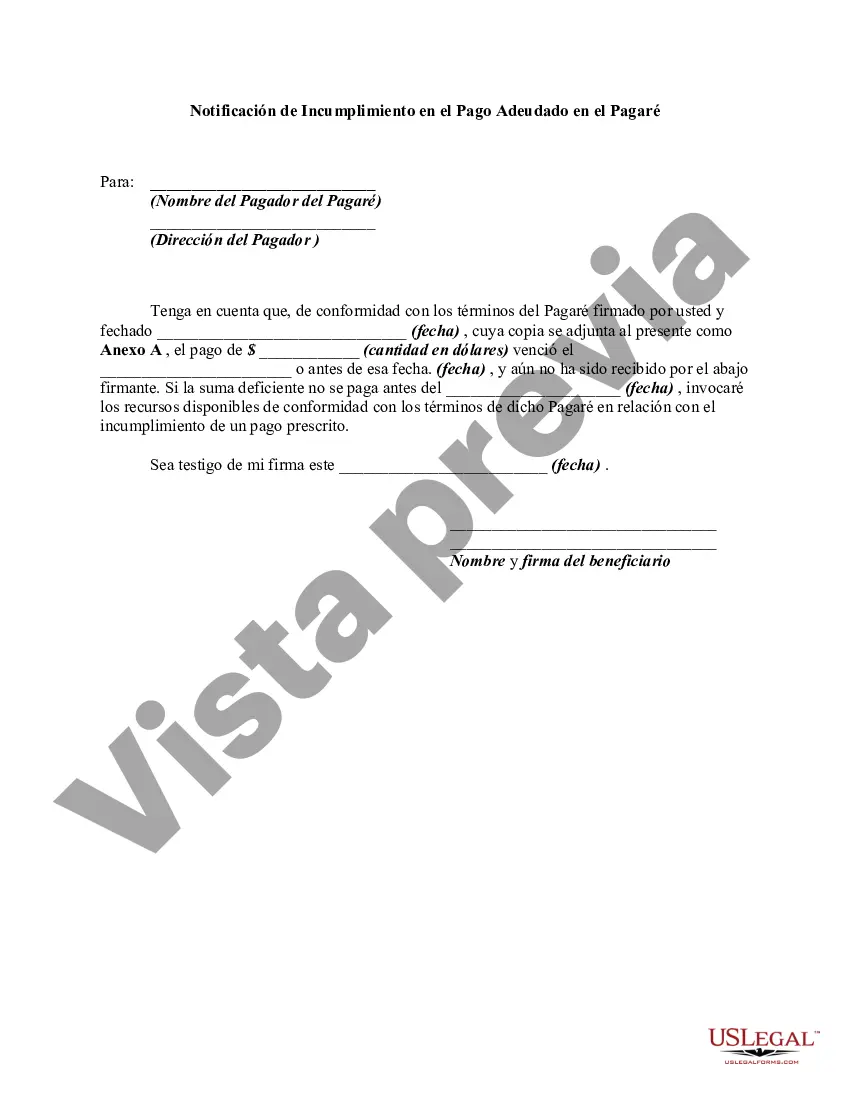

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

A New York Notice of Default in Payment Due on Promissory Note is a legal document that notifies the borrower that they have failed to make the required payments on a promissory note. This notice serves as an official communication from the lender, informing the borrower of their default and the consequences that may follow. In New York, there are several types of Notice of Default in Payment Due on Promissory Note, each with its own purpose and specific requirements. Some common variations include: 1. Notice of Default: This type of notice is issued when the borrower has missed one or more payments on the promissory note. It notifies the borrower of their delinquency and provides them with an opportunity to rectify the situation by making the outstanding payments within a specified timeframe. 2. Notice of Acceleration: If the borrower fails to cure the default within the given period, the lender may issue a Notice of Acceleration. This notice informs the borrower that the entire remaining balance of the loan is now due immediately. It typically includes instructions on how to make the payment or propose an alternative arrangement. 3. Notice of Foreclosure: If the borrower still does not comply with the requirements stated in the Notice of Acceleration, the lender may proceed with initiating foreclosure proceedings. The Notice of Foreclosure officially notifies the borrower that legal action will be taken to sell the property securing the loan to recover the outstanding debt. 4. Notice of Sale: In cases where the lender decides to sell the property through a foreclosure auction, a Notice of Sale is issued to inform the borrower and interested parties about the upcoming sale. This notice provides details about the date, time, and location of the auction, as well as any specific requirements or conditions. It is crucial to note that the content and specific format of a New York Notice of Default in Payment Due on Promissory Note may vary based on the terms outlined in the promissory note and applicable state laws. Therefore, it is advisable to consult an attorney or legal expert to ensure compliance with all necessary requirements and to tailor the notice according to the specific circumstances.A New York Notice of Default in Payment Due on Promissory Note is a legal document that notifies the borrower that they have failed to make the required payments on a promissory note. This notice serves as an official communication from the lender, informing the borrower of their default and the consequences that may follow. In New York, there are several types of Notice of Default in Payment Due on Promissory Note, each with its own purpose and specific requirements. Some common variations include: 1. Notice of Default: This type of notice is issued when the borrower has missed one or more payments on the promissory note. It notifies the borrower of their delinquency and provides them with an opportunity to rectify the situation by making the outstanding payments within a specified timeframe. 2. Notice of Acceleration: If the borrower fails to cure the default within the given period, the lender may issue a Notice of Acceleration. This notice informs the borrower that the entire remaining balance of the loan is now due immediately. It typically includes instructions on how to make the payment or propose an alternative arrangement. 3. Notice of Foreclosure: If the borrower still does not comply with the requirements stated in the Notice of Acceleration, the lender may proceed with initiating foreclosure proceedings. The Notice of Foreclosure officially notifies the borrower that legal action will be taken to sell the property securing the loan to recover the outstanding debt. 4. Notice of Sale: In cases where the lender decides to sell the property through a foreclosure auction, a Notice of Sale is issued to inform the borrower and interested parties about the upcoming sale. This notice provides details about the date, time, and location of the auction, as well as any specific requirements or conditions. It is crucial to note that the content and specific format of a New York Notice of Default in Payment Due on Promissory Note may vary based on the terms outlined in the promissory note and applicable state laws. Therefore, it is advisable to consult an attorney or legal expert to ensure compliance with all necessary requirements and to tailor the notice according to the specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.