When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Title: New York Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Introduction: In this article, we will provide a comprehensive guide to writing a New York letter to a credit card company seeking to reduce monthly payments due to financial challenges. Many individuals in challenging financial situations find it overwhelming to keep up with their credit card payments. In this letter, we will cover the necessary elements, key terms, and the right approach to communicate your difficulties and negotiate for lower payments. Section 1: Understanding New York's Consumer Protection Laws — The specific provisions of New York's consumer protection laws that can be useful when negotiating with credit card companies. — Brief overview of key regulations that can support your request for lower payments, such as the New York State Banking Law and the New York State Consumer Credit Protection Act. Section 2: Preparing your New York Letter — Essential details to include in your letter, such as contact information, account details, and the credit card company's information. — Explanation of your financial difficulties, providing relevant context and documenting any hardships you have faced. — Highlighting your determination and willingness to pay, despite the current challenges. — State your request for lowered payments and specific terms you are proposing, considering your financial constraints. Section 3: Tips for a Successful Letter — Advice on maintaining a respectful and professional tone throughout the letter. — Strategies for demonstrating your commitment to fixing your financial situation, such as mentioning any steps you have taken to cut expenses or increase income. — Encouraging documentation to support your claims, such as medical bills, unemployment records, or pay stubs. — Discussing potential long-term arrangements, such as debt consolidation or credit counseling, if applicable. Section 4: Following up and Tracking Progress — Suggested methods for tracking your correspondence with the credit card company, such as keeping copies of all documents and maintaining a log. — Recommendations for maintaining open lines of communication and regularly following up with the credit card company to ensure your request is being processed. — Understanding your rights as a consumer and knowing when to seek further assistance, such as contacting consumer protection agencies or consulting with legal professionals specializing in debt relief. Section 5: Other Variations of New York Letters — Additional types of letters that may be necessary in the context of financial difficulties, such as requesting a temporary payment suspension, negotiating a settlement, or exploring hardship repayment programs. — Exploring resources available within New York, such as nonprofit credit counseling services or legal aid organizations to support your efforts. Conclusion: Writing a New York letter to a credit card company seeking to lower payments due to financial difficulties requires a strategic and empathetic approach. By understanding the relevant consumer protection laws, preparing a comprehensive letter, maintaining professionalism, and diligently following up, you increase your chances of negotiating a mutually beneficial agreement with your credit card company. Remember, seeking assistance through professional counseling or legal channels can provide valuable guidance tailored to your specific situation.Title: New York Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Introduction: In this article, we will provide a comprehensive guide to writing a New York letter to a credit card company seeking to reduce monthly payments due to financial challenges. Many individuals in challenging financial situations find it overwhelming to keep up with their credit card payments. In this letter, we will cover the necessary elements, key terms, and the right approach to communicate your difficulties and negotiate for lower payments. Section 1: Understanding New York's Consumer Protection Laws — The specific provisions of New York's consumer protection laws that can be useful when negotiating with credit card companies. — Brief overview of key regulations that can support your request for lower payments, such as the New York State Banking Law and the New York State Consumer Credit Protection Act. Section 2: Preparing your New York Letter — Essential details to include in your letter, such as contact information, account details, and the credit card company's information. — Explanation of your financial difficulties, providing relevant context and documenting any hardships you have faced. — Highlighting your determination and willingness to pay, despite the current challenges. — State your request for lowered payments and specific terms you are proposing, considering your financial constraints. Section 3: Tips for a Successful Letter — Advice on maintaining a respectful and professional tone throughout the letter. — Strategies for demonstrating your commitment to fixing your financial situation, such as mentioning any steps you have taken to cut expenses or increase income. — Encouraging documentation to support your claims, such as medical bills, unemployment records, or pay stubs. — Discussing potential long-term arrangements, such as debt consolidation or credit counseling, if applicable. Section 4: Following up and Tracking Progress — Suggested methods for tracking your correspondence with the credit card company, such as keeping copies of all documents and maintaining a log. — Recommendations for maintaining open lines of communication and regularly following up with the credit card company to ensure your request is being processed. — Understanding your rights as a consumer and knowing when to seek further assistance, such as contacting consumer protection agencies or consulting with legal professionals specializing in debt relief. Section 5: Other Variations of New York Letters — Additional types of letters that may be necessary in the context of financial difficulties, such as requesting a temporary payment suspension, negotiating a settlement, or exploring hardship repayment programs. — Exploring resources available within New York, such as nonprofit credit counseling services or legal aid organizations to support your efforts. Conclusion: Writing a New York letter to a credit card company seeking to lower payments due to financial difficulties requires a strategic and empathetic approach. By understanding the relevant consumer protection laws, preparing a comprehensive letter, maintaining professionalism, and diligently following up, you increase your chances of negotiating a mutually beneficial agreement with your credit card company. Remember, seeking assistance through professional counseling or legal channels can provide valuable guidance tailored to your specific situation.

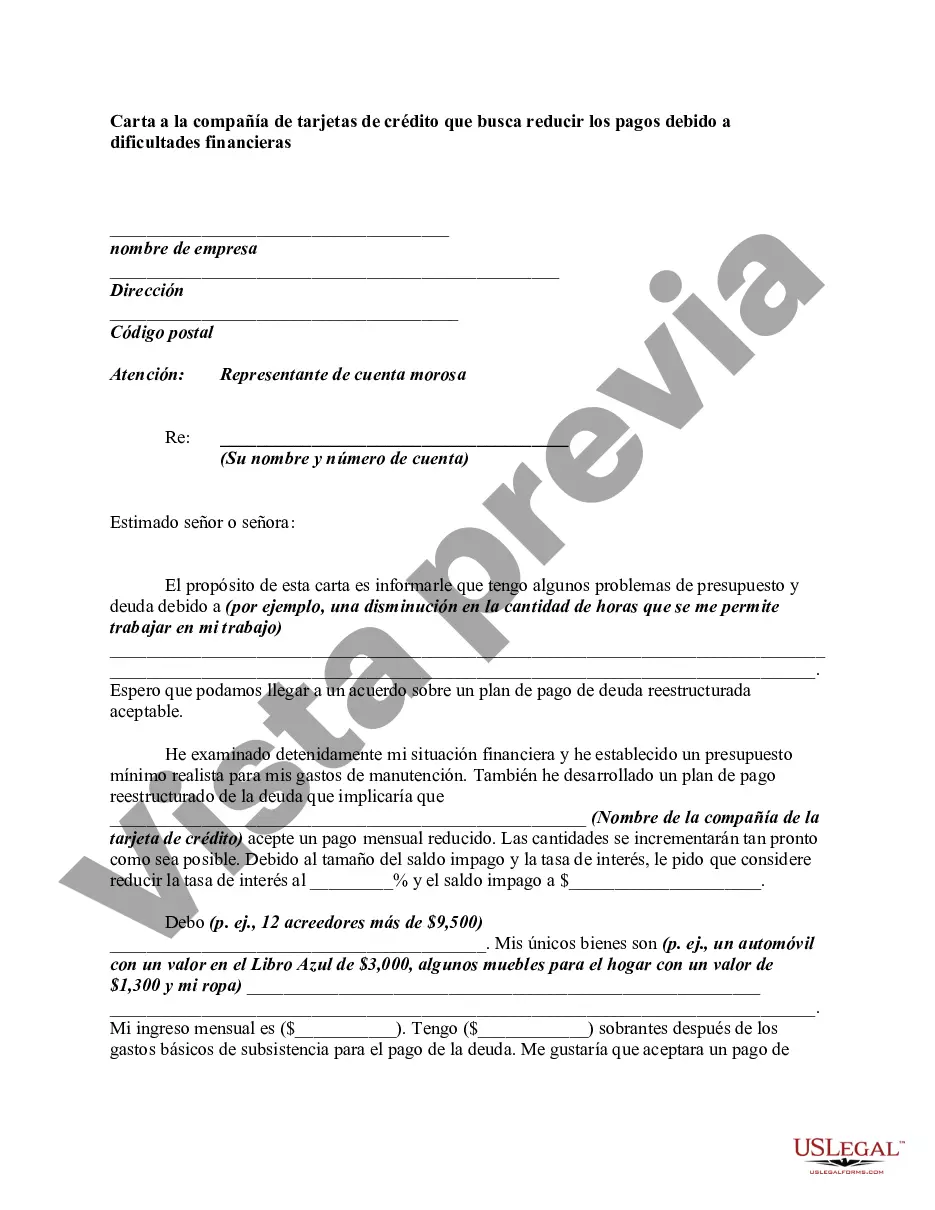

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.