New York Aging of Accounts Receivable is a financial process that involves categorizing and analyzing outstanding invoices or receivables according to their age to assess the company's cash flow and monitor the effectiveness of credit collection efforts. It allows businesses in New York to evaluate the timeliness of customer payments, identify any potential delinquencies, and take appropriate actions to improve cash flow. The different types of New York Aging of Accounts Receivable include: 1. Current: This category refers to invoices or receivables that are still within the agreed payment terms and have not yet become overdue. 2. 30 Days: This classification includes invoices or receivables that are past their due date by up to 30 days but still within a reasonable collection period. 3. 60 Days: This category comprises invoices or receivables that are past their due date by 31 to 60 days, indicating a lengthier delay in payment. 4. 90 Days: This classification includes invoices or receivables that are past their due date by 61 to 90 days, suggesting a substantial overdue period requiring immediate attention. 5. Over 90 Days: This category represents invoices or receivables that are past their due date by more than 90 days, indicating a significant delinquency and potential risk of non-payment. Businesses in New York utilize the Aging of Accounts Receivable to track the progression of outstanding balances and identify any potential discrepancies or patterns related to late payments. By categorizing invoices according to their age, businesses can develop effective strategies to minimize the risk of non-payment, improve cash flow, and maintain a healthy financial position. Moreover, New York Aging of Accounts Receivable helps businesses identify customers with consistent delayed payments, enabling them to offer targeted solutions such as revised payment terms, installment plans, or more proactive collection efforts. Overall, New York Aging of Accounts Receivable provides businesses with a valuable financial tool to manage and optimize cash flow by closely monitoring the timeliness of customer payments, identifying potential risks, and taking appropriate actions to ensure a healthy account receivable balance.

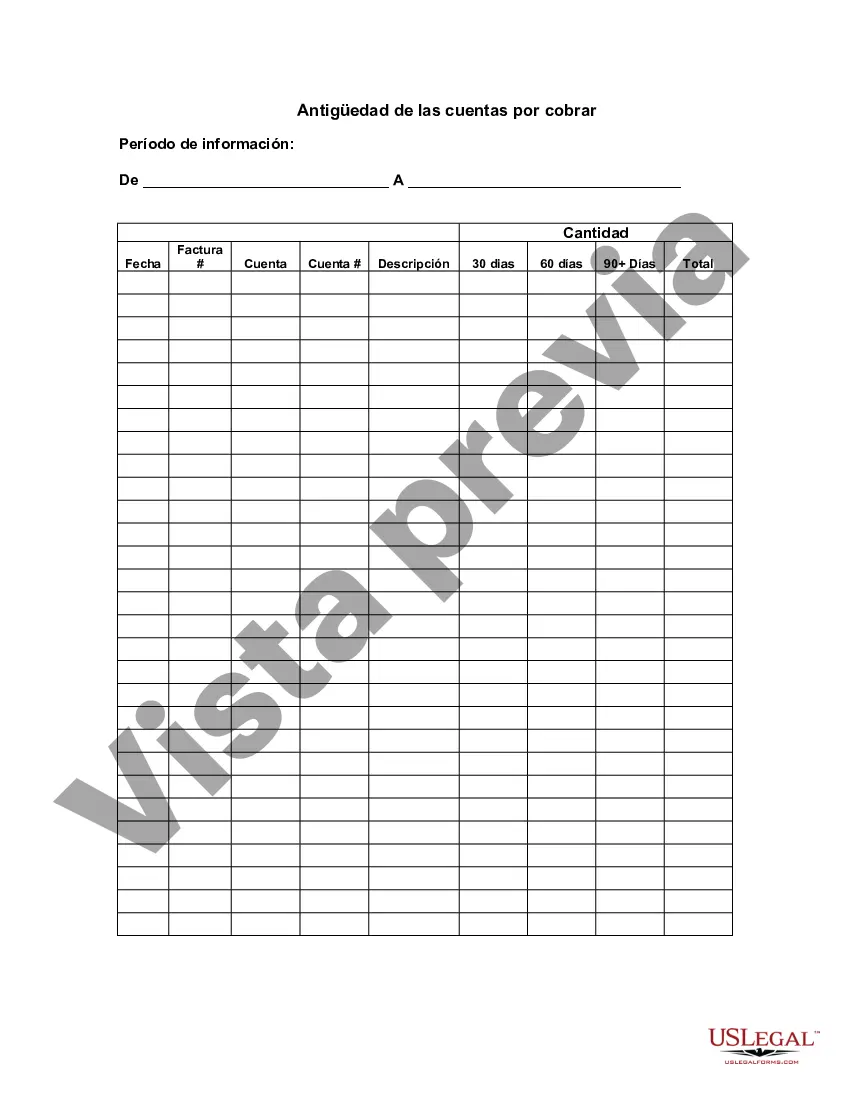

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New York Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out New York Antigüedad De Las Cuentas Por Cobrar?

US Legal Forms - one of the biggest libraries of legal forms in the USA - offers a wide array of legal document themes you are able to obtain or produce. While using internet site, you can get a large number of forms for enterprise and individual functions, sorted by classes, suggests, or keywords.You can get the most recent versions of forms much like the New York Aging of Accounts Receivable in seconds.

If you already have a monthly subscription, log in and obtain New York Aging of Accounts Receivable from the US Legal Forms catalogue. The Obtain button will show up on each and every develop you view. You get access to all in the past acquired forms in the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, listed here are easy directions to help you started out:

- Be sure to have chosen the best develop for your city/state. Click the Review button to examine the form`s articles. See the develop outline to actually have chosen the proper develop.

- In the event the develop doesn`t match your specifications, utilize the Search industry at the top of the screen to discover the the one that does.

- In case you are happy with the form, validate your decision by simply clicking the Purchase now button. Then, select the prices prepare you want and provide your accreditations to register to have an accounts.

- Method the purchase. Utilize your bank card or PayPal accounts to perform the purchase.

- Select the formatting and obtain the form on your own product.

- Make alterations. Fill out, change and produce and sign the acquired New York Aging of Accounts Receivable.

Each template you included with your account does not have an expiry date which is your own property permanently. So, in order to obtain or produce an additional duplicate, just go to the My Forms section and then click around the develop you need.

Obtain access to the New York Aging of Accounts Receivable with US Legal Forms, one of the most comprehensive catalogue of legal document themes. Use a large number of professional and status-specific themes that satisfy your small business or individual needs and specifications.