This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

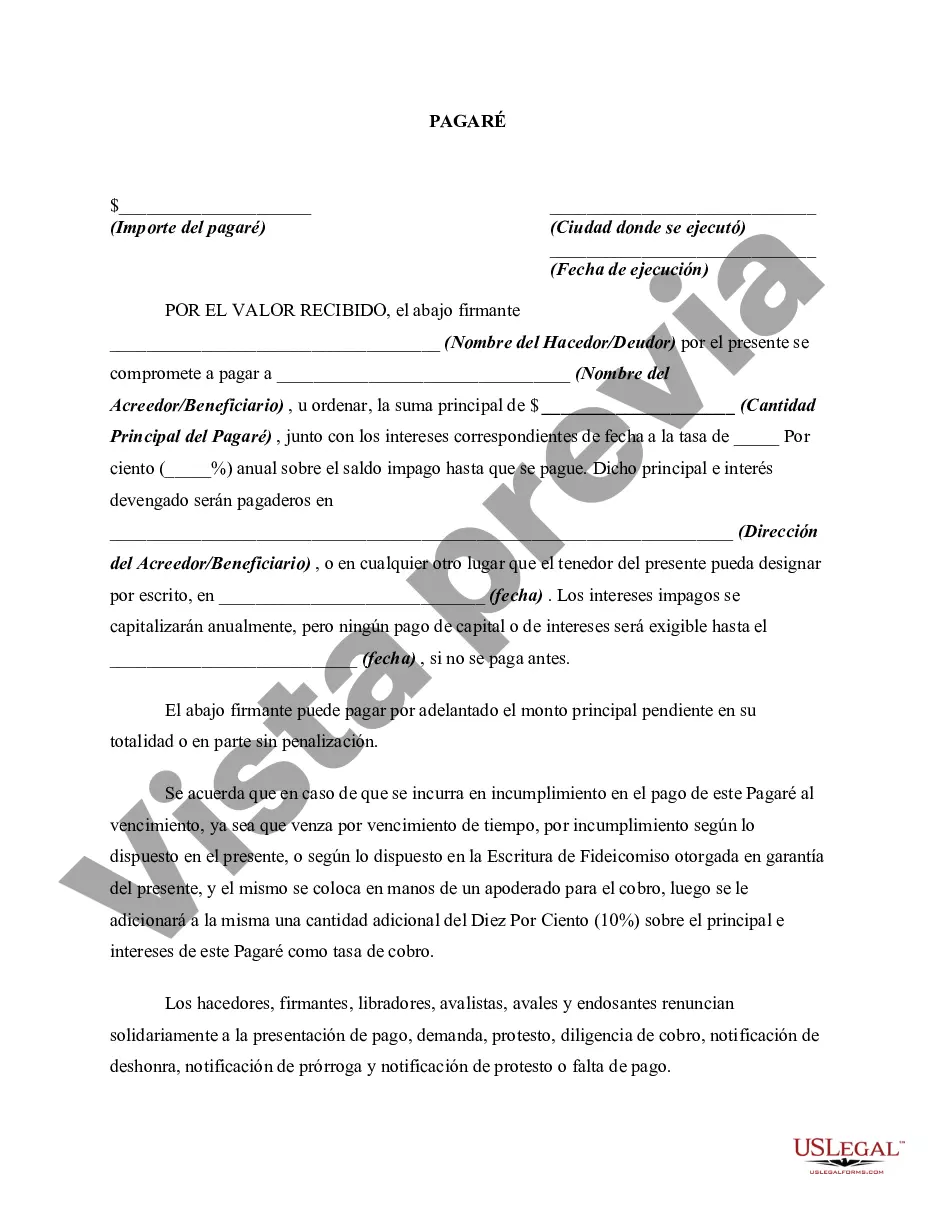

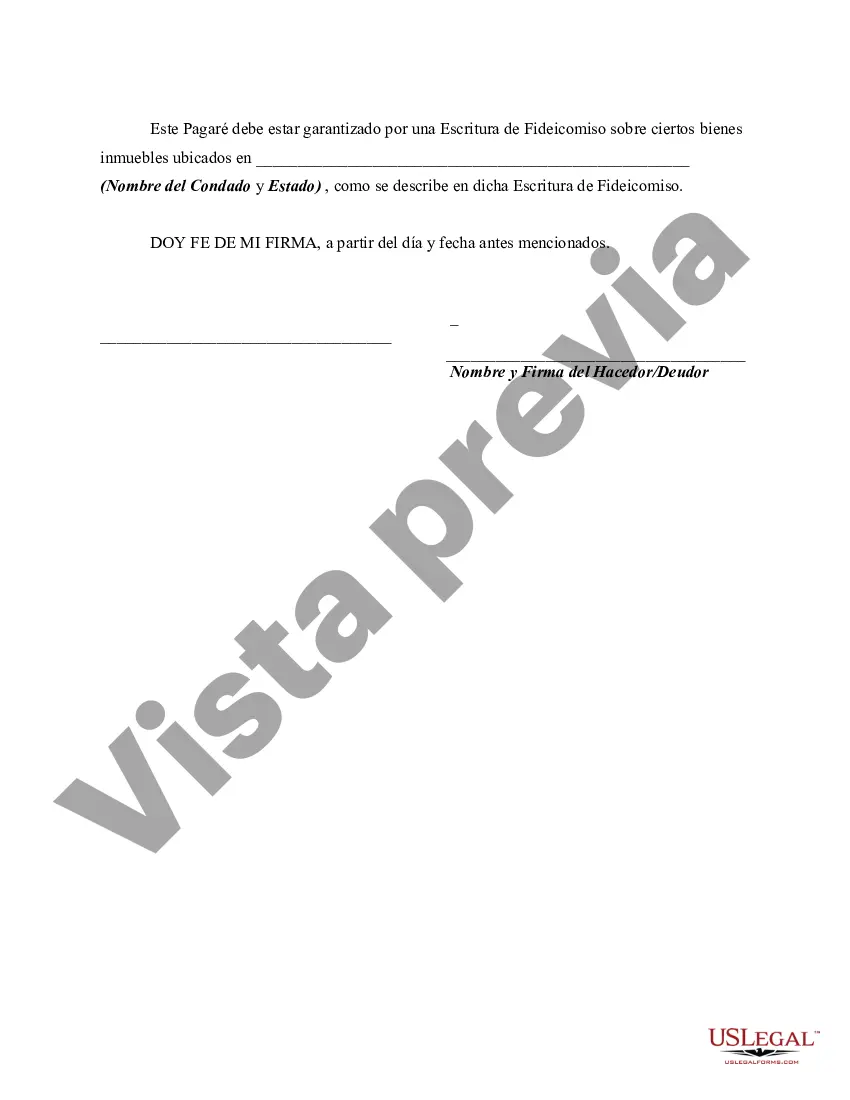

A New York Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of New York. This type of promissory note allows the borrower to defer making any payments until the maturity date of the loan, and the interest on the loan is compounded annually. This type of promissory note is commonly used in various financial transactions such as real estate financing, business loans, or personal loans. It provides a clear framework for both parties involved, ensuring that the borrower understands when the payments will commence and the lender comprehends the terms of interest calculation and repayment. One key advantage of this type of promissory note is that it allows the borrower to use the funds for the agreed-upon purpose without the burden of immediate repayment. This can be particularly beneficial for borrowers who need capital for a specific project and expect a return on investment before initiating payments. It is worth noting that while the primary characteristic of this promissory note is the absence of payments until maturity, the interest is compounded annually. This means that the interest on the loan increases each year, creating a larger repayment obligation for the borrower at maturity. In New York, there may be different types or variations of this promissory note with additional terms and conditions to suit the specific needs of the parties involved. These variations can include adjustable interest rates, prepayment options, or late payment penalties. Each type may have its own name or description, depending on the specific clauses included. It is essential to consult with a qualified attorney or financial professional to ensure that any New York Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually properly reflects the intentions of the borrower and lender and complies with the relevant state laws and regulations. Implementing the appropriate keywords when searching for information or templates online can help in finding specific variations of this promissory note tailored to individual requirements.A New York Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of New York. This type of promissory note allows the borrower to defer making any payments until the maturity date of the loan, and the interest on the loan is compounded annually. This type of promissory note is commonly used in various financial transactions such as real estate financing, business loans, or personal loans. It provides a clear framework for both parties involved, ensuring that the borrower understands when the payments will commence and the lender comprehends the terms of interest calculation and repayment. One key advantage of this type of promissory note is that it allows the borrower to use the funds for the agreed-upon purpose without the burden of immediate repayment. This can be particularly beneficial for borrowers who need capital for a specific project and expect a return on investment before initiating payments. It is worth noting that while the primary characteristic of this promissory note is the absence of payments until maturity, the interest is compounded annually. This means that the interest on the loan increases each year, creating a larger repayment obligation for the borrower at maturity. In New York, there may be different types or variations of this promissory note with additional terms and conditions to suit the specific needs of the parties involved. These variations can include adjustable interest rates, prepayment options, or late payment penalties. Each type may have its own name or description, depending on the specific clauses included. It is essential to consult with a qualified attorney or financial professional to ensure that any New York Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually properly reflects the intentions of the borrower and lender and complies with the relevant state laws and regulations. Implementing the appropriate keywords when searching for information or templates online can help in finding specific variations of this promissory note tailored to individual requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.