A New York Revocable Trust for Real Estate is a legal arrangement that allows an individual or entity, known as the granter, to transfer ownership of their real estate assets into a trust for the purpose of managing and distributing them. This type of trust is revocable, meaning the granter can make changes, amend or even terminate the trust during their lifetime. The main objective of a New York Revocable Trust for Real Estate is to ensure efficient management, protection, and seamless transfer of real estate assets upon the granter's death. By establishing this trust, the granter can maintain control over their real estate and avoid probate, thus allowing for the timely and private distribution of assets. Different types of New York Revocable Trusts for Real Estate may vary depending on specific circumstances and goals. Some common types of New York Revocable Trusts for Real Estate include: 1. Living Trust: A living trust is created and funded during the granter's lifetime, allowing them to transfer their real estate assets into the trust. This type of trust helps avoid probate, provides a smooth transition of assets upon the granter's death, and allows for continued management during incapacity. 2. Joint Revocable Trust: A joint revocable trust is established by a married couple and includes real estate assets jointly owned by them. This ensures seamless transfer and management of the assets in case of one spouse's death. 3. Irrevocable Life Insurance Trust: Though not revocable, this trust can be relevant to real estate planning. The granter transfers ownership of their real estate assets to the trust, and upon their death, the proceeds from a life insurance policy held within the trust can be used to compensate beneficiaries for the loss of real estate. 4. Charitable Remainder Trust: This type of trust allows the granter to transfer real estate assets to the trust while retaining the right to receive income from the property for a specified period of time. At the end of the specified period or the granter's death, the remaining assets are distributed to a designated charity. 5. Qualified Personnel Residence Trust: Specifically designed for personal residences, this trust enables the granter to transfer ownership of their primary or secondary home to the trust while retaining occupancy rights for a predetermined period. This tool can assist in estate tax reduction as the property's value is removed from the granter's estate. In conclusion, a New York Revocable Trust for Real Estate serves as a flexible and efficient estate planning tool for individuals looking to manage, protect, and distribute their real estate assets. It offers various types of trusts, each tailored to specific objectives, providing individuals with peace of mind and control over their assets.

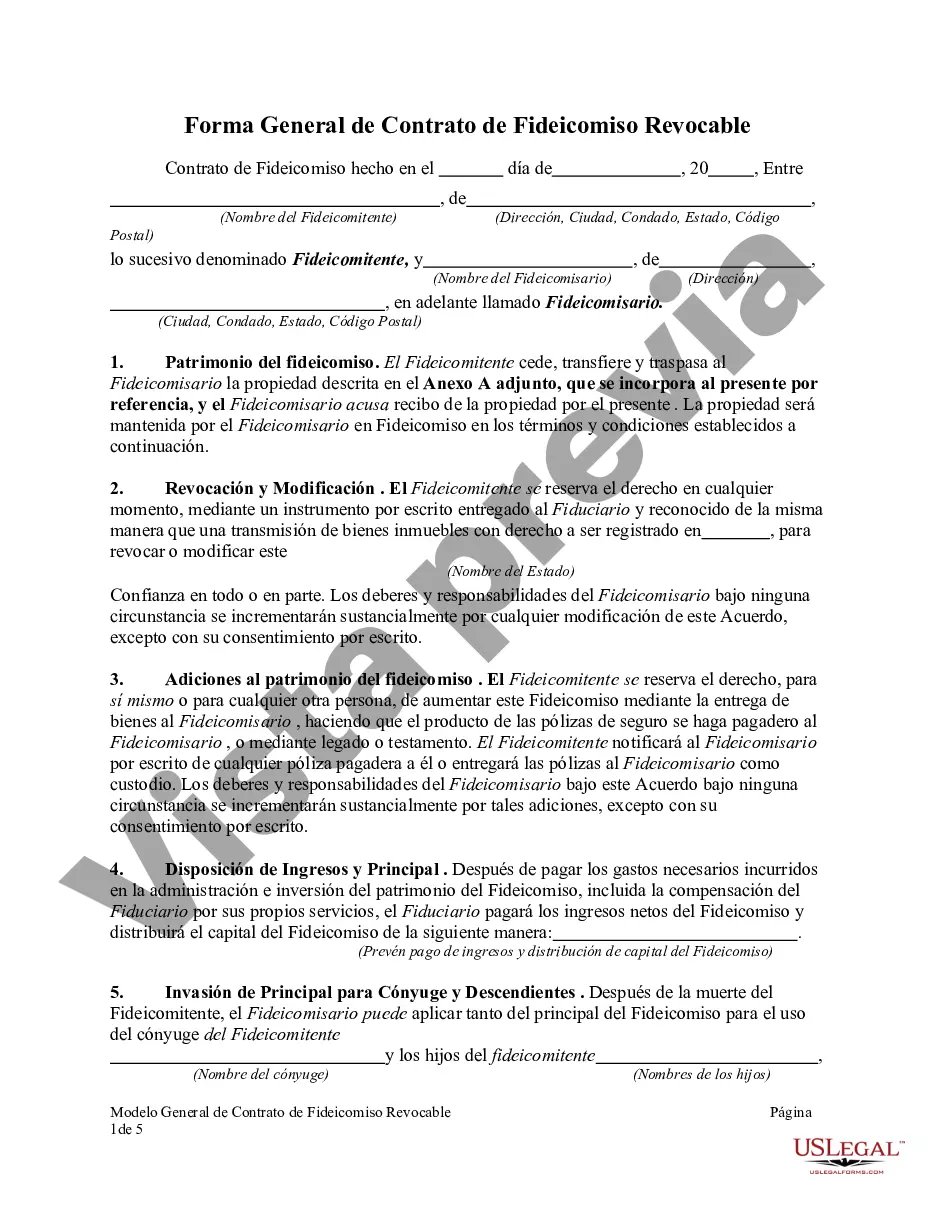

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New York Fideicomiso Revocable para Bienes Raíces - Revocable Trust for Real Estate

Description

How to fill out New York Fideicomiso Revocable Para Bienes Raíces?

US Legal Forms - one of the biggest libraries of legitimate types in the USA - gives a wide range of legitimate document themes it is possible to acquire or print. Making use of the website, you may get a large number of types for company and person uses, categorized by classes, claims, or keywords.You will discover the newest variations of types just like the New York Revocable Trust for Real Estate in seconds.

If you already have a subscription, log in and acquire New York Revocable Trust for Real Estate in the US Legal Forms catalogue. The Acquire option can look on every single type you view. You have access to all earlier delivered electronically types within the My Forms tab of the profile.

In order to use US Legal Forms for the first time, listed here are basic instructions to help you started:

- Make sure you have picked out the right type for your town/area. Go through the Preview option to examine the form`s articles. Browse the type description to ensure that you have selected the appropriate type.

- When the type does not satisfy your specifications, utilize the Research field near the top of the display screen to get the one that does.

- In case you are content with the form, confirm your option by simply clicking the Get now option. Then, opt for the costs prepare you like and supply your qualifications to register to have an profile.

- Approach the transaction. Use your bank card or PayPal profile to accomplish the transaction.

- Select the file format and acquire the form in your gadget.

- Make modifications. Complete, change and print and indication the delivered electronically New York Revocable Trust for Real Estate.

Each template you included with your money lacks an expiry date which is your own forever. So, if you wish to acquire or print one more copy, just go to the My Forms segment and then click on the type you require.

Obtain access to the New York Revocable Trust for Real Estate with US Legal Forms, by far the most comprehensive catalogue of legitimate document themes. Use a large number of skilled and express-certain themes that meet your company or person demands and specifications.