The New York Contract for the International Sale of Goods with Purchase Money Security Interest is a legal document that governs the sale and purchase of goods with the inclusion of a purchase money security interest. This contract is based on the United Nations Convention on Contracts for the International Sale of Goods (CSG), which provides a harmonized framework for international trade. When entering into a New York Contract for the International Sale of Goods with Purchase Money Security Interest, it is essential to understand the key elements and types of provisions included within the agreement. Here are some relevant keywords that can shed light on different aspects of this contractual arrangement: 1. Purchase Money Security Interest (PSI): This term refers to a lender's security interest in the goods that the buyer acquires through financing. The PSI allows the lender to have a superior claim to the goods in case of default by the buyer. 2. Goods: Goods encompass any tangible, movable property that is the subject of the contract, such as products, machinery, or equipment. This term distinguishes them from services or intangible assets. 3. International Sale of Goods: The contract applies to the sale of goods between parties located in different countries, where the principles of international trade law, as set forth in the CSG, govern the contractual relationship. 4. New York Governing Law: This refers to the choice of the New York legal system to govern the rights and obligations of the parties involved. By selecting New York, the contract adopts the relevant legislation and precedents established within the state for dispute resolution. 5. Jurisdiction: Jurisdiction determines which court or courts have the authority to hear and resolve any disputes that may arise under the contract. Parties must agree on the appropriate jurisdiction, such as New York state or a specific court within it. 6. CSG Compliance: The New York Contract for International Sale of Goods with Purchase Money Security Interest should adhere to the principles outlined by the CSG. The CSG provides a uniform framework for the formation of contracts, rights, and obligations of the parties, and remedies in case of breach. 7. Security Interest Perfection: This refers to the process of establishing and securing the security interest in the goods, making it enforceable against third parties. The contract might include provisions specifying the necessary steps for perfecting the security interest, such as filing a financing statement or obtaining a specific type of security document. 8. Default and Remedies: The contract will outline the consequences in case of default by either party, including breach of payment obligations or failure to deliver the goods. It will also specify the available remedies for the non-defaulting party, such as the right to demand specific performance, terminate the contract, or pursue financial compensation. In conclusion, the New York Contract for the International Sale of Goods with Purchase Money Security Interest is a legal instrument that facilitates international trade by ensuring clarity and protection for the parties involved. It is important to understand the provisions related to purchase money security interests, governing law, jurisdiction, and compliance with the CSG when entering into such agreements.

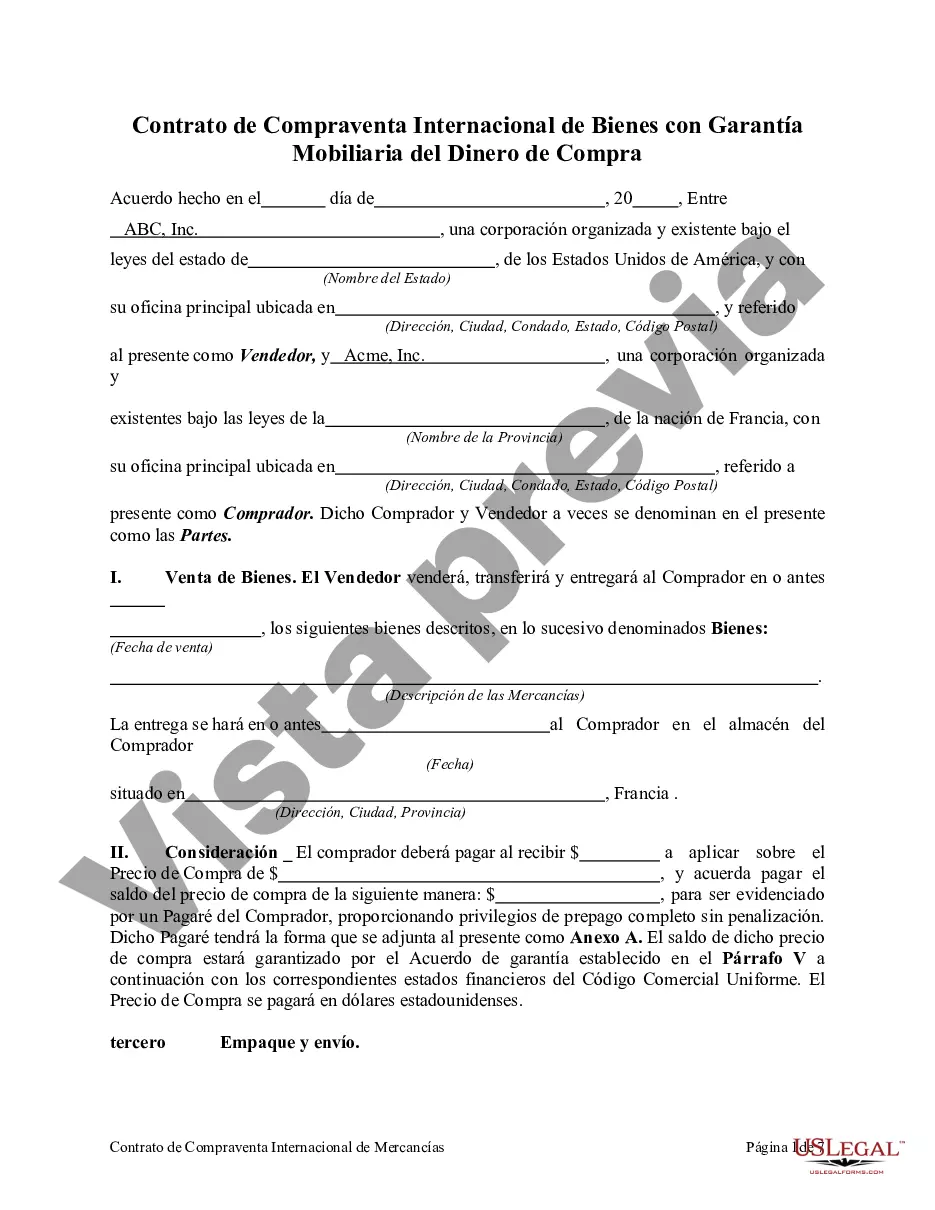

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New York Contrato de Compraventa Internacional de Bienes con Garantía Mobiliaria del Dinero de Compra - Contract for the International Sale of Goods with Purchase Money Security Interest

Description

How to fill out New York Contrato De Compraventa Internacional De Bienes Con Garantía Mobiliaria Del Dinero De Compra?

Choosing the best legal papers web template could be a have a problem. Needless to say, there are a variety of themes available online, but how would you get the legal type you will need? Make use of the US Legal Forms website. The services provides a large number of themes, such as the New York Contract for the International Sale of Goods with Purchase Money Security Interest, which you can use for organization and personal needs. Every one of the types are checked by experts and satisfy federal and state demands.

When you are previously registered, log in to the accounts and click the Acquire switch to get the New York Contract for the International Sale of Goods with Purchase Money Security Interest. Make use of accounts to check throughout the legal types you have ordered earlier. Proceed to the My Forms tab of the accounts and acquire one more backup of your papers you will need.

When you are a fresh consumer of US Legal Forms, allow me to share simple directions so that you can adhere to:

- Very first, make certain you have chosen the correct type for your personal city/state. You are able to examine the shape while using Preview switch and read the shape information to make sure this is the right one for you.

- In the event the type fails to satisfy your preferences, make use of the Seach discipline to get the correct type.

- When you are certain that the shape would work, go through the Purchase now switch to get the type.

- Opt for the prices prepare you would like and enter the required information. Design your accounts and pay for the order using your PayPal accounts or charge card.

- Opt for the data file formatting and obtain the legal papers web template to the system.

- Total, change and produce and indicator the received New York Contract for the International Sale of Goods with Purchase Money Security Interest.

US Legal Forms will be the greatest catalogue of legal types that you can find numerous papers themes. Make use of the service to obtain expertly-made documents that adhere to status demands.

Form popularity

FAQ

When filing for PMSI in inventory, you should take the following steps:File the UCC.Run a search to identify other secured party creditors.Send PMSI notices, which is a letter that will be sent to the identified secured party creditors.Deliver the inventory collateral.

A purchase money security interest (PMSI) is a security interest that is granted to a person who facilitates the acquisition of personal property. The person who facilitates the acquisition could be a lender, a lessor, a consignor or a supplier.

The term purchase money security interest (PMSI) refers to a legal claim that allows a lender to either repossess property financed with its loan or to demand repayment in cash if the borrower defaults. It gives the lender priority over claims made by other creditors.

A security interest granted by a buyer of goods to the seller thereof that secures the deferred payment of the purchase price would generally be a PMSI, as would a security interest granted by a buyer to a lender that advances funds to the buyer to enable the buyer to buy goods from a seller to secure such advances.

PURCHASE-MONEY SECURITY INTEREST; APPLICATION OF PAYMENTS; BURDEN OF ESTABLISHING. (a) Definitions. In this section: (1) "purchase-money collateral" means goods or software that secures a purchase-money obligation incurred with respect to that collateral; and.

What is Non-Purchase Money Security Interest? A security interest in which the property is already owned by the debtor and is put up as security for a loan. This kind of lien is subject to elimination in a bankruptcy proceeding.

However, generally speaking, the primary ways for a secured party to perfect a security interest are:by filing a financing statement with the appropriate public office.by possessing the collateral.by "controlling" the collateral; or.it's done automatically upon attachment of the security interest.

Goods or software used for the purpose of securing a purchase-money obligation that a debtor incurs to buy goods.

PMSI in InventoryAssume that a lender has made a loan to a borrower secured by all assets of the borrower. The lender properly perfects its security interest by filing a financing statement in the borrower's jurisdiction of formation.