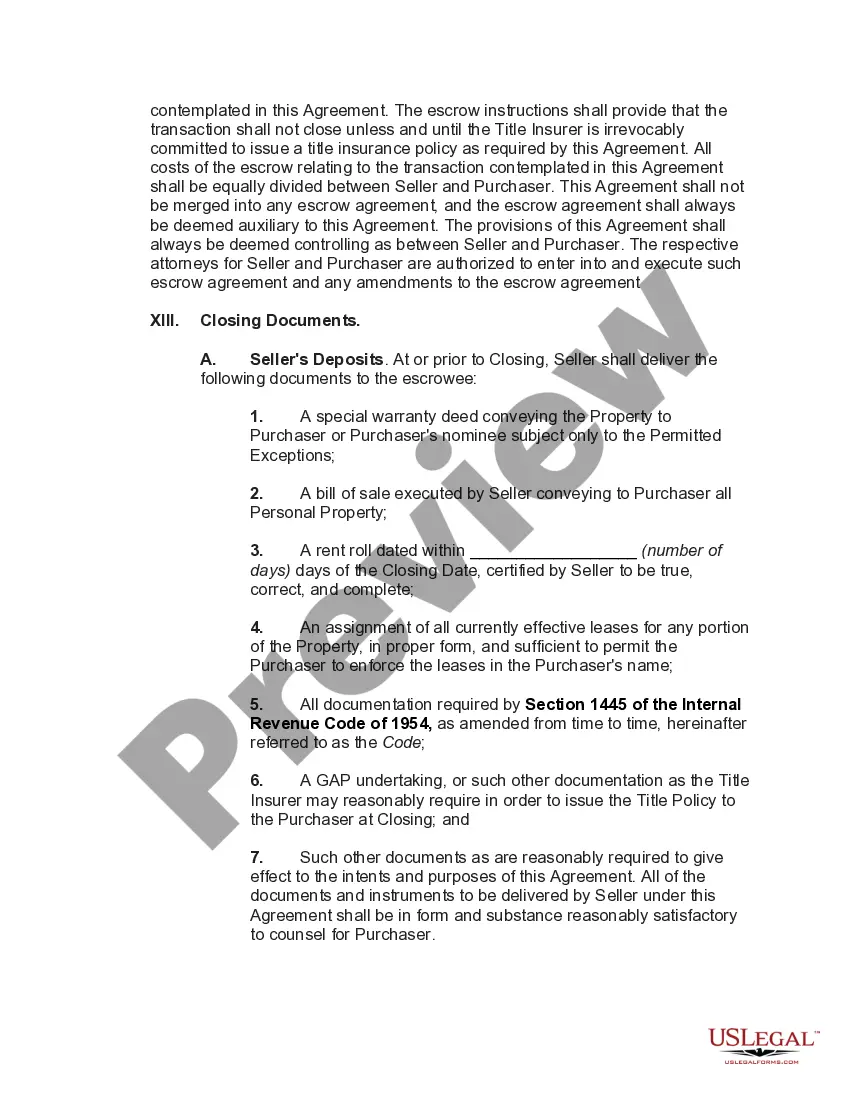

New York Contract for the Sale of Self Storage Facility

Description

How to fill out Contract For The Sale Of Self Storage Facility?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document formats you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can quickly find the latest versions of forms like the New York Contract for the Sale of Self Storage Facility.

If you already have a subscription, Log In and download the New York Contract for the Sale of Self Storage Facility from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms from the My documents section of your account.

Choose the file format and download the form to your device.

Make changes. Complete, modify, print, and sign the saved New York Contract for the Sale of Self Storage Facility. Each template you acquire with your payment has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you want.

Access the New York Contract for the Sale of Self Storage Facility with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- Ensure you've selected the correct form for your area/region. Click on the Preview button to review the form's content.

- Check the form description to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the appropriate one.

- If you are satisfied with the form, confirm your selection by clicking on the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to sign up for the account.

- Process the transaction. Use your Visa, Mastercard, or PayPal account to complete the payment.

Form popularity

FAQ

Introduction. Sales of tangible personal property are subject to New York sales tax unless they are specifically exempt. Sales of services are generally exempt from New York sales tax unless they are specifically taxable.

The Tax Law exempts purchases for resale; most sales to or by the federal and New York State governments, charitable organizations, and certain other exempt organizations; sales of most food for home consumption; and sales of prescription and nonprescription medicines. Sales tax also does not apply to most services.

A warehouse is a building for storing goods.

The City Sales Tax rate is 4.5% on the service, there is no New York State Sales Tax. If products are purchased, an 8.875% combined City and State tax will be charged. The City charges a 10.375% tax and an additional 8% surtax on parking, garaging, or storing motor vehicles in Manhattan.

Warehouse in RetailA warehouse is a large building where goods are stored before they are sold.

SaaS Transactions are Taxable Under New York's Tax Law, software is considered to be tangible personal property. The Tax Law essentially creates the legal fiction that something that has virtually no physical properties qualifies as tangible property.

A warehouse is a large building where goods are stored before they are sold.

Profit margin of a self-storage business According to one estimate, a self-storage facility generates a typical profit margin of 41%.

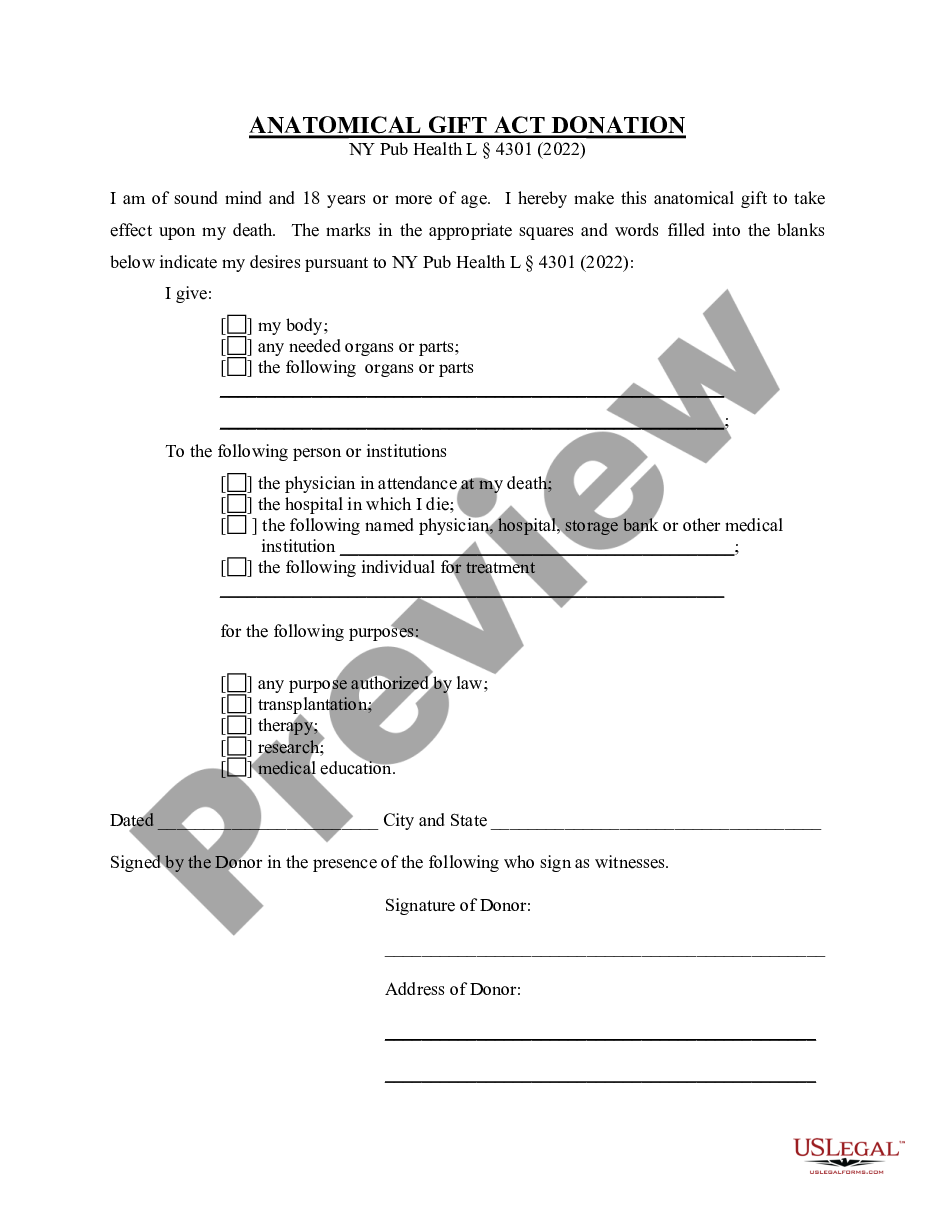

A storage space lease agreement is an obligatory contract to lease a storage unit, which is mostly prepared by the space owner or his or her agent.

Storage of tangible personal property is generally subject to sales tax in New York State. However, the rental of real property is not subject to sales tax. Also, storage services delivered to the purchaser outside of New York State are not subject to sales or use tax.