As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Title: Comprehensive Understanding of New York Report of Independent Accountants after Audit of Financial Statements Introduction: The New York Report of Independent Accountants after Audit of Financial Statements is a crucial document that provides an objective evaluation of an organization's financial health and transparency. Prepared by independent accountants, this report is of paramount importance for investors, stakeholders, regulatory bodies, and management to make informed decisions based on reliable financial data. This article aims to delve into the various types of New York Reports of Independent Accountants after Audit of Financial Statements and explore their significance using relevant keywords. 1. Standard Report: The Standard Report is the most common type of New York Report presented by independent accountants. It follows the Generally Accepted Accounting Principles (GAAP) and provides an unqualified opinion on the fairness of the financial statements, without significant concerns about their presentation or compliance with regulations. This report instills confidence among investors and stakeholders, assuring them of the organization's financial accuracy and transparency. 2. Qualified Report: In cases where auditors discover certain limitations or reservations in the financial statements due to inadequate record-keeping, internal control deficiencies, or non-compliance with accounting standards, they issue a Qualified Report. This report highlights the specific areas of concern while still providing an overall opinion that the financial statements are fairly presented except for the aforementioned limitations. It is crucial for organizations to rectify the identified issues to restore investors' trust and improve financial transparency. 3. Adverse Report: When the magnitude of identified issues in the financial statements is significant enough to undermine their overall fairness, auditors may issue an Adverse Report. This report indicates that the financial data presented does not comply with the GAAP, rendering them untrustworthy for decision-making purposes. An Adverse Report signifies a worrisome state of financial affairs, which requires immediate attention from management to rectify the deficiencies and regain stakeholders' confidence. 4. Disclaimer of Opinion: In certain cases, independent accountants may be unable to express an opinion on the financial statements due to substantial uncertainties, insufficient evidence, or significant scope limitations. In such instances, they present a Disclaimer of Opinion. This report aims to highlight the auditors' inability to provide a conclusive verdict, emphasizing the need to address the underlying issues and obtain more reliable financial data for future reporting periods. Conclusion: The New York Report of Independent Accountants after Audit of Financial Statements encompasses various types of reports, each signifying different aspects of an organization's financial state. Whether it is the Standard Report, Qualified Report, Adverse Report, or Disclaimer of Opinion, these reports play a critical role in establishing transparency, bolstering investor confidence, and facilitating informed decision-making. It is crucial for organizations to address any identified issues promptly, ensuring accuracy, compliance, and financial well-being.Title: Comprehensive Understanding of New York Report of Independent Accountants after Audit of Financial Statements Introduction: The New York Report of Independent Accountants after Audit of Financial Statements is a crucial document that provides an objective evaluation of an organization's financial health and transparency. Prepared by independent accountants, this report is of paramount importance for investors, stakeholders, regulatory bodies, and management to make informed decisions based on reliable financial data. This article aims to delve into the various types of New York Reports of Independent Accountants after Audit of Financial Statements and explore their significance using relevant keywords. 1. Standard Report: The Standard Report is the most common type of New York Report presented by independent accountants. It follows the Generally Accepted Accounting Principles (GAAP) and provides an unqualified opinion on the fairness of the financial statements, without significant concerns about their presentation or compliance with regulations. This report instills confidence among investors and stakeholders, assuring them of the organization's financial accuracy and transparency. 2. Qualified Report: In cases where auditors discover certain limitations or reservations in the financial statements due to inadequate record-keeping, internal control deficiencies, or non-compliance with accounting standards, they issue a Qualified Report. This report highlights the specific areas of concern while still providing an overall opinion that the financial statements are fairly presented except for the aforementioned limitations. It is crucial for organizations to rectify the identified issues to restore investors' trust and improve financial transparency. 3. Adverse Report: When the magnitude of identified issues in the financial statements is significant enough to undermine their overall fairness, auditors may issue an Adverse Report. This report indicates that the financial data presented does not comply with the GAAP, rendering them untrustworthy for decision-making purposes. An Adverse Report signifies a worrisome state of financial affairs, which requires immediate attention from management to rectify the deficiencies and regain stakeholders' confidence. 4. Disclaimer of Opinion: In certain cases, independent accountants may be unable to express an opinion on the financial statements due to substantial uncertainties, insufficient evidence, or significant scope limitations. In such instances, they present a Disclaimer of Opinion. This report aims to highlight the auditors' inability to provide a conclusive verdict, emphasizing the need to address the underlying issues and obtain more reliable financial data for future reporting periods. Conclusion: The New York Report of Independent Accountants after Audit of Financial Statements encompasses various types of reports, each signifying different aspects of an organization's financial state. Whether it is the Standard Report, Qualified Report, Adverse Report, or Disclaimer of Opinion, these reports play a critical role in establishing transparency, bolstering investor confidence, and facilitating informed decision-making. It is crucial for organizations to address any identified issues promptly, ensuring accuracy, compliance, and financial well-being.

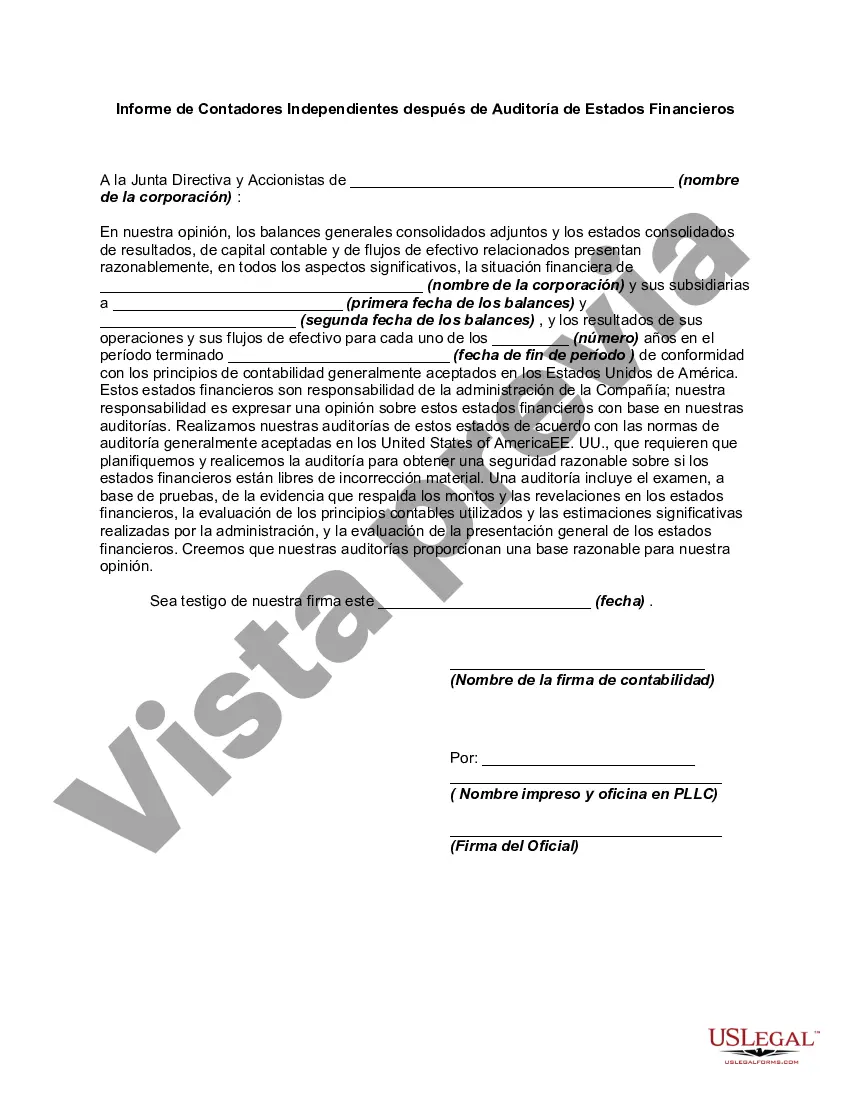

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.