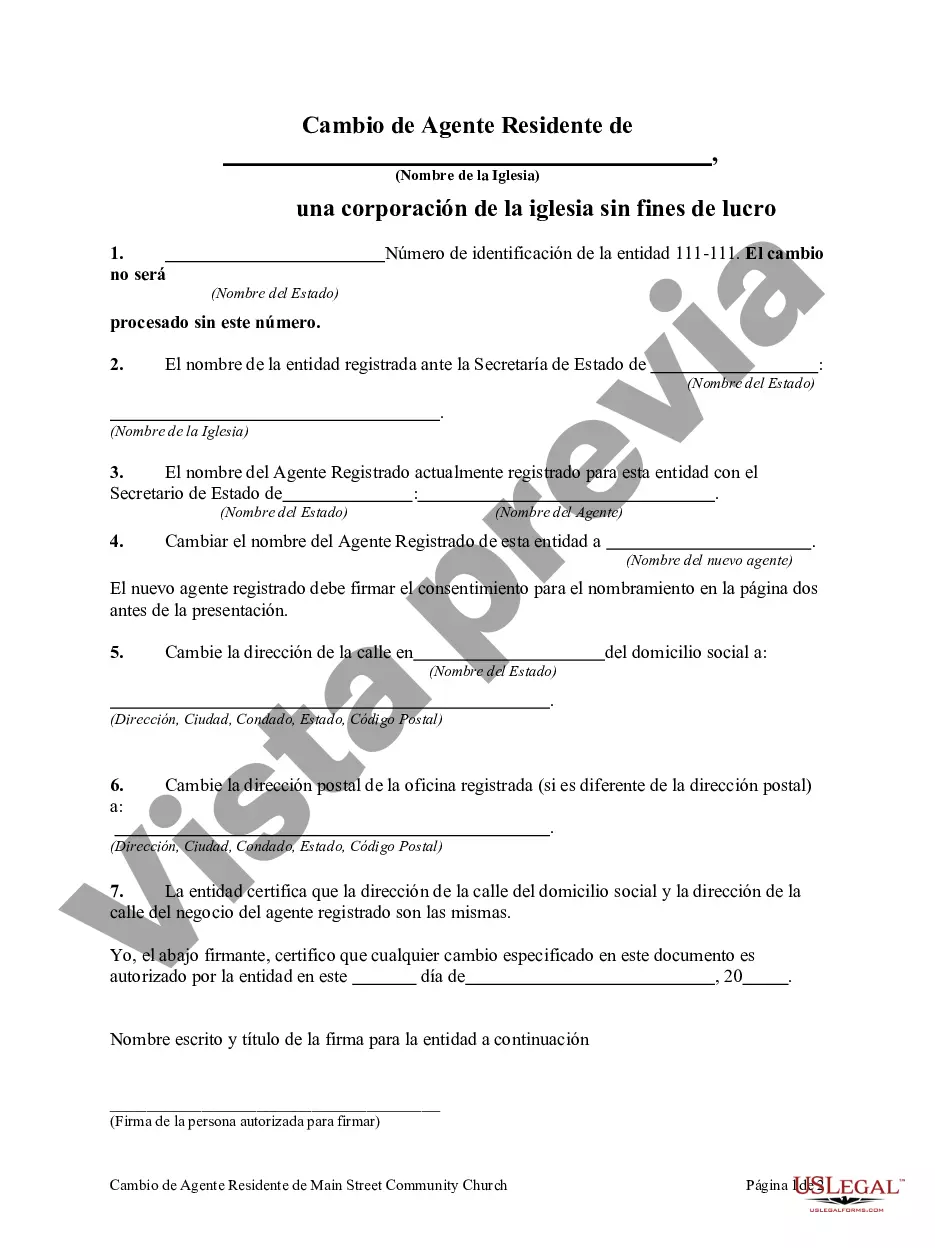

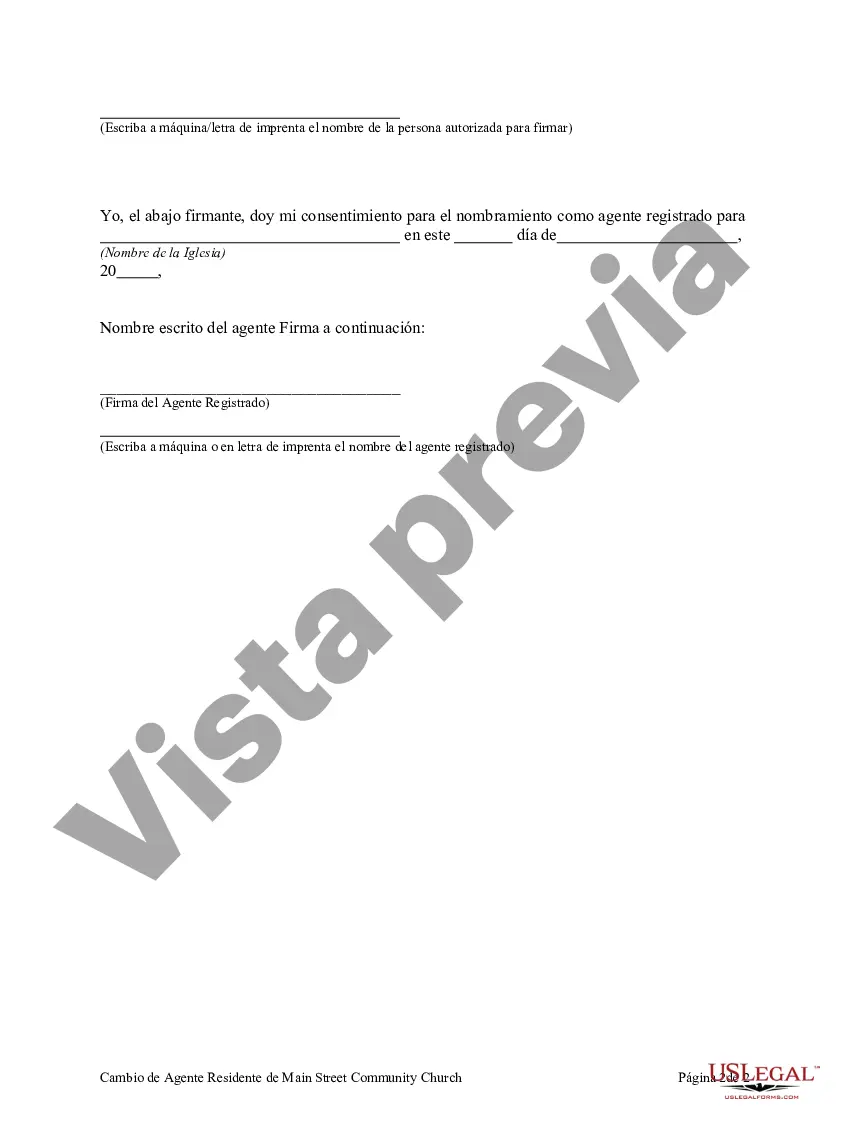

A New York Change of Resident Agent of Non-Profit Church Corporation refers to the process of updating the resident agent information for a non-profit church corporation in the state of New York. The resident agent, also known as the registered agent, is a designated individual or entity responsible for accepting legal documents and important correspondence on behalf of the corporation. New York has specific regulations and requirements when it comes to changing the resident agent for a non-profit church corporation. This process can be necessary when the current resident agent resigns, moves out of state, or if the corporation decides to change its registered agent for any reason. By completing the Change of Resident Agent filing, the church corporation ensures that it maintains compliance with state laws and can continue to receive important legal notifications. When initiating a New York Change of Resident Agent of Non-Profit Church Corporation, several key steps need to be followed. First, it is important to identify a new resident agent who meets the state's requirements. The resident agent must be a New York resident or a legal entity authorized to conduct business in the state. Non-profit church corporations usually choose an individual within their organization or appoint a professional registered agent service to fulfill this role. Once a new resident agent is identified, the corporation needs to complete the necessary forms and file them with the New York Department of State, Division of Corporations. The specific form required for changing the resident agent is the Certificate of Change — Non-Profit Church Corporation. This form includes important information such as the name of the corporation, the current resident agent's details, and the new resident agent's information. It also requires a signature from an authorized representative of the church corporation. Along with the completed form, the corporation must submit the filing fee as mandated by the state. The fee may vary depending on the type of corporation and the method of filing (online or by mail). It is important to check the latest fee schedule provided by the New York Department of State to ensure accurate payment. After submitting the Change of Resident Agent filing, the corporation should receive an acknowledgement from the New York Department of State confirming the successful change. It is advisable to keep a copy of this confirmation for the organization's records. There are no different types of Change of Resident Agent for Non-Profit Church Corporation in New York. The process remains the same regardless of the size or religious denomination of the church corporation. In conclusion, a New York Change of Resident Agent of Non-Profit Church Corporation is a crucial procedure for updating the resident agent information to ensure legal compliance. By appointing a new resident agent and completing the required filing with the New York Department of State, church corporations can continue to receive important legal documents and notifications promptly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New York Cambio de Agente Residente de Non-Profit Church Corporation - Change of Resident Agent of Non-Profit Church Corporation

Description

How to fill out New York Cambio De Agente Residente De Non-Profit Church Corporation?

If you need to full, obtain, or print out authorized file web templates, use US Legal Forms, the largest collection of authorized varieties, which can be found on-line. Utilize the site`s simple and easy convenient lookup to obtain the paperwork you require. Numerous web templates for enterprise and person uses are categorized by classes and says, or keywords and phrases. Use US Legal Forms to obtain the New York Change of Resident Agent of Non-Profit Church Corporation in a couple of click throughs.

If you are currently a US Legal Forms customer, log in in your profile and click on the Acquire option to get the New York Change of Resident Agent of Non-Profit Church Corporation. You can even accessibility varieties you in the past delivered electronically inside the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the form for your appropriate metropolis/land.

- Step 2. Use the Review method to look through the form`s content material. Do not forget about to read through the explanation.

- Step 3. If you are not happy together with the form, use the Lookup field near the top of the display screen to locate other variations in the authorized form web template.

- Step 4. When you have identified the form you require, go through the Purchase now option. Select the prices plan you favor and add your credentials to sign up to have an profile.

- Step 5. Approach the purchase. You should use your Мisa or Ьastercard or PayPal profile to perform the purchase.

- Step 6. Find the formatting in the authorized form and obtain it on your own device.

- Step 7. Full, modify and print out or signal the New York Change of Resident Agent of Non-Profit Church Corporation.

Every authorized file web template you acquire is your own property for a long time. You may have acces to each form you delivered electronically in your acccount. Select the My Forms area and choose a form to print out or obtain once again.

Contend and obtain, and print out the New York Change of Resident Agent of Non-Profit Church Corporation with US Legal Forms. There are millions of skilled and status-particular varieties you can utilize to your enterprise or person requirements.