A New York Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a specific type of trust established in New York for the purpose of ensuring financial security and support for a wife during her lifetime, with the assets remaining in trust for the benefit of children upon her death. This type of trust can be created through the Last Will and Testament of the deceased individual, known as the testator, and is subject to New York state laws and regulations. The primary goal of a New York Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is to protect both the wife and the children by establishing a legal structure that manages and distributes the assets of the estate in a manner that provides ongoing financial support and stability. The trust can be tailored to the specific needs and circumstances of the family, ensuring that the wife receives adequate income and support while alive, and that the children are provided for after her passing. There are several variations or types of New York Testamentary Trusts for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife, depending on the specific provisions outlined in the testator's will. Some possible types of New York Testamentary Trusts include: 1. Testamentary Trust with Income for the Wife and Principal Distributed to the Children: In this type of trust, the wife receives regular income generated by the assets in the trust during her lifetime, while the principal or remaining assets are distributed to the children upon her death. 2. Testamentary Trust with Income and Principal Used for the Benefit of the Wife and Children: Here, both the wife and the children can benefit from the income and principal of the trust during the wife's lifetime. The trustee may have discretion to allocate funds as needed for the best interests of both parties. 3. Testamentary Trust with a Fixed Period for the Benefit of the Wife and then for the Children: This trust structure specifies a predetermined period during which the wife receives income or support from the trust, after which the remaining assets are distributed to the children. 4. Testamentary Trust with Discretionary Powers for the Trustee: In this type of trust, the trustee is granted discretionary powers to manage and distribute the assets based on the evolving needs and circumstances of the wife and children, ensuring flexibility and adaptability to changing financial situations. It is important for individuals considering such a trust arrangement to consult with an experienced estate planning attorney in New York to ensure that the trust is properly drafted and executed, and that it complies with all applicable laws and regulations. By doing so, they can effectively protect the interests of their wife and children, provide financial security, and enable the smooth administration of their estate in accordance with their wishes.

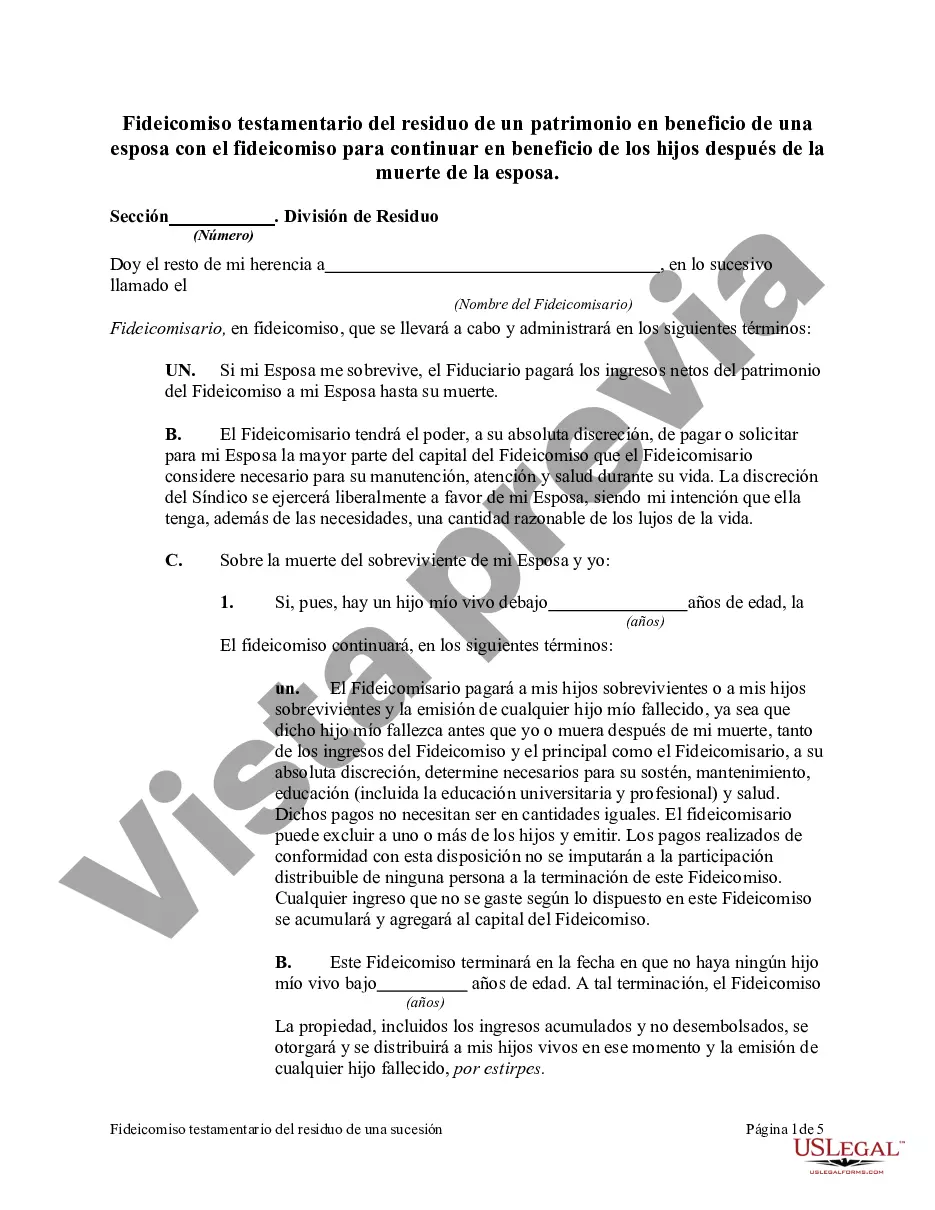

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New York Fideicomiso testamentario del residuo de un patrimonio en beneficio de una esposa con el fideicomiso para continuar en beneficio de los hijos después de la muerte de la esposa - Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out New York Fideicomiso Testamentario Del Residuo De Un Patrimonio En Beneficio De Una Esposa Con El Fideicomiso Para Continuar En Beneficio De Los Hijos Después De La Muerte De La Esposa?

If you wish to full, download, or print out lawful papers web templates, use US Legal Forms, the most important assortment of lawful forms, which can be found online. Make use of the site`s simple and hassle-free search to get the paperwork you need. A variety of web templates for company and personal reasons are sorted by categories and says, or key phrases. Use US Legal Forms to get the New York Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife with a few mouse clicks.

When you are presently a US Legal Forms customer, log in for your profile and click on the Obtain button to have the New York Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife. You may also gain access to forms you formerly downloaded from the My Forms tab of your own profile.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape to the correct area/land.

- Step 2. Use the Preview method to look over the form`s information. Don`t forget about to read the information.

- Step 3. When you are not happy with the kind, use the Research discipline near the top of the display screen to get other models in the lawful kind design.

- Step 4. When you have discovered the shape you need, click the Acquire now button. Opt for the rates strategy you prefer and put your qualifications to sign up on an profile.

- Step 5. Approach the transaction. You may use your bank card or PayPal profile to complete the transaction.

- Step 6. Pick the structure in the lawful kind and download it on your gadget.

- Step 7. Complete, edit and print out or sign the New York Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

Every single lawful papers design you buy is the one you have permanently. You may have acces to each and every kind you downloaded with your acccount. Go through the My Forms section and choose a kind to print out or download again.

Compete and download, and print out the New York Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife with US Legal Forms. There are many skilled and condition-particular forms you can use for the company or personal demands.