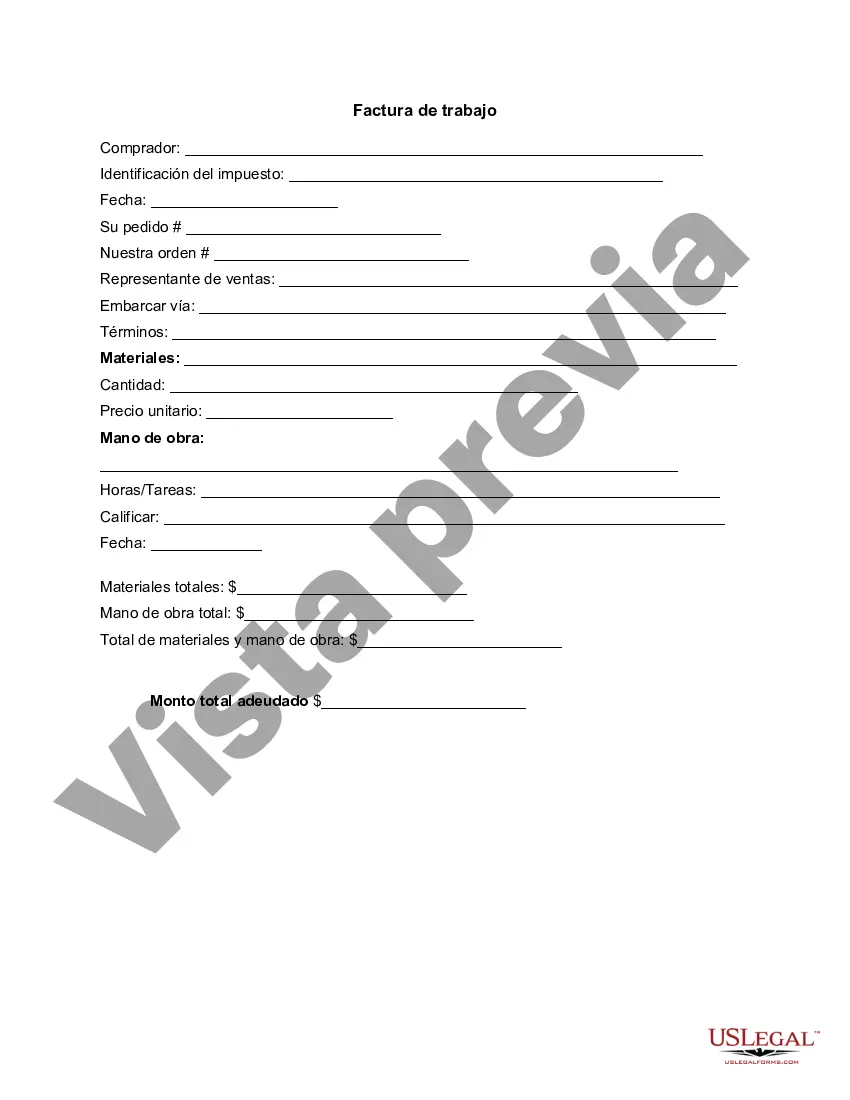

A New York Invoice Template for Consultant is a professionally designed document that enables consultants operating in New York state to bill their clients for their services. This template follows the specific guidelines and requirements provided by the New York Department of Taxation and Finance. The New York Invoice Template for Consultant usually includes the following key elements: 1. Header: It typically consists of your consultancy business name, logo, and contact details like address, phone number, and email. 2. Consultant and Client Information: This section includes the name, address, and contact information of both the consultant and the client. It is essential to provide accurate details to maintain clear communication and facilitate prompt payment. 3. Invoice Details: This part of the template provides a space to input specific invoice information. It includes the unique invoice number, date of issue, payment due date, and terms of payment. Additionally, it may also include a reference or project number if applicable. 4. Itemized Services: This section enables the consultant to itemize the services provided. Each item should be described in detail, including the date, description of the service, the hours worked, the hourly rate or fixed fee agreed upon, and the total amount for each item. 5. Total Amount Due: This section calculates the total amount due, which includes the sum of all the services provided. It may include any applicable taxes as per the New York state tax regulations. 6. Payment Instructions: This part of the template provides information on how the client can make the payment, such as the preferred payment method, bank account details, or other payment options like online platforms. Types of New York Invoice Template for Consultant: 1. Hourly Rate Invoice Template: This invoice template suits consultants who charge their clients based on an hourly rate for their services. It enables them to accurately calculate the total amount owed by multiplying the hours worked by the agreed-upon hourly rate. 2. Fixed Fee Invoice Template: Some consultants prefer to charge clients a fixed fee for a specific project or service. This type of invoice template allows consultants to specify the agreed-upon amount for the project and include any additional charges or expenses incurred. 3. Retainer Invoice Template: For consultants who work on retainer basis, this invoice template is suitable. It allows consultants to outline the retainer agreement, including the duration, fee structure, and any additional charges. 4. Recurring Invoice Template: This template is useful for consultants who provide ongoing services on a recurring basis, such as monthly retainers or subscription-based services. It automates the invoicing process for consistent payment cycles. Using a New York Invoice Template for Consultant ensures that consultants adhere to the specific invoicing requirements set by the state. It promotes professionalism, helps maintain accurate financial records, and encourages timely payments from clients.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New York Plantilla de factura para consultor - Invoice Template for Consultant

Description

How to fill out New York Plantilla De Factura Para Consultor?

US Legal Forms - one of many biggest libraries of authorized kinds in America - delivers a wide range of authorized record web templates it is possible to acquire or print out. Making use of the internet site, you can find 1000s of kinds for company and personal functions, categorized by classes, suggests, or keywords.You will find the newest variations of kinds like the New York Invoice Template for Consultant within minutes.

If you have a registration, log in and acquire New York Invoice Template for Consultant from the US Legal Forms collection. The Obtain button will show up on each and every develop you view. You get access to all in the past delivered electronically kinds from the My Forms tab of your respective bank account.

If you would like use US Legal Forms the very first time, listed here are straightforward instructions to obtain started off:

- Make sure you have selected the right develop for the metropolis/region. Click on the Review button to check the form`s information. See the develop outline to ensure that you have chosen the appropriate develop.

- When the develop doesn`t satisfy your requirements, utilize the Look for industry at the top of the monitor to find the the one that does.

- If you are pleased with the form, verify your choice by visiting the Buy now button. Then, opt for the prices strategy you prefer and provide your references to register for an bank account.

- Process the deal. Make use of your bank card or PayPal bank account to finish the deal.

- Select the formatting and acquire the form on your own system.

- Make alterations. Fill up, revise and print out and indication the delivered electronically New York Invoice Template for Consultant.

Every format you put into your account lacks an expiration particular date and is also yours forever. So, if you want to acquire or print out yet another duplicate, just check out the My Forms area and click on on the develop you need.

Obtain access to the New York Invoice Template for Consultant with US Legal Forms, probably the most comprehensive collection of authorized record web templates. Use 1000s of specialist and condition-specific web templates that meet your company or personal requires and requirements.