The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

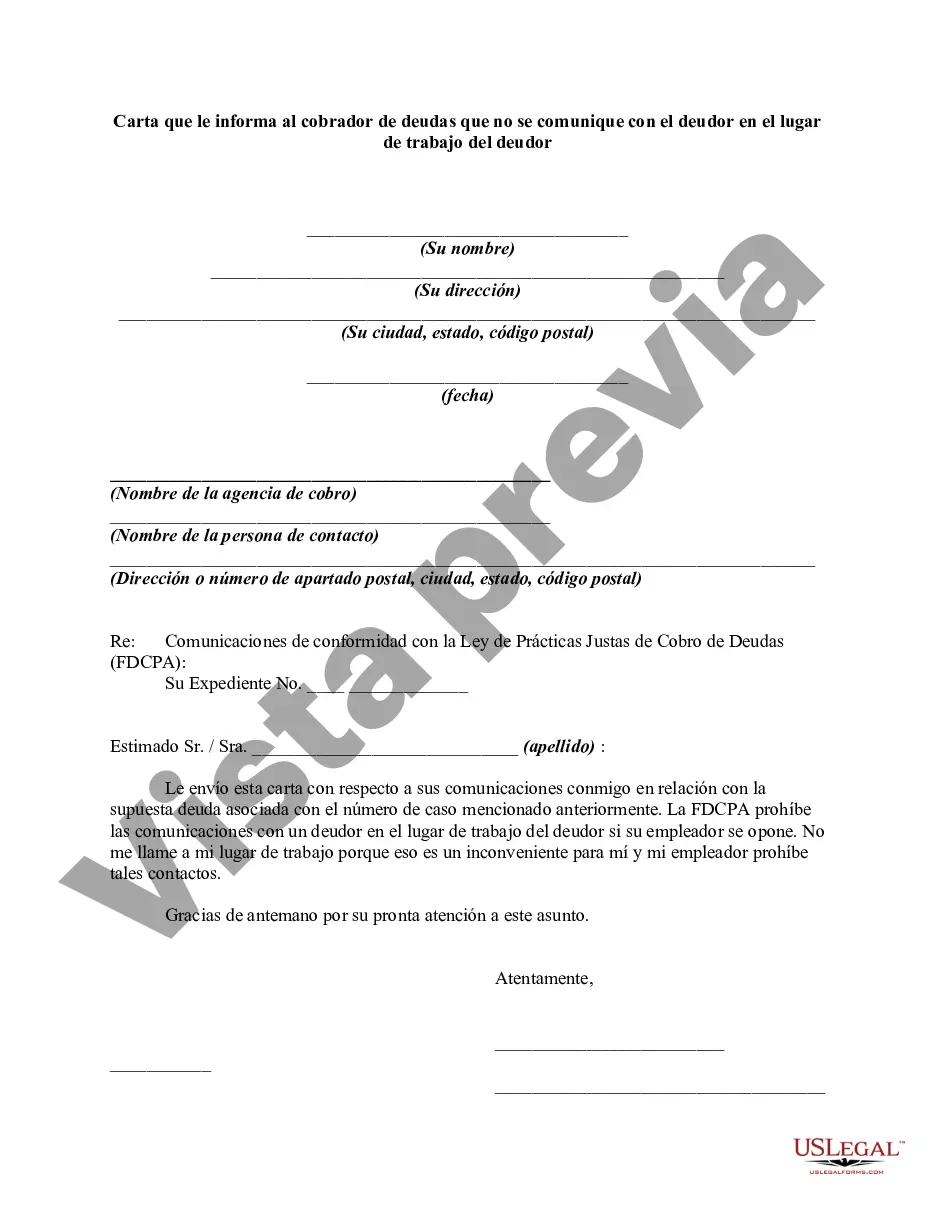

New York Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment A debt collector is required to follow specific guidelines when contacting a debtor to collect a debt. In the state of New York, debtors have the right to request that a debt collector refrain from communicating with them at their place of employment. This letter serves as a formal notification to the debt collector, explicitly requesting them to stop any communication related to the debt at the debtor's workplace. It is essential to point out that there are different types of New York letters informing a debt collector not to communicate with the debtor at their place of employment. Depending on the specific circumstances, some letters may include additional elements such as legal references, personal information, or specific justifications. The content of a New York Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment typically consists of: 1. Date: The letter should begin by clearly indicating the date it is written. 2. Debtor's Information: Clearly state the debtor's full name, address, and contact details. 3. Debt Collector's Information: Identify the debt collector by providing their full name, company name, address, and contact details. 4. Re: Debt Details: Briefly outline the relevant details of the debt, including the creditor's name, the amount owed, and any associated account numbers. 5. Request to Cease Communication at Debtor's Place of Employment: Clearly state the purpose of the letter, informing the debt collector of the debtor's request to cease all communication regarding the debt at their workplace. Emphasize that this request is made based on the debtor's rights under the Fair Debt Collection Practices Act (FD CPA) and New York state laws. 6. Legal References (if applicable): If the debtor wishes to include legal references or relevant laws supporting their request, this information can be included to strengthen their position. For example, references to the FD CPA, the New York General Business Law Article 29-H, or any other relevant state laws can be added. 7. Personal Justifications (if applicable): In some cases, debtors may choose to provide a brief explanation as to why they are requesting the debt collector not to communicate at their workplace. This may include reasons like the potential harm to their employment, privacy concerns, or personal circumstances that make such communication unsuitable. 8. Request for Written Confirmation: Include a section requesting the debt collector to confirm in writing that they have received the letter and will comply with the debtor's request. This confirmation will serve as documentation to prove that the request was made. 9. Thank You and Sincerely: Express gratitude to the debt collector for their attention to this matter. Close the letter with a polite closing, such as "Thank you for your prompt attention to this request. Sincerely," followed by the debtor's name and signature. It is essential to keep copies of the letter and the confirmation of receipt to ensure proper documentation of the debtor's request. Different variations of this letter may exist based on the debtor's specific circumstances, legal advice, or additional information deemed necessary.New York Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment A debt collector is required to follow specific guidelines when contacting a debtor to collect a debt. In the state of New York, debtors have the right to request that a debt collector refrain from communicating with them at their place of employment. This letter serves as a formal notification to the debt collector, explicitly requesting them to stop any communication related to the debt at the debtor's workplace. It is essential to point out that there are different types of New York letters informing a debt collector not to communicate with the debtor at their place of employment. Depending on the specific circumstances, some letters may include additional elements such as legal references, personal information, or specific justifications. The content of a New York Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment typically consists of: 1. Date: The letter should begin by clearly indicating the date it is written. 2. Debtor's Information: Clearly state the debtor's full name, address, and contact details. 3. Debt Collector's Information: Identify the debt collector by providing their full name, company name, address, and contact details. 4. Re: Debt Details: Briefly outline the relevant details of the debt, including the creditor's name, the amount owed, and any associated account numbers. 5. Request to Cease Communication at Debtor's Place of Employment: Clearly state the purpose of the letter, informing the debt collector of the debtor's request to cease all communication regarding the debt at their workplace. Emphasize that this request is made based on the debtor's rights under the Fair Debt Collection Practices Act (FD CPA) and New York state laws. 6. Legal References (if applicable): If the debtor wishes to include legal references or relevant laws supporting their request, this information can be included to strengthen their position. For example, references to the FD CPA, the New York General Business Law Article 29-H, or any other relevant state laws can be added. 7. Personal Justifications (if applicable): In some cases, debtors may choose to provide a brief explanation as to why they are requesting the debt collector not to communicate at their workplace. This may include reasons like the potential harm to their employment, privacy concerns, or personal circumstances that make such communication unsuitable. 8. Request for Written Confirmation: Include a section requesting the debt collector to confirm in writing that they have received the letter and will comply with the debtor's request. This confirmation will serve as documentation to prove that the request was made. 9. Thank You and Sincerely: Express gratitude to the debt collector for their attention to this matter. Close the letter with a polite closing, such as "Thank you for your prompt attention to this request. Sincerely," followed by the debtor's name and signature. It is essential to keep copies of the letter and the confirmation of receipt to ensure proper documentation of the debtor's request. Different variations of this letter may exist based on the debtor's specific circumstances, legal advice, or additional information deemed necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.