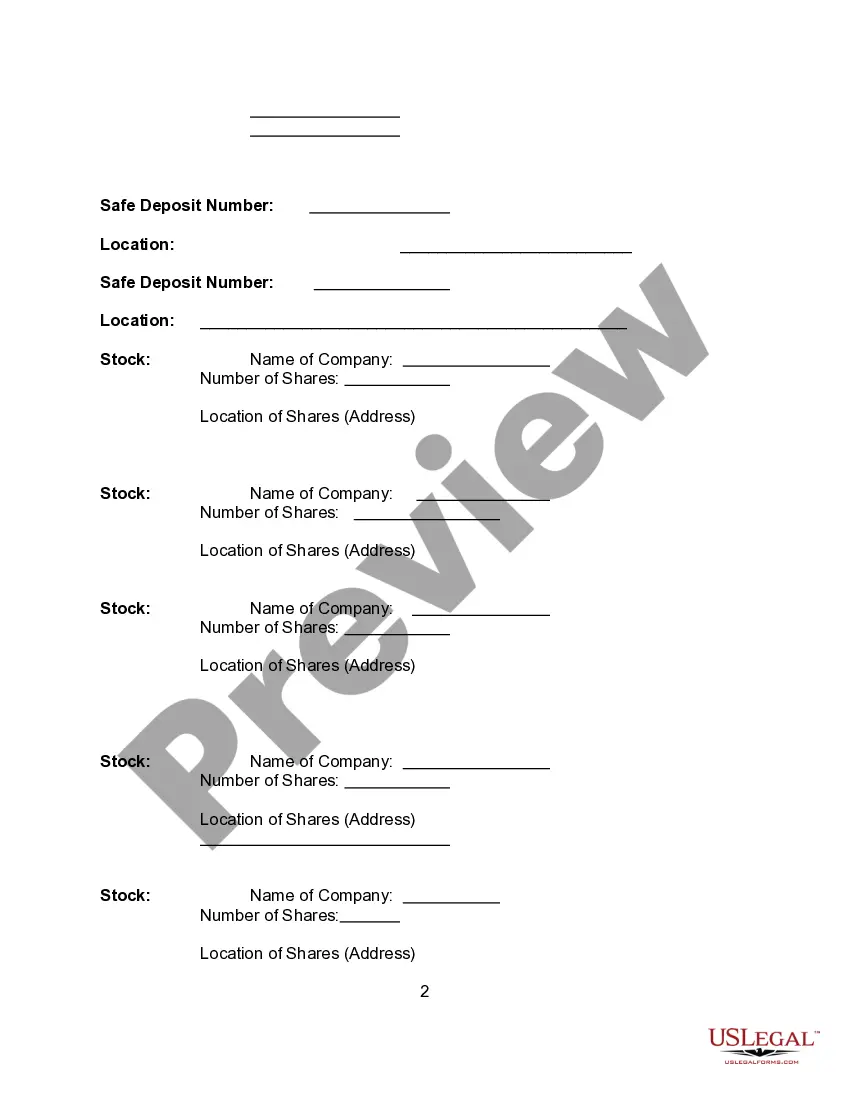

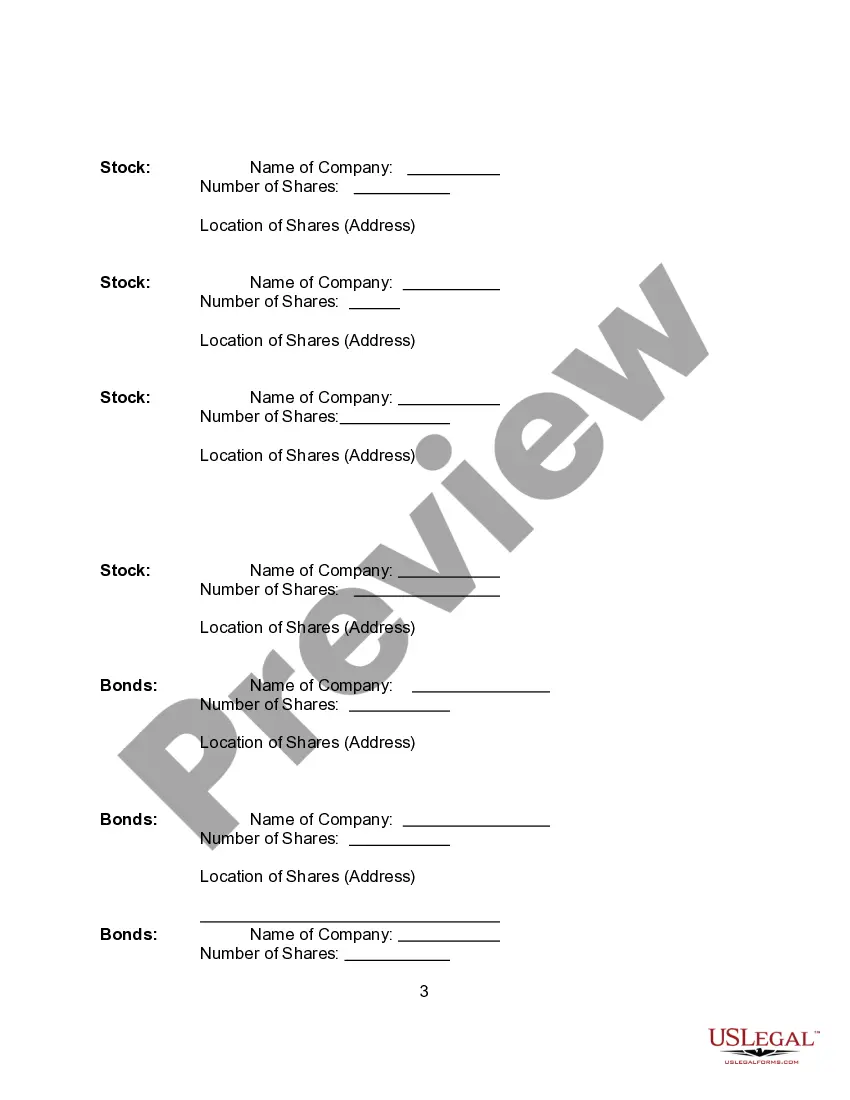

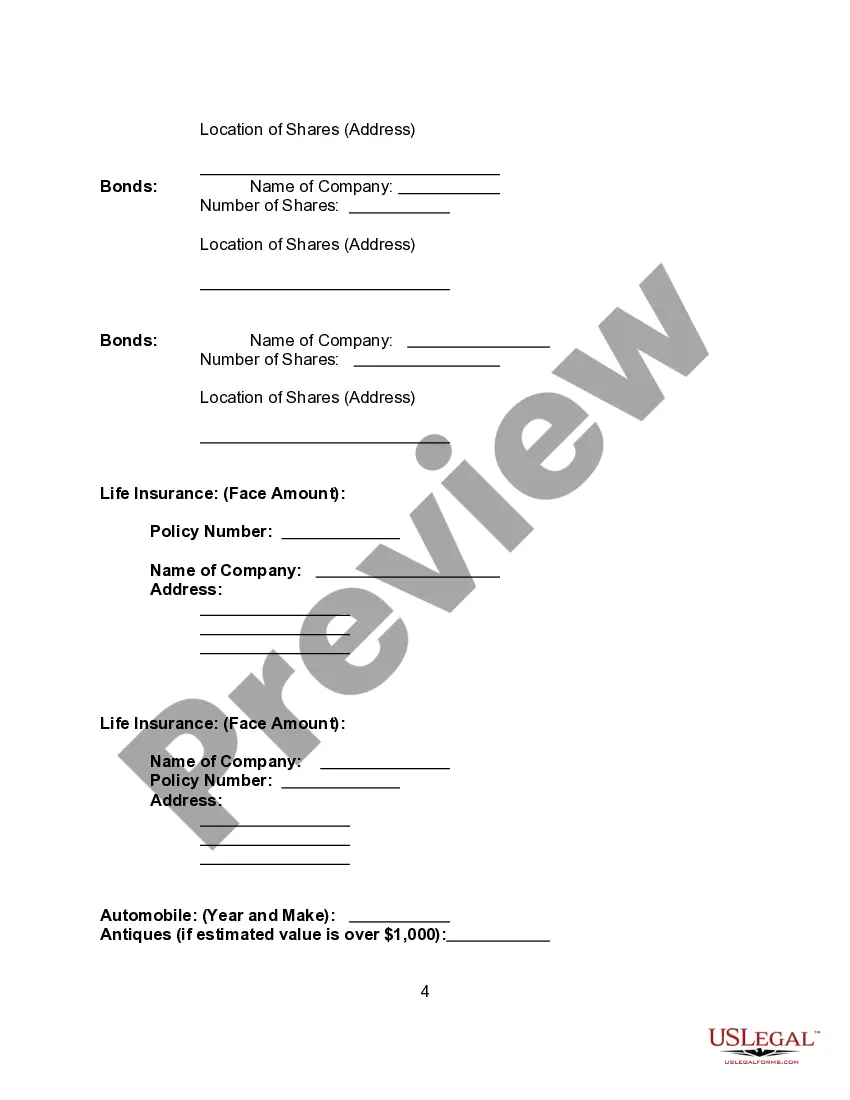

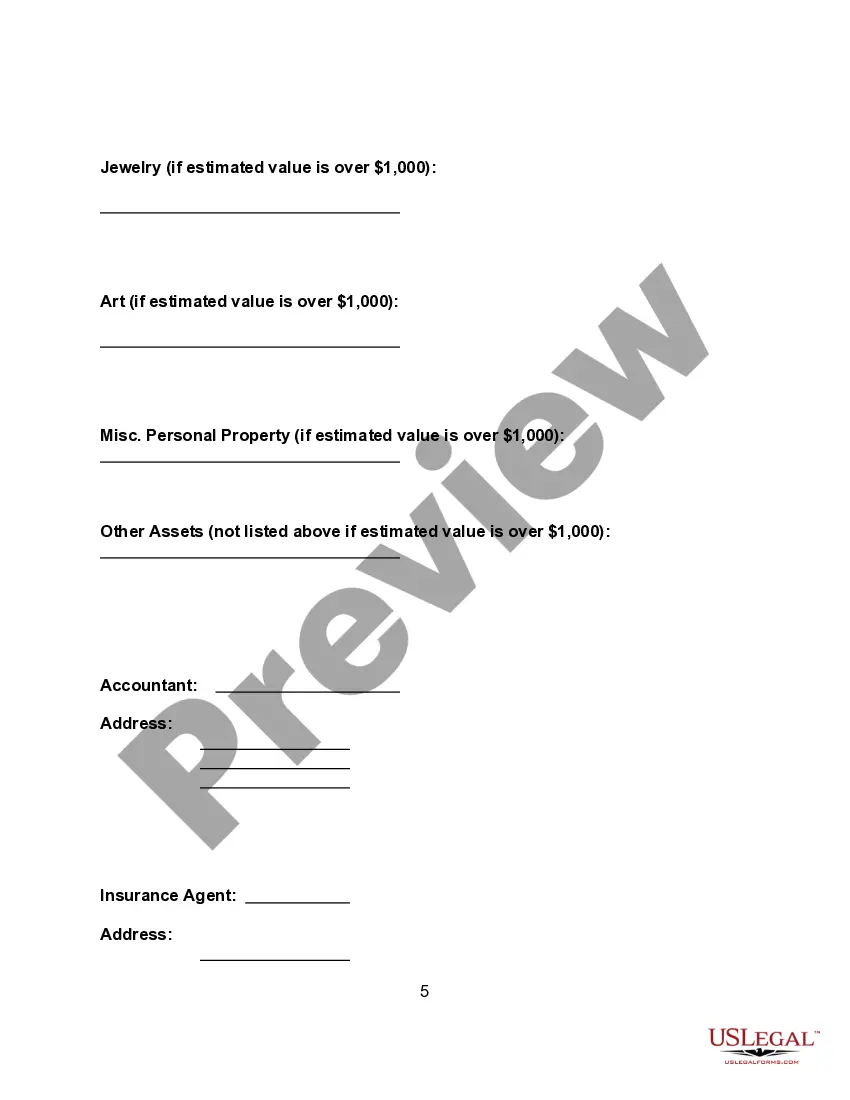

New York Asset Information Sheet

Description

How to fill out Asset Information Sheet?

If you need to complete, acquire, or print legal document templates, use US Legal Forms, the largest collection of legal forms available online.

Utilize the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you bought in your account.

Take initiative and download or print the New York Asset Information Sheet using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the New York Asset Information Sheet in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the New York Asset Information Sheet.

- You can also find forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Make sure to read the instructions.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal document format.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New York Asset Information Sheet.

Form popularity

FAQ

New York additions and subtractions that relate to intangible items of income, such as interest or ordinary dividends, are only required to the extent the property that generates the income is employed in a business, trade, profession, or occupation carried on in New York State.

This fiduciary adjustment is the net amount of modifications relating to estate or trust items of income, gain, loss or deduction, and is computed by the fiduciary in such fiduciary's New York State personal income tax return for the estate or trust.

If you received a W-2 for a job which you worked some days in New York and some days outside of New York, you must complete NY IT-203B Schedule A - Allocation of wage and salary income to New York State to adjust the State wage amounts.

First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k). Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.

For taxable years beginning on or after January 1, 1997, a partnership engaged in an unincorporated business is required to file an Unincorpo- rated Business Tax return if its unincorporated business gross income is more than $25,000 or it has unincorporated business taxable income of more than $15,000.

Who Must File Who Must Pay. The Unincorporated Business Tax (UBT) is imposed on any individual or unincorporated entity that is carrying on or currently liquidating a trade, business, profession, or occupation within New York City.

This would be the income earned in New York or attributed to New York, for instance, interest you received when you were a resident of New York.

Individuals must file on Form NYC-202 or NYC-202S. Single-member LLCs must file on Form NYC-202. Partnerships (including any incorporated entity other than a single-member LLC treated as a partnership for federal income tax purposes) or other unincorporated organiza- tions must file Form NYC-204 or Form 204EZ.

FORM NYC-CR-A - Commercial Rent Tax Annual Return must be filed by every tenant that rents premises for business purposes in Manhattan south of the center line of 96th Street and whose annual or annualized gross rent for any premises is at least $200,000.

Non-resident Employees of the City of New York - Form 1127Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127. This form calculates the City Waiver liability, which is the amount due as if the filer was a resident of NYC.