This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information

Description

How to fill out Letter To Credit Bureau Requesting The Removal Of Inaccurate Information?

You can allocate time on the web attempting to discover the legal document template that satisfies the state and federal requirements you will require.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can easily download or print the New York Letter to Credit Bureau Requesting the Removal of Incorrect Information from your assistance.

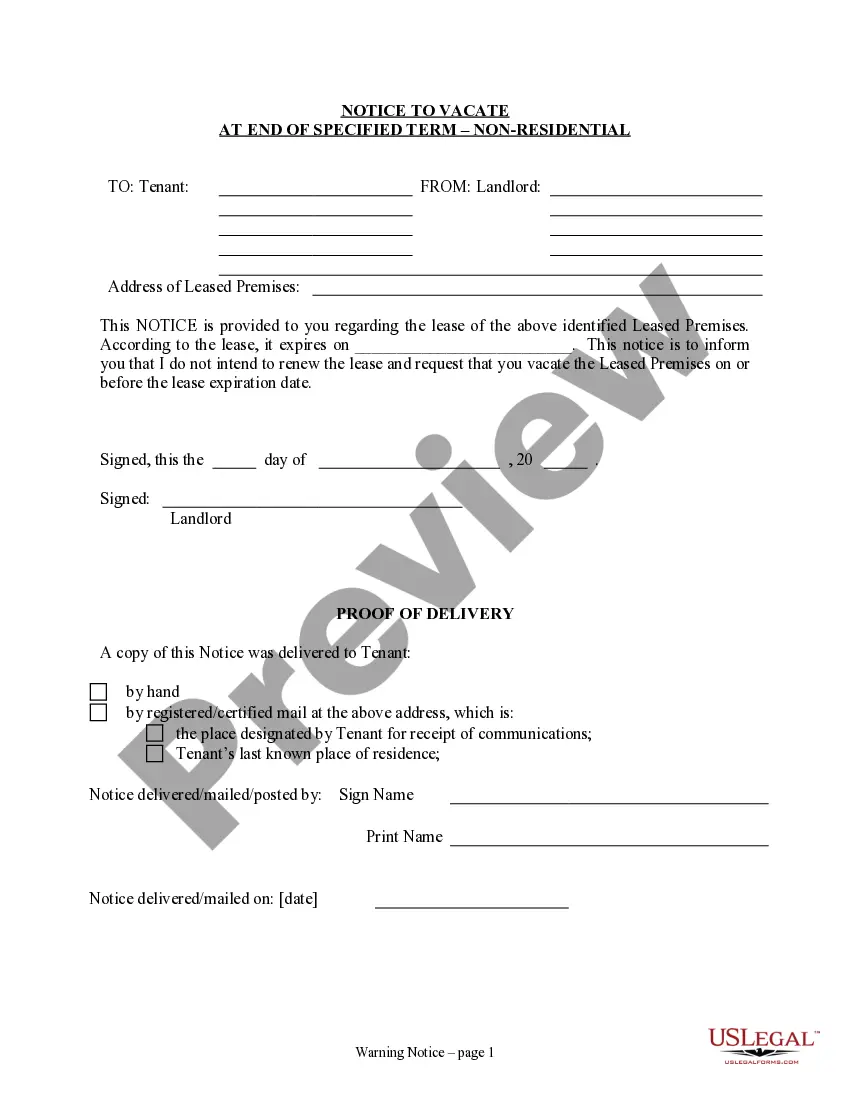

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Obtain button.

- Subsequently, you may complete, modify, print, or sign the New York Letter to Credit Bureau Requesting the Removal of Incorrect Information.

- Every legal document template you purchase is yours forever.

- To retrieve another copy of any acquired document, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure that you have selected the correct document template for your chosen area/city.

- Refer to the document information to confirm you have selected the appropriate form.

Form popularity

FAQ

Removing an incorrect default from your credit report requires you to first verify its accuracy. Review your records to confirm the default is an error. Then, draft a New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information, outlining the discrepancy and including supporting evidence. The credit bureau will investigate your claim and should remove the incorrect default if your evidence is strong.

To remove inaccurate personal information from your credit report, start by collecting your identification and supporting documents. Write a clear and concise New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information, specifying the incorrect details and what the correct information should be. Send the letter to the credit bureau, and they will take action to correct your report.

To remove incorrect personal information from your credit report, you need to identify what is inaccurate. Gather supporting documents that confirm your correct information. Then, use a New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information to formally notify the bureau of the inaccuracies. Your letter should include your correct details and any necessary corrections.

Removing an incorrect collection from your credit report involves a few steps. First, confirm the collection is indeed inaccurate by checking your records. Then, you can submit a New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information, detailing the errors and providing evidence. The credit bureau will review your request and act accordingly to remove the incorrect information.

To fix incorrect information on your credit report, start by reviewing your report thoroughly. Identify any inaccuracies and gather supporting documents. Next, you can draft a New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information, clearly stating your case and including any evidence. This formal request prompts the credit bureau to investigate the inaccuracies.

A 623 letter refers to a written request under Section 623 of the Fair Credit Reporting Act, which allows consumers to dispute information with the original creditor. An example would be a New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information that details the dispute, includes your account information, and requests validation of the debt. This letter acts as a formal way to communicate with your creditor regarding the inaccuracies on your report. You can find templates for this type of letter on platforms like US Legal Forms for ease of use.

Yes, credit dispute letters can be quite effective in resolving inaccuracies on your credit report. When you send a New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information, you prompt the bureau to investigate your claim. If they cannot validate the information, it must be removed from your credit report, improving your credit score. Utilizing a reliable service like US Legal Forms can help you craft a professional letter that meets all legal requirements.

To effectively remove collections from your credit report, start by drafting a New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information. Ensure that you clearly state the inaccuracies and include any supporting documentation. It's important to send this letter by certified mail to provide proof of your request. Following up with the credit bureau can help ensure that they address the issue and update your credit report accordingly.

To write a letter to the credit bureau for removing an inquiry, start by clearly identifying the inquiry in question. Explain why you believe it should be removed, and provide relevant information to support your claim. Utilizing a New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information can assist in crafting a well-structured and persuasive letter.

You cannot erase bad credit history, but you can address inaccuracies that may exist. By filing disputes and requesting corrections through a New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information, you can effectively clean up your credit report. This proactive approach can help pave the way for improved credit standing.