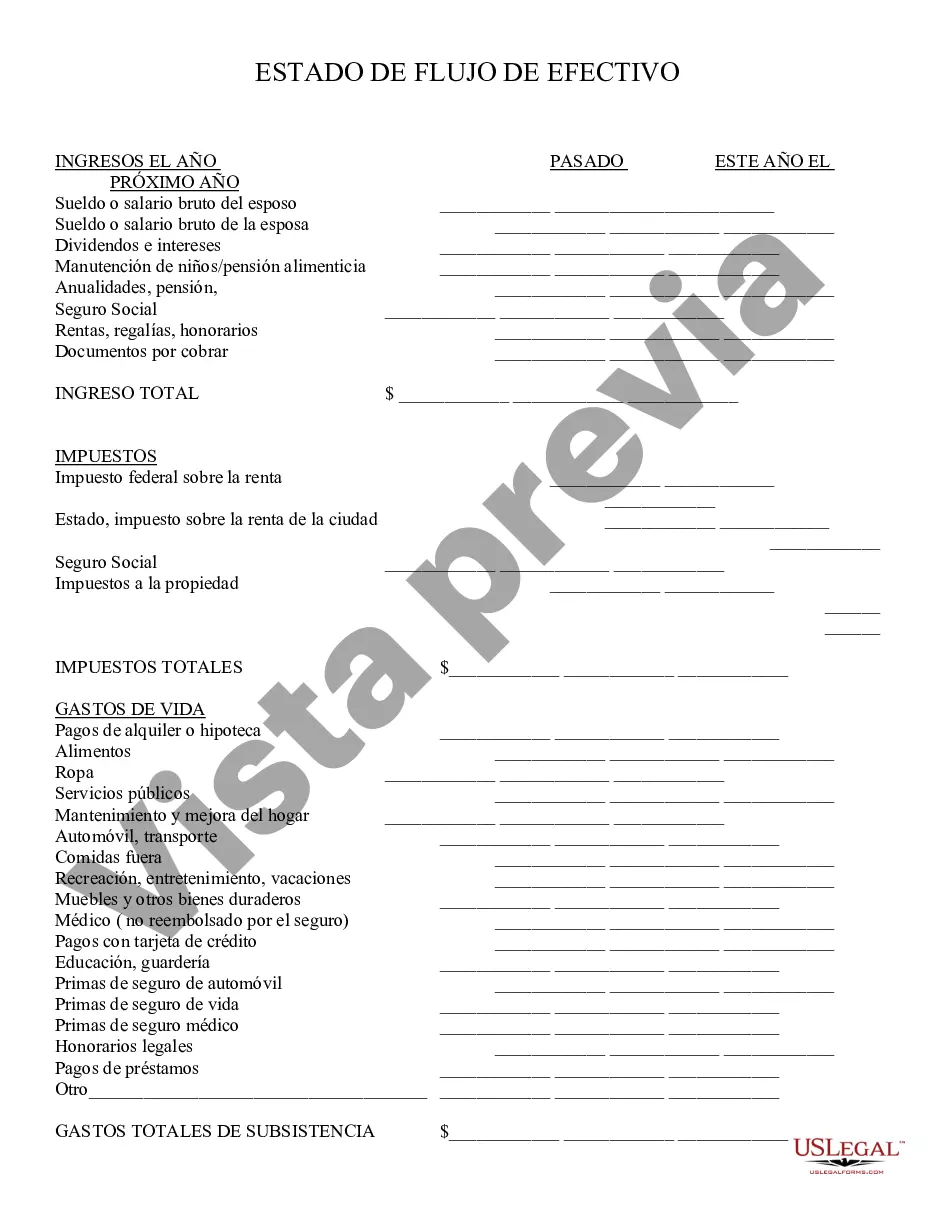

The New York Cash Flow Statement is a financial document that provides a comprehensive record of the incoming and outgoing cash flows of a business or organization operating in the state of New York. It presents a detailed breakdown of cash inflows, outflows, and net changes in cash over a specific accounting period. The primary purpose of the cash flow statement is to help stakeholders, including investors, creditors, and management, to assess the entity's liquidity, financial health, and ability to generate and utilize cash effectively. By analyzing the statement, users can gain insights into the sources and uses of cash, identify trends, and make informed financial decisions. There are three main types of cash flows presented in the New York Cash Flow Statement: 1. Operating Activities: This section outlines the cash flows resulting from the core operations of the business, such as revenue from sales, payments to suppliers and employees, and other operational expenses. It facilitates the evaluation of the entity's ability to generate cash from its primary business activities. 2. Investing Activities: This portion details the cash flows relating to investments in long-term assets or securities. It includes transactions such as the acquisition or sale of property, plant, and equipment, purchases or sales of investments, loans made to other entities, and proceeds from the disposal of fixed assets. The investing activities section helps assess the entity's investment strategy, potential for future growth, and capital allocation decisions. 3. Financing Activities: This segment discloses the cash flows associated with the entity's financing activities, including external funding and liabilities. It encompasses transactions such as obtaining loans, issuing or repurchasing company shares, issuing bonds, and payment of dividends. The financing activities portion helps evaluate the entity's capital structure, debt management, and ability to distribute returns to shareholders. Each of these cash flow categories contributes to the overall cash position of the business, with the net cash flow representing the difference between total cash inflows and outflows. A positive net cash flow indicates an increase in cash reserves, while a negative value implies a decrease. The New York Cash Flow Statement is prepared in accordance with Generally Accepted Accounting Principles (GAAP) and must adhere to the guidelines set by the Financial Accounting Standards Board (FAST). It is an essential component of the financial statements, which also include the balance sheet and income statement, providing a comprehensive overview of a company's financial performance and position.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New York Estado de Flujo de Efectivo - Cash Flow Statement

Description

How to fill out New York Estado De Flujo De Efectivo?

Choosing the right legitimate record format can be quite a have difficulties. Naturally, there are a variety of layouts available online, but how do you find the legitimate develop you will need? Use the US Legal Forms internet site. The services delivers a large number of layouts, for example the New York Cash Flow Statement, that you can use for business and personal demands. Each of the varieties are checked out by experts and satisfy state and federal demands.

If you are currently registered, log in to the account and click on the Down load button to have the New York Cash Flow Statement. Make use of your account to check through the legitimate varieties you might have acquired earlier. Go to the My Forms tab of your account and obtain an additional version in the record you will need.

If you are a new customer of US Legal Forms, here are straightforward guidelines for you to follow:

- Initially, ensure you have selected the correct develop for the area/region. You can look over the shape while using Preview button and study the shape information to guarantee it is the right one for you.

- In case the develop fails to satisfy your needs, use the Seach area to get the correct develop.

- When you are certain that the shape is proper, click the Get now button to have the develop.

- Choose the prices prepare you need and type in the needed info. Make your account and pay for the transaction making use of your PayPal account or credit card.

- Select the file formatting and obtain the legitimate record format to the system.

- Total, modify and print out and sign the acquired New York Cash Flow Statement.

US Legal Forms may be the most significant collection of legitimate varieties for which you will find a variety of record layouts. Use the company to obtain appropriately-created papers that follow condition demands.