New York Sixty Day New Hire Survey

Description

How to fill out Sixty Day New Hire Survey?

Locating the appropriate legal document template can be challenging. Obviously, there are numerous templates accessible online, but how can you find the legal form you need? Utilize the US Legal Forms website. This service offers a vast array of templates, including the New York Sixty Day New Hire Survey, which can serve both business and personal purposes.

All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the New York Sixty Day New Hire Survey. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

Complete, edit, print, and sign the obtained New York Sixty Day New Hire Survey. US Legal Forms is the largest library of legal forms where you can access a variety of document templates. Take advantage of the service to download professionally crafted papers that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have selected the correct form for your area/region. You can examine the document using the Preview button and read the description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate document.

- Once you are confident that the form is correct, click on the Buy now button to purchase the form.

- Select the pricing plan you prefer and enter the required details. Create your account and complete the purchase using your PayPal account or a credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

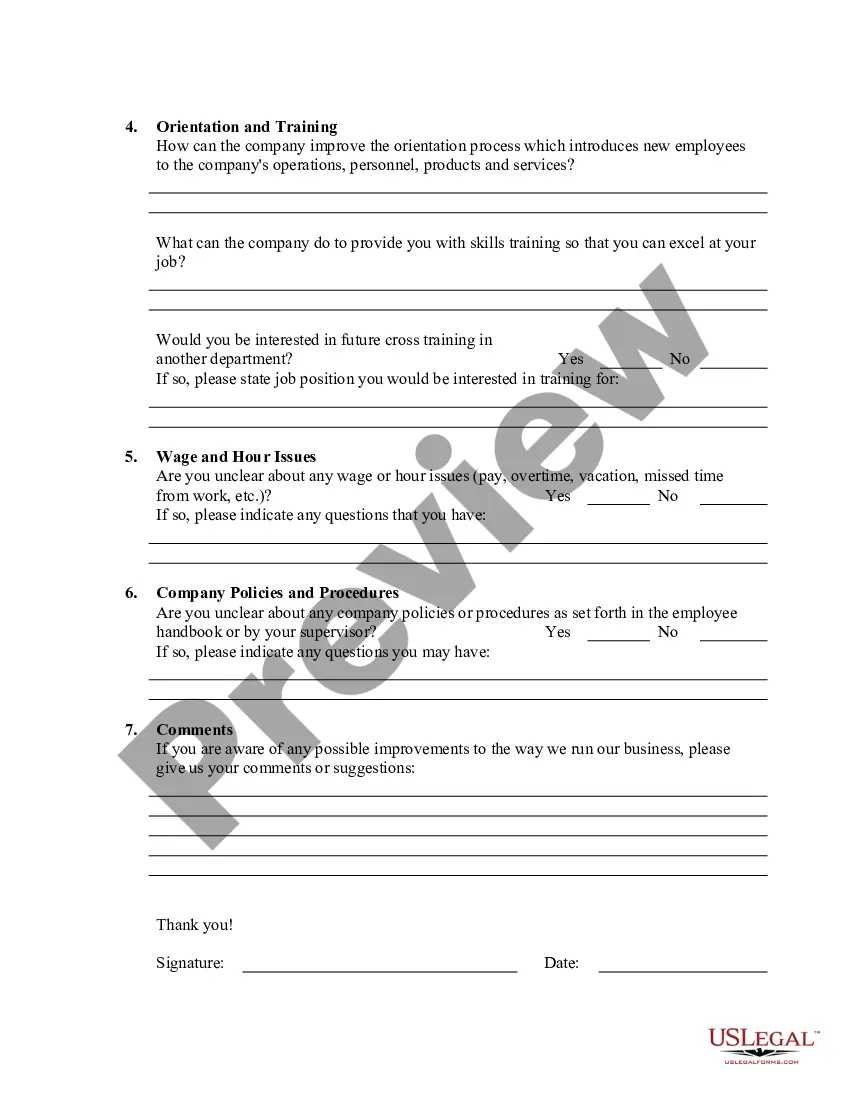

A 60-day check-in with a new employee is a scheduled meeting that focuses on their experiences and feedback regarding their role and workplace environment. This check-in serves as a platform for open communication, allowing managers to support new hires effectively. Incorporating the New York Sixty Day New Hire Survey can streamline this check-in process.

12 Questions to Ask During a 60-Day ReviewHow has your training in the first 30 days set you up for success in the following 30 days?What about our onboarding process has worked best in getting you up to speed?What would you change about the onboarding process to better prepare you for the position?

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

New York employers should provide each new employee with a New York State Form IT-2104, Employee's Withholding Allowance Certificate, as well as a federal Form W-4.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.

Federal law requires employers to report basic information on new and rehired employees within 20 days of hire to the state where the new employees work. Some states require it sooner.

Create conversation around long-term goals. The 60-day review is still early in the process, but you want to begin the conversation around long-term goals to help encourage employees to plan ahead and increase retention. Ask for specific feedback about the team and organization.

New York employers should provide each new employee with a New York State Form IT-2104, Employee's Withholding Allowance Certificate, as well as a federal Form W-4.

A 60 day review or evaluation is a performance review (also known as a performance appraisal) that measures the new hire's happiness with their work environment and the current culture, as well as learning what has been most effective in their onboarding experience.

You must report newly hired or rehired employees who will be employed in New York State within 20 calendar days from the hiring date. The hiring date is the first day the employee: performs any services for which they will be paid wages, tips, commissions, or any other type of compensation.