meet your needs, utilize the Search bar at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by hitting the Download now button.

- Then, choose your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

To find out if a default judgment has been entered against you in New York, you can check online court records or visit your local courthouse for information. Additionally, reviewing the New York Acceptance of Claim and Report of Past Experience with Debtor can help you understand the implications of any prior claims. If you feel you have been wrongly subjected to a default judgment, platforms like uslegalforms can provide guidance on next steps in addressing this issue.

To secure a default judgment in New York, file a motion with the court if the defendant has not answered your complaint. Ensure you include proof that the defendant was properly served. When pursuing this route, the New York Acceptance of Claim and Report of Past Experience with Debtor provides a framework for your claim, offering clarity on your past dealings. Consider using resources from uslegalforms to streamline this legal procedure.

In New York, you obtain a default judgment by filing the appropriate paperwork with the court after the defendant fails to respond by the deadline. You must provide proof of service to demonstrate that the defendant received the claim. This process aligns with the New York Acceptance of Claim and Report of Past Experience with Debtor, which helps support your case by documenting related experiences. Tools on uslegalforms can help ensure that you complete the required forms accurately.

To vacate a default judgment in New York, you typically need to show a reasonable excuse for not responding to the lawsuit on time, along with a potentially valid defense to the claim. It's important to act promptly, as delays can undermine your case. The New York Acceptance of Claim and Report of Past Experience with Debtor may also provide insights that help demonstrate your position effectively. For assistance, consider using resources like uslegalforms to guide you through the process.

Filing a claim against the state of New York involves submitting a notice of claim to the relevant agency within 90 days of the incident. Ensure you include all necessary information and documentation to support your claim. The New York Acceptance of Claim and Report of Past Experience with Debtor can assist you in compiling your past experiences and presenting your case effectively.

If someone lies in small claims court, it can undermine their credibility, leading to potential legal consequences. The court may investigate claims of perjury, which can carry serious penalties. Maintaining honesty, along with leveraging the New York Acceptance of Claim and Report of Past Experience with Debtor, can reinforce your case and demonstrate your integrity.

Responding to a summons for debt collection in New York requires you to file a written answer with the court by the specified deadline. In your response, clearly contest the debt or assert any defenses you have. Using the New York Acceptance of Claim and Report of Past Experience with Debtor can strengthen your response, helping you outline your financial history and experiences effectively.

To defend yourself in Small Claims Court, prepare your case with facts and documents that support your argument. Practice your presentation and anticipate questions that may arise. Additionally, the New York Acceptance of Claim and Report of Past Experience with Debtor can serve as a helpful resource in articulating your experience and perspective.

When defending yourself in court, it is essential to be calm and respectful. Clearly explain your side, highlight any evidence, and address the claims made against you directly. Using the New York Acceptance of Claim and Report of Past Experience with Debtor can help you organize your thoughts and communicate effectively in your defense.

To write a response to a claim, start by clearly stating your position regarding the allegations. Provide factual information and any evidence that supports your side. Incorporating the New York Acceptance of Claim and Report of Past Experience with Debtor can help structure your response, ensuring that you address the key issues competently.